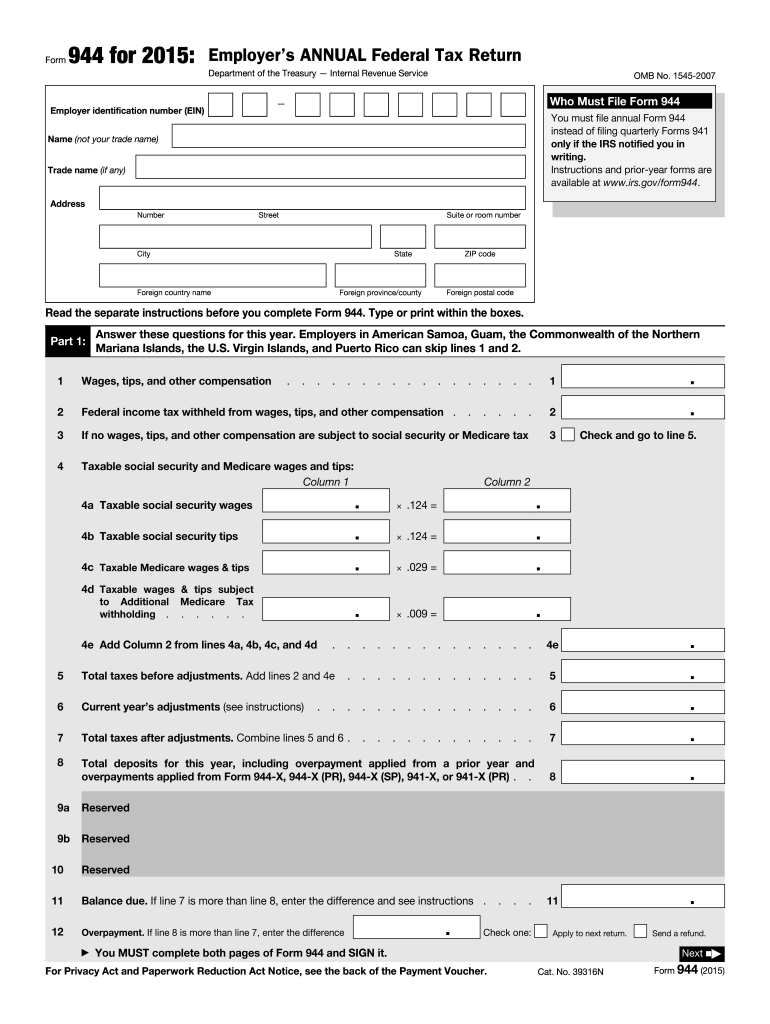

Definition & Meaning

The "2015 IRS tax return form" typically refers to various forms used by taxpayers in the United States to report their income to the Internal Revenue Service for the tax year 2015. This includes forms such as the 1040, 1040A, and 1040EZ, which are used to file individual income tax returns. The purpose of these forms is to calculate the amount of tax owed or the refund due. The choice of form depends on the individual's financial situation, such as marital status, sources of income, and other factors.

Steps to Complete the 2015 IRS Tax Return Form

Completing your 2015 IRS tax return form involves several key steps:

- Gather Required Documents: Before you start, collect necessary documents such as your W-2s, 1099s, and any other records of income.

- Select the Appropriate Form: Based on your financial circumstances, choose between forms 1040, 1040A, or 1040EZ.

- Fill Out Personal Information: Enter your name, Social Security number, and other basic details.

- Report Income: Accurately report all sources of income, including wages, dividends, and any other taxable income.

- Claim Deductions and Credits: Apply eligible deductions and credits to reduce your taxable income.

- Calculate Tax Liability: Use the form to determine the amount of tax owed or refund due.

- Sign and Submit: Ensure the form is signed before submission. Save a copy for your records.

How to Use the 2015 IRS Tax Return Form

Utilizing the form correctly requires understanding various sections and their purposes. The form is segmented into different parts for reporting personal information, income, deductions, tax credits, and more. It's imperative to:

- Fill each section with accurate details.

- Use worksheets or supplemental schedules if needed to provide additional information.

- Review the instructions accompanying the form to clarify any uncertainties.

Required Documents

When preparing to fill out the 2015 IRS tax return form, you should have the following documents at hand:

- W-2 Forms: For reporting wages and salary.

- 1099 Forms: Includes 1099-MISC for freelance work and 1099-DIV for dividends.

- Previous Year’s Tax Return: Helpful for reference and consistency.

- Receipts for Deductions: Necessary for claiming itemized deductions.

- Social Security Numbers: For you, your spouse, and any dependents.

Legal Use of the 2015 IRS Tax Return Form

The 2015 IRS tax return form is a legally binding document that taxpayers must complete and submit to comply with U.S. tax laws. Filing accurately is critical to avoid penalties. The information provided will be used by the IRS to assess your tax obligations. Misrepresentation or omission can lead to legal repercussions, including fines or audits.

Penalties for Non-Compliance

Failing to file the 2015 tax return or paying owed taxes can result in penalties. The IRS imposes:

- Failure-to-File Penalty: Charged when you do not submit your return by the deadline.

- Failure-to-Pay Penalty: Incurred when taxes remain unpaid after the due date.

- Interest on Unpaid Taxes: Accrues until the debt is settled.

Penalties can add up quickly, making timely and accurate filing crucial.

Filing Deadlines / Important Dates

The standard deadline for filing the 2015 IRS tax return was April 18, 2016. However, if you filed for an extension, the deadline was extended to October 17, 2016. It is essential to be aware of these dates to avoid late submission penalties. Extensions do not waive late payment penalties, so payments due must be made by the original deadline.

Taxpayer Scenarios: Examples and Use Cases

Certain taxpayer scenarios can affect how you complete your 2015 IRS tax return form:

- Self-Employed: Individuals must report additional income and expenses related to their business operations.

- Families with Dependents: Eligible for various credits, such as the Child Tax Credit.

- Retirees: Social Security benefits and pension income need correct reporting.

Understanding specific scenarios ensures precise filing and optimizes deductions and credits.

Digital vs. Paper Version

The 2015 IRS tax return form can be filed either digitally or on paper:

- Digital Filing: Known as e-filing, it is fast, secure, and often results in quicker refunds. Services such as TurboTax and QuickBooks support e-filing.

- Paper Filing: Involves filling out and mailing a hard copy of the form. It is traditional but might take longer to process.

Choosing between these methods depends on personal preference and comfort with digital platforms.