Definition & Meaning

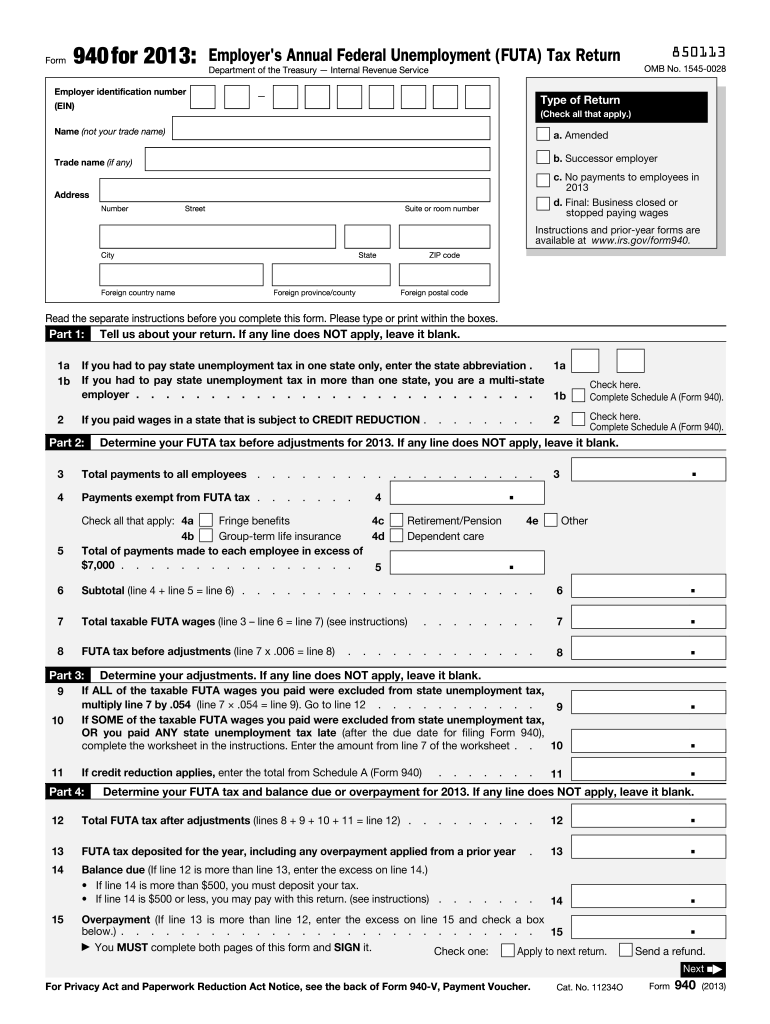

Form 940 for the year 2013, commonly referred to as the "Employer's Annual Federal Unemployment (FUTA) Tax Return," is a crucial document required by the IRS. It is used by employers to report their federal unemployment tax liability. The form plays a significant role in the unemployment compensation system, as it helps finance programs for unemployed workers.

Purpose of Form 2013 Federal

- To report annual federal unemployment tax

- To ensure compliance with federal tax laws

- To maintain records of employment-related tax contributions

Steps to Complete the Form 2013 Federal

Completing Form 2013 Federal involves several steps, each requiring careful attention to detail. Here’s a step-by-step guide:

-

Gather Required Information:

- Employer Identification Number (EIN)

- Total payments made to employees

- Taxable wages

- Adjustments for state unemployment tax

-

Complete Each Section:

- Enter wages up to $7,000 per employee for the unemployment tax

- Calculate the FUTA tax liability based on the total wages

- Account for state unemployment contributions and apply credits where applicable

-

Review Instructions:

- Carefully follow the IRS guidelines provided with the form to ensure accuracy

- Verify calculations to avoid errors that could result in penalties

Important Terms Related to Form 2013 Federal

Understanding essential terminology aids in accurate form completion. Here are key terms associated with Form 2013 Federal:

- FUTA: Federal Unemployment Tax Act; the law governing unemployment taxes.

- Taxable Wages: Employee wages subject to unemployment tax.

- Credits: Deductions applied for state tax payments that reduce overall FUTA liability.

IRS Guidelines

The IRS provides comprehensive guidelines for completing Form 2013 Federal. These guidelines clarify compliance requirements and ensure accurate filing:

- Filing Deadline: The form is typically due by January 31st following the calendar year.

- FUTA Tax Rate: Generally, 0.6% of the first $7,000 paid to each employee. Understanding rate changes from credits is crucial.

- Payment Instructions: Options include electronic funds transfer and mailing checks with vouchers.

Filing Deadlines / Important Dates

Filing by the designated deadline is mandatory to avoid penalties:

- Annual Filing Date: January 31st of each year

- Quarterly Deposit Requirements: If FUTA tax liability exceeds $500, deposits are required at the end of each quarter.

Grace Periods and Extensions

- Grace Period: Businesses have until February 10th if all FUTA taxes are deposited on time throughout the year.

Required Documents

Submitting Form 2013 Federal necessitates gathering the right documentation to streamline the filing process:

- Employee Wage Records: Accurate documentation of salaries paid.

- State Unemployment Contributions Receipts: Proof of payments made to state unemployment funds.

- Tax Credit Documentation: Records supporting any applied credits.

Form Submission Methods (Online / Mail / In-Person)

Multiple submission avenues are available, allowing employers to choose the most convenient method:

- Electronic Submission: E-file using IRS-approved software.

- Mailing: Send physical forms to the appropriate IRS address as per guidelines.

- In-Person Submission: For those who prefer direct filing, forms can be submitted at local IRS offices.

Penalties for Non-Compliance

Failure to accurately file Form 2013 Federal on time comes with implications:

- Late Fees: Interest and additional charges for overdue payment or form submission.

- Penalties: Financial penalties imposed for underreporting or inaccurate data.

Who Typically Uses the Form 2013 Federal

Form 2013 Federal is essential for specific entities:

- Employers: Required for businesses who pay wages to employees and meet the FUTA tax threshold.

- Business Owners: LLCs, corporations, and partnerships who hire employees.

Understanding the function and requirements of Form 2013 Federal ensures compliance and a smooth filing experience.