Definition and Purpose of Prior Year Products - IRS.gov

Prior Year Products - IRS.gov serve as a repository of tax forms and publications from previous tax years. These resources are primarily utilized by taxpayers needing to access or reference specific tax forms relevant to past financial activities. The primary purpose of accessing these prior year documents is to handle situations requiring detailed tax history, such as audits, claims for filing amendments, or verifying past data for financial planning.

The IRS website houses a multitude of forms and instructions, enabling individuals, tax professionals, and businesses to download necessary documents for transactions or amendments pertinent to prior tax years. Having access to these prior products ensures compliance with federal tax regulations and aids in rectifying historical tax filings.

How to Use the Prior Year Products - IRS.gov

Using Prior Year Products on IRS.gov is a straightforward process that caters to various user requirements. To utilize these resources effectively, users should:

- Start at the IRS Website: Visit the IRS official website and navigate to the 'Forms & Publications' section to find the 'Prior Year' subsection.

- Select the Relevant Year: Choose the tax year for which you need documents. The website categorizes forms by year to facilitate easy navigation.

- Search for Specific Forms: Use the search function to locate a particular form by its number or name. This is particularly helpful for taxpayers or preparers who need precise documentation.

- Download and Review: Once the desired form is located, download it. Each form comes with instructions to aid users in understanding nuances necessary for accuracy.

It's essential for users to ensure they download all parts of a form and its instructions to fully understand the requirements and any changes that might have occurred in subsequent years.

Who Typically Uses the Prior Year Products - IRS.gov

The users of Prior Year Products span diverse groups, including but not limited to:

- Individual Taxpayers: People who need to amend past tax returns or verify filed taxes. Individuals who face an audit or need to claim deductions for past periods can find relevant forms here.

- Tax Professionals: Accountants, tax preparers, and consultants require these products to assist clients accurately. Prior year products help ensure that all corrections or amendments are filed with respect to past tax codes and guide against errors.

- Business Entities: Companies that need records for fiscal audits, historical compliance checks, or internal accounting purposes use these forms to ensure all past tax obligations were met.

These groups leverage the comprehensive history available on IRS.gov to ensure historical accuracy in tax reporting and compliance.

Key Elements of Prior Year Products - IRS.gov

Understanding the key elements encompassed in the Prior Year Products is crucial to utilizing them effectively:

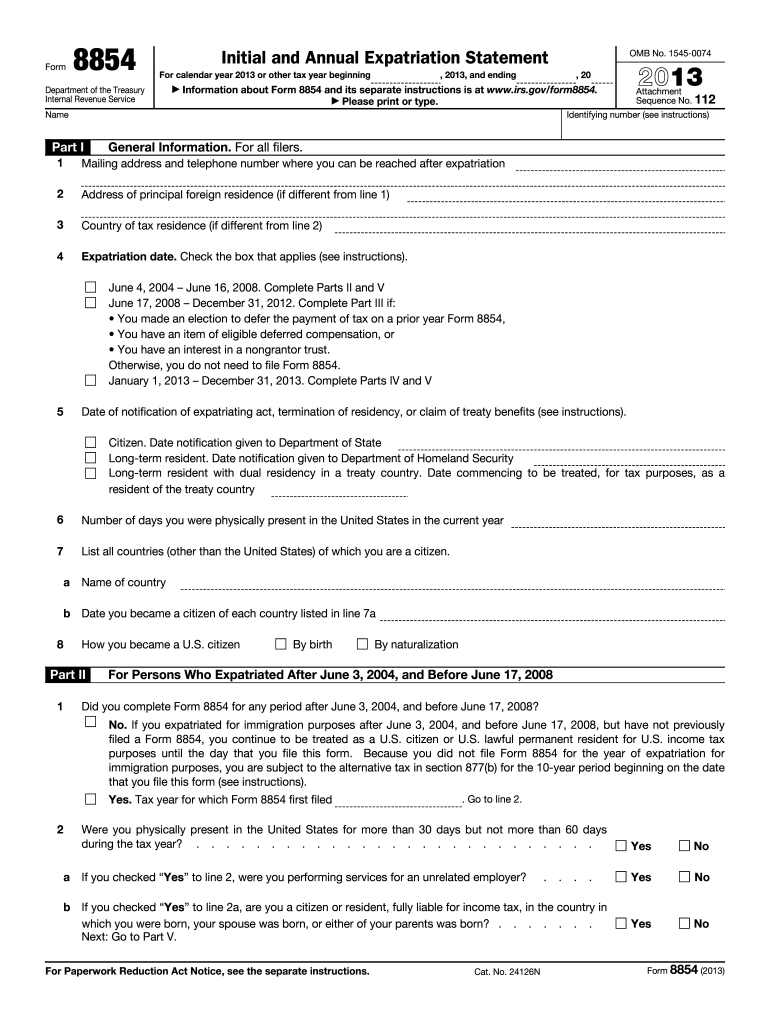

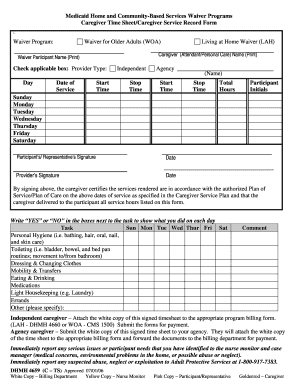

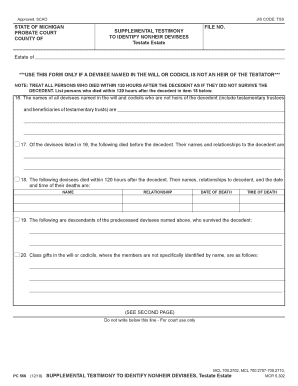

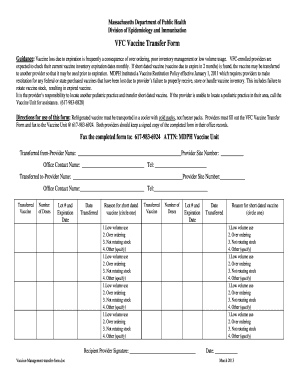

- Forms: Complete sets of IRS tax forms that have been used in previous filing years.

- Publications: Detailed guides and explanations for form utilization, ensuring users understand any changes in statutes or instructions that have occurred since the date of the forms.

- Instructions: Each form comes with instructions that detail how to fill out the forms correctly. This includes explanations of terms and fields found within the forms.

Accessing these key elements means recognizing what needs to be corrected and how to adjust past filings to reflect accurate financial standings as per IRS guidelines.

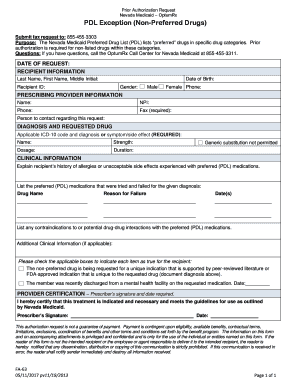

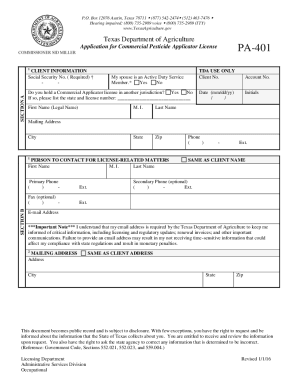

Form Submission Methods for Prior Year Products

When submitting forms utilizing Prior Year Products, several submission methods are available:

- Online Filing: Taxpayers can e-file some prior year forms directly through tax software. This method is contingent on the year and whether the software supports e-filing for that period.

- Mail Submission: Many prior year forms must be printed and mailed. Ensuring all necessary documentation is included is crucial for compliance.

- In-Person Submission: Although less common, some taxpayers may prefer to submit forms in person at an IRS office, especially if they require immediate assistance or confirmation of receipt.

Regardless of the method chosen, ensuring the completeness and correct postage or filing guidelines should be a priority to avoid delays or penalties.

IRS Guidelines on Prior Year Products

The IRS provides comprehensive guidance on utilizing prior year forms:

- Amended Returns: Instructions on how to file an amendment for a prior year return, addressing changes such as credits or additional income not initially reported.

- Auditing and Compliance: Guidelines on how to support documentation is managed when under audit, including which older forms should be referenced.

- Filing Limits: Clarifications on statute limitations for filing amendments, often set as a three-year period from the original filing date.

Adhering to these guidelines ensures taxpayers meet all federal requirements and maintain compliance with historical tax obligations.

Required Documents for Utilizing Prior Year Products

Certain documents are essential when handling prior year tax forms:

- Original Filed Returns: Copies of originally filed tax returns for the year in question.

- Supporting Documents: Receipts, W-2s, 1099s, and other proofs of income or expense.

- IRS Correspondence: Any letters or notices received from the IRS about specific tax years.

Maintaining an organized record of these documents streamlines the process of amending returns and verifying past financial activities.