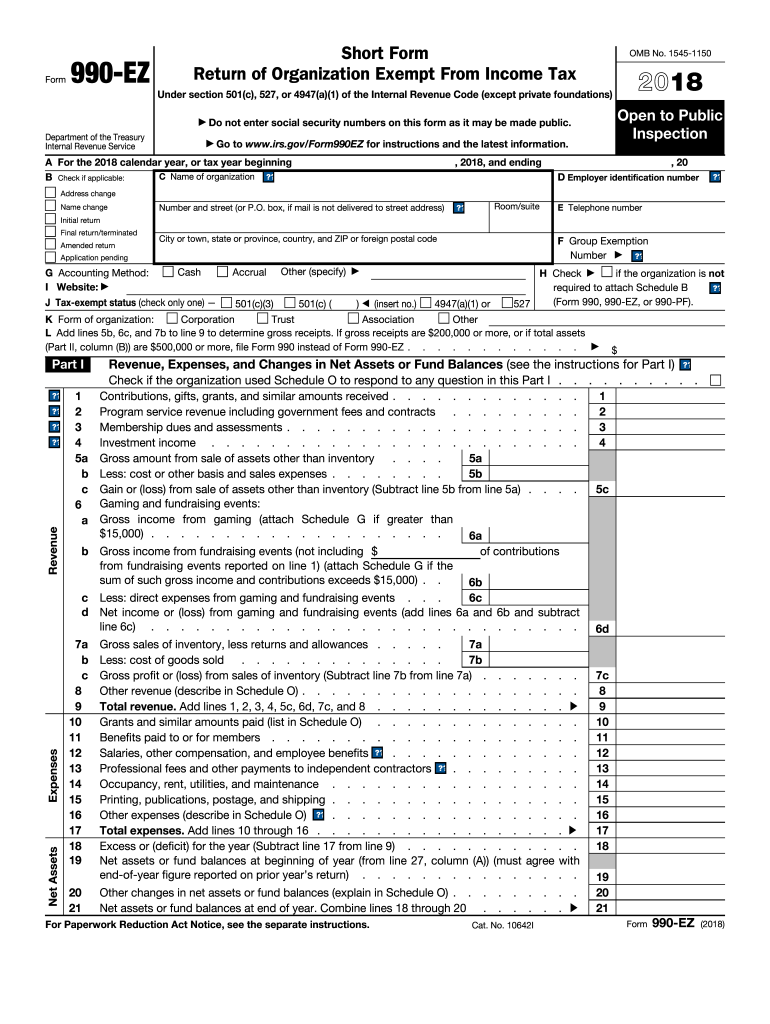

Definition & Purpose of Form 990-EZ

The 2015 Form 990-EZ is a short-form tax return used by tax-exempt organizations in the United States, such as charities and nonprofits, to report their financial activities to the Internal Revenue Service (IRS). This form is designed for organizations with gross receipts of less than $200,000 and total assets of less than $500,000. It provides a streamlined method for eligible organizations to comply with IRS requirements while ensuring transparency in their financial dealings.

Key Components of Form 990-EZ

- Revenue and Expenses: Organizations must detail their income and expenditures to provide a clear picture of their financial health.

- Net Assets and Fund Balances: Includes information on the asset and liability positions at the start and end of the fiscal year.

- Program Service Accomplishments: Description of the organization's main activities and how funds were used to achieve its objectives.

- List of Officers, Directors, and Key Employees: Identifies individuals responsible for the organization's governance and decision-making.

Steps to Complete the 2015 Form 990-EZ

Completing the Form 990-EZ involves several steps that require careful attention to ensure accuracy. Below is a general guide to help you through the process:

- Gather Required Information: Collect all necessary financial records, including income statements, expenses, and balance sheets.

- Fill Out Each Section: Complete each part of the form per the IRS instructions. Pay special attention to financial data and descriptions of program services.

- Attach Schedules and Statements: Depending on the organization's activities, you may be required to attach additional schedules, like Schedule O for additional explanations.

- Review for Accuracy: Double-check all entries for consistency and accuracy to minimize potential errors and inquiries from the IRS.

Important Forms and Schedules

- Schedule A: For public charities and certain other organizations to provide additional information on public charity status.

- Schedule B: To report significant contributions from donors.

- Schedule O: Used for supplemental information and explanations.

Filing Methods for the 2015 Form 990-EZ

Organizations have several options for submitting the Form 990-EZ to the IRS. Whether filing online or through traditional means, adhering to the submission rules is crucial for compliance.

Electronic Filing

- Benefits: Electronic filing is faster, more secure, and reduces chances of errors. The IRS often processes electronic returns more quickly than paper submissions.

- Software Options: Official IRS e-file providers and third-party software such as TurboTax and QuickBooks can assist in electronic submission.

Mail-In Option

- Where to Send: Mailed forms should be directed to the IRS office processing center that handles the organization's geographic location.

- Tips for Mailing: Use certified mail or a delivery service that provides tracking to confirm receipt by the IRS.

Eligibility Criteria & Compliance

Eligibility to file the 2015 Form 990-EZ is determined by specific financial thresholds and the nature of the organization. Compliance with these requirements is essential for maintaining tax-exempt status.

Who Can Use Form 990-EZ?

- Financial Thresholds: Organizations with annual gross receipts below $200,000 and total assets under $500,000.

- Type of Organization: Includes public charities, religious organizations, and other nonprofits recognized under IRS tax code.

Penalties for Non-Compliance

- Late Filing Penalties: The IRS may impose fines for late submission of the form. These can escalate based on the organization's size and the duration of the delay.

- Failure to File: Consistent failure to file can result in the loss of tax-exempt status, impacting both legal stature and donor relations.

Typical Users of the 2015 Form 990-EZ

Several types of organizations regularly employ the Form 990-EZ to fulfill their annual reporting obligations.

Common Examples

- Nonprofit Organizations: Small to mid-sized charities, educational institutions, and arts organizations.

- Foundations: Certain private foundations and trusts, depending on income and financial activities.

IRS Guidelines & Requirements

The IRS provides comprehensive guidelines to assist organizations in accurately completing and filing the 2015 Form 990-EZ.

Key Considerations

- Detailed Instructions: Instructions are available on the IRS website and include guidance on each part of the form.

- Additional Guidance: Regular updates and FAQs from the IRS can further help in addressing specific concerns about unusual transactions or unique organizational structures.

Important Terms Associated with Form 990-EZ

Understanding the terminology used in Form 990-EZ is crucial for correct filing and compliance.

Definitions

- Gross Receipts: Total income from all sources before deducting any costs or expenses.

- Net Assets: The difference between the total assets and liabilities of the organization, reflecting financial health.

- Program Services: Activities and services directly working toward achieving the organization's mission.

With careful adherence to these guidelines and steps, completing the 2015 Form 990-EZ can become a streamlined process, vital for maintaining the transparency and compliance of tax-exempt organizations.