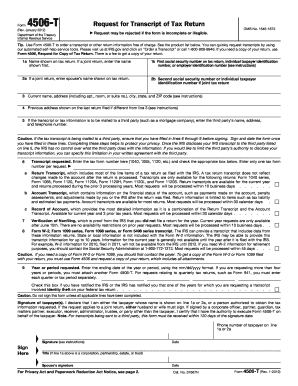

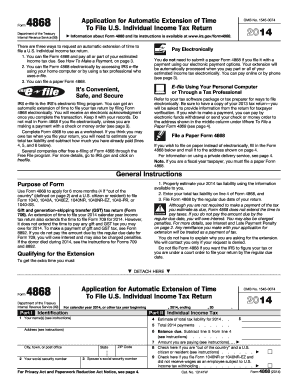

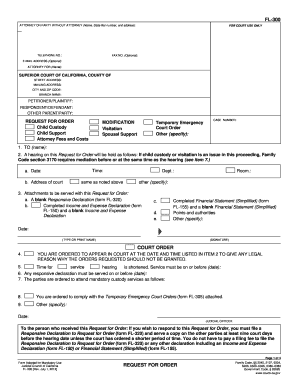

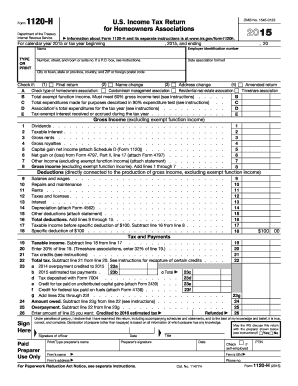

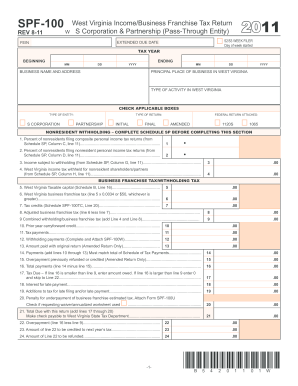

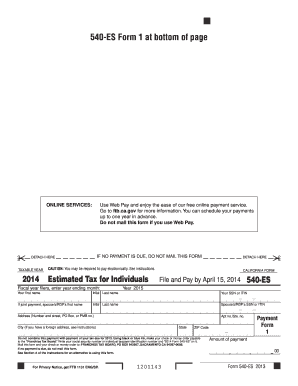

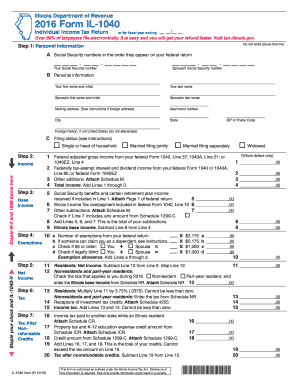

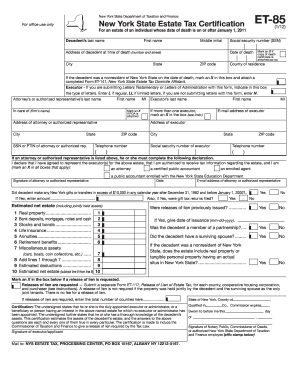

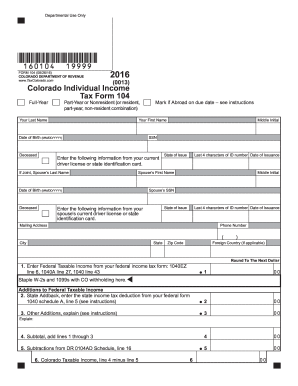

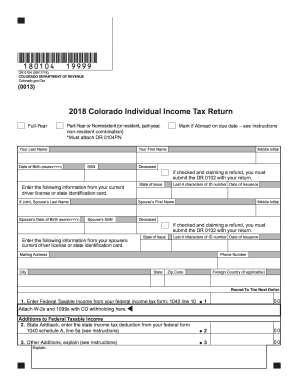

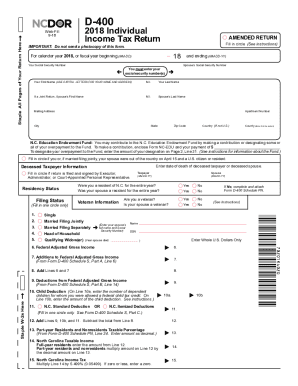

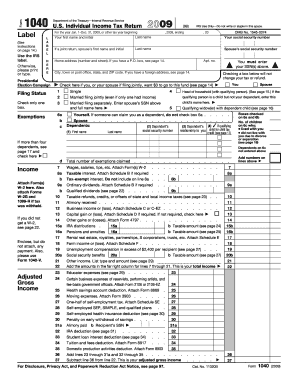

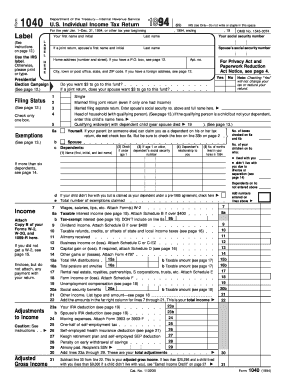

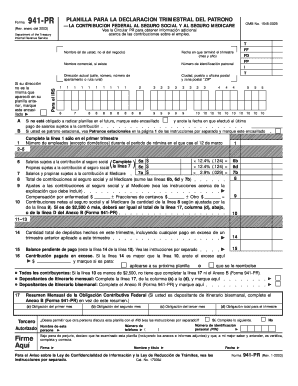

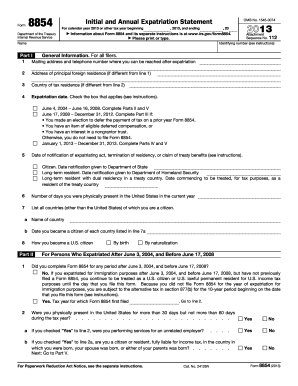

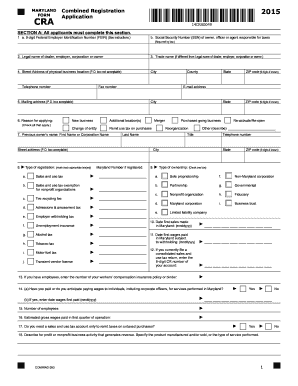

Discover state-specific Prior year tax Order Forms and adjust them online. Use DocHub's effective document management capabilities and monitor your documents' progress with an audit log.

Your workflows always benefit when you can find all the forms and files you may need at your fingertips. DocHub gives a a huge library of templates to alleviate your day-to-day pains. Get a hold of Prior year tax Order Forms category and quickly browse for your document.

Start working with Prior year tax Order Forms in a few clicks:

Enjoy smooth file management with DocHub. Explore our Prior year tax Order Forms online library and find your form right now!