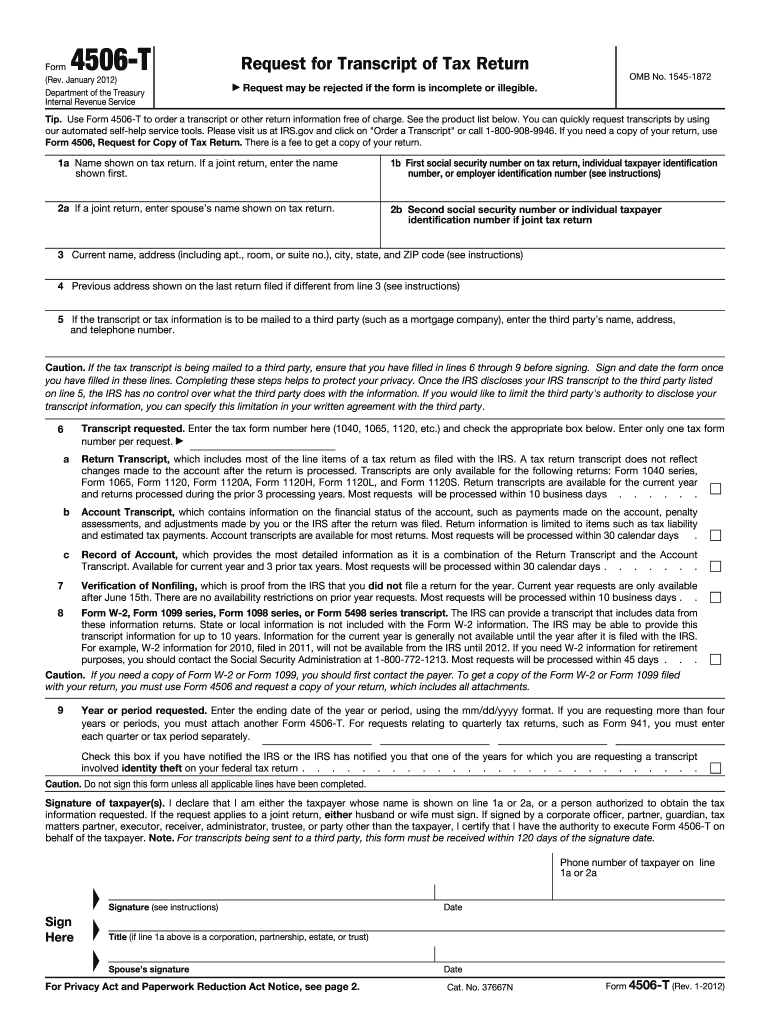

Definition & Purpose of the Tax Return Transcript 2012 Form

The tax return transcript 2012 form, primarily known as Form 4506-T, is an essential document provided by the IRS to taxpayers seeking access to tax return transcripts or other tax-related information from the year 2012 without any cost. It serves the purpose of giving taxpayers an official record of their previously filed tax forms. Tax practitioners often use it to verify income details or to settle previous discrepancies in documentation with financial institutions or legal entities.

Types of Information Provided

- Tax Return Transcript: This includes most line items from the originally filed tax return along with any accompanying forms and schedules. It is useful for loan applications or income verification.

- Account Transcript: Offers a more detailed view, showing changes made by a taxpayer after filing, payments made, penalties assessed, and adjustments.

- Record of Account Transcript: Combines tax return and account transcripts for complete coverage.

- Wage and Income Transcript: Information from documents like Forms W-2, 1099, 1098, and 5498, gathered by the IRS.

- Verification of Non-filing Letter: Provides proof that the IRS has no record of a filed tax return for a specific year.

Key Reasons for Using This Form

Financial institutions or those transitioning between jobs may need to provide past tax data. This form facilitates accurate and verified data provision without requiring taxpayers to retain old records for many years. Additionally, it is beneficial in resolving identity theft issues with the IRS or when correcting past tax disputes.

Steps to Obtain the Tax Return Transcript 2012 Form

The process to obtain the tax return transcript 2012 form has been streamlined for user ease, ensuring that access to past tax data is straightforward.

- Access Form 4506-T: Download or obtain Form 4506-T from the IRS website or an IRS office.

- Fill Out Personal Information: Include essential information such as name, Social Security number, current address, and the specific years required.

- Specify Transcript Type: Indicate which type of transcript is needed by checking the appropriate box on the form.

- Sign & Submit: The form must be signed and dated by the taxpayer; electronic signatures are not permitted.

- Mail or Fax: Send the completed form via mail or fax to the designated IRS address or fax number specific for your location.

Processing Time

After submission, the transcript request is typically processed within 10 business days, although delays may occur during peak times like tax season.

Who Typically Uses This Form

Various individuals and entities often require the tax return transcript 2012 form for multiple reasons.

- Individuals: Taxpayers needing to check past return details for accuracy or when called upon to verify income or tax filings during audits or loan applications.

- Corporate Entities: Corporations verifying past tax filings for audits or when restructuring.

- Legal Representatives: Tax professionals and legal advisors retrieving accurate tax data for client consultation or representation.

- Educational Institutions: Required for students applying for financial aid to verify income information.

Important Terms Related to the Form

Several terminologies are crucial for understanding and utilizing the tax return transcript 2012 form effectively.

- Transcript Types: Different transcripts provide varied details; knowing the right one to request is essential.

- Non-filing Verification: Important for individuals who did not file a tax return in 2012 but need evidence of this status.

- Tax Year: Always ensure the correct year is specified to avoid receiving the wrong data.

Commonly Confused Terms

- Transcript vs. Copy of Return: A transcript is a summary whereas a full copy includes exact replicas of filed forms. A request for a copy requires Form 4506 and a payment.

Legal Use and Compliance

Using the tax return transcript 2012 form ensures compliance with legal standards and requirements for handling tax information.

Privacy and Security Measures

When information from the transcript is shared with third parties, all IRS privacy requirements must be followed to protect sensitive data. Any unauthorized sharing or misrepresentation of the data can lead to legal repercussions under IRS guidelines.

Key Elements and Details

The form contains several critical sections that must be accurately filled out to avoid processing delays or rejections.

- Taxpayer Details: Accurate name and SSN entries are crucial.

- Requested Transcripts: Ensure the correct type is requested.

- Year of Tax Information: Specify the precise tax year(s) needed (e.g., 2012).

- Signatures: Must be physically signed by the taxpayer, no digital or xeroxed copies.

IRS Guidelines and Requirements

The IRS provides clear guidelines on how to fill and submit Form 4506-T for ensuring efficiency and compliance.

Filing Instructions

Follow exact IRS instructions regarding form filling, submission, and handling to avoid errors that may cause retrieval issues or privacy breaches.

Rejection Scenarios

Rejections occur due to illegible entries, incorrect years specified, or unauthorized signatures. Ensure all sections are completed accurately.

Filing Deadlines and Important Dates

Although there are no strict deadlines for requesting tax return transcripts, certain time-sensitive scenarios, such as financial audits or loan applications, might require prompt action. It is advisable to request them well in advance of deadlines set by third-party institutions requiring this data to avoid last-minute complications.