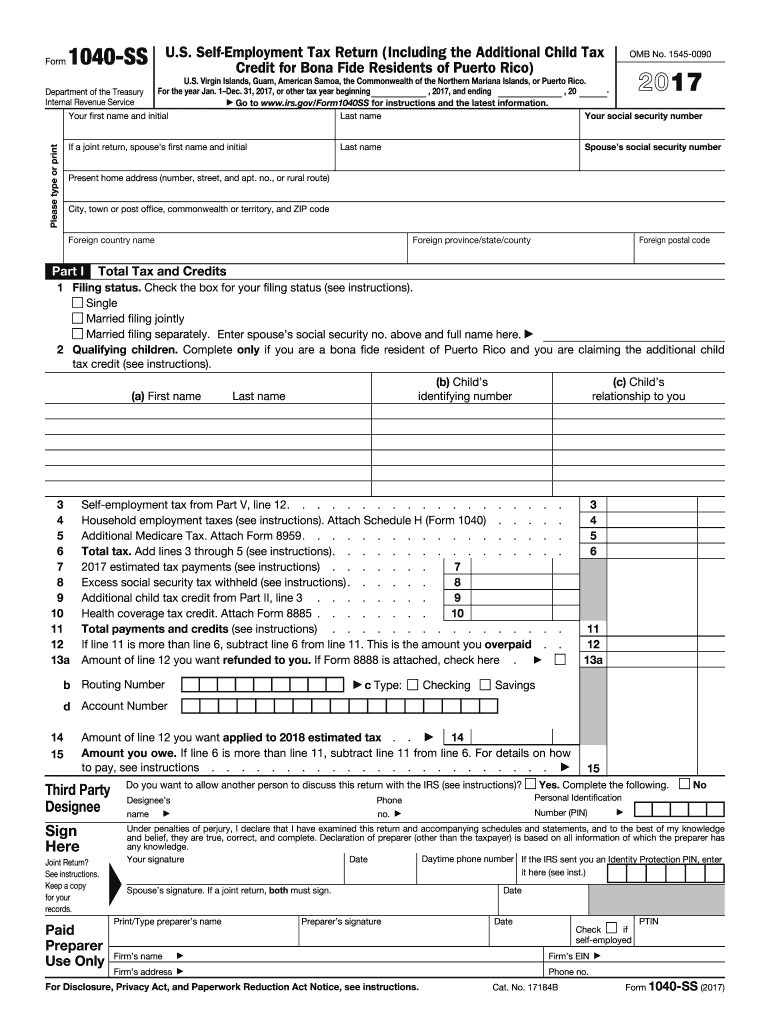

Definition and Purpose of the 2017 Form 1040

The 2017 Form 1040 is the standard IRS form used by taxpayers in the United States to report their annual income. Unlike other variations such as Form 1040EZ or 1040A, this form allows for a more comprehensive accounting of income, deductions, and credits. It is designed for individuals who have a complex tax situation and need to provide detailed information on different types of income, tax credits, and deductions. The form is essential for calculating the total tax liability and determining if a taxpayer is entitled to a refund or owes additional taxes.

Components Included in the Form

- Income Reporting: The form requires detailed reporting of all income sources including wages, dividends, capital gains, and retirement distributions.

- Deductions and Credits: Taxpayers can list itemized deductions or opt for the standard deduction, which impacts the calculation of taxable income.

- Tax Liability Calculation: It includes sections for determining the tax liability based on reported income and claimed deductions.

How to Use the 2017 Form 1040

Completing the 2017 Form 1040 involves several key steps to ensure accurate reporting and compliance with IRS guidelines. Below is a step-by-step guide:

- Gather Necessary Documentation: Collect all financial documents such as W-2s, 1099s, and receipts for deductible expenses.

- Start with Personal Information: Fill in your name, Social Security number, and filing status.

- Report Income: Enter all sources of income in the appropriate sections.

- Claim Deductions and Credits: Decide between itemizing deductions or taking the standard deduction.

- Calculate Tax Owed or Refund Due: Use the tables and worksheets provided to determine tax liability or refund.

- Sign and Submit: Ensure that the form is signed and dated before submission.

Special Scenarios

- Joint Filers: Married couples filing jointly need to combine their income and deductions.

- Dependents: Include information about qualifying dependents to maximize credits.

Obtaining the 2017 Form 1040

Taxpayers can access the 2017 Form 1040 through various channels:

- IRS Website: Download directly from the official IRS website in PDF format.

- Tax Software: Integrated into most tax preparation software like TurboTax or QuickBooks, ensuring ease of use.

- Local IRS Office: Visit the nearest IRS location to request a physical copy.

- Post Office or Library: Some public institutions may carry copies of commonly used forms.

Key Elements of the 2017 Form 1040

Understanding the structure of the 2017 Form 1040 is crucial for correct completion:

- Personal and Filing Status Information: This section establishes identity and filing status, which affects tax brackets and obligations.

- Income Section: Details various income streams and adjustments.

- Adjusted Gross Income: Determines modified amount upon which tax liability is based.

- Tax and Credits: Offers avenues to apply for reductions in tax liability.

- Payments: Shows taxes already paid through withholding or estimated payments.

- Refund or Amount Owed: Concludes whether the taxpayer owes additional taxes or qualifies for a refund.

Form Attachments

- Schedules: Additional forms may be necessary for itemizing deductions, reporting capital gains, or other situations.

IRS Guidelines for the 2017 Form 1040

Following IRS guidelines is essential to ensure compliance:

- Accuracy: Double-check calculations and reported figures to avoid errors.

- Timeliness: File the return by the due date, typically April 15, unless an extension is granted.

- Signature: The form must be signed to be considered valid.

Filing Deadlines for the 2017 Form 1040

Timely filing of the form is crucial to avoid penalties:

- Standard Deadline: Generally due by April 15 of the following year.

- Extension Requests: If more time is needed, taxpayers can file for an extension, typically extending the deadline to October 15.

Important Dates

- Estimated Payments: Quarterly payments are due if you expect to owe more than a certain amount.

- Amendments: Corrections can be made by submitting Form 1040X after the initial filing.

Required Documents for Completing the 2017 Form 1040

Bringing together the necessary documents eases form completion:

- Income Statements: W-2s, 1099s, or other income statements.

- Deduction Proofs: Receipts for itemized deductions.

- Identity Verification: A valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Verification and Documentation

- Supporting Documents: Additional documentation may be required if claiming certain deductions or credits.

Form Submission Methods

Different methods are available for submitting the completed form:

- E-Filing: Preferred by the IRS due to speed and efficiency. Available through various online tax platforms.

- Mail: Send the completed form to the designated IRS address for your location.

- In-Person: Drop off at your local IRS office if needed.

Benefits of E-Filing

- Quicker Processing: Refunds are generally processed faster.

- Confirmation: Immediate acknowledgment from the IRS on receipt.

By understanding the intricacies of the 2017 Form 1040, taxpayers can accurately report their financial situation and comply with federal tax obligations.