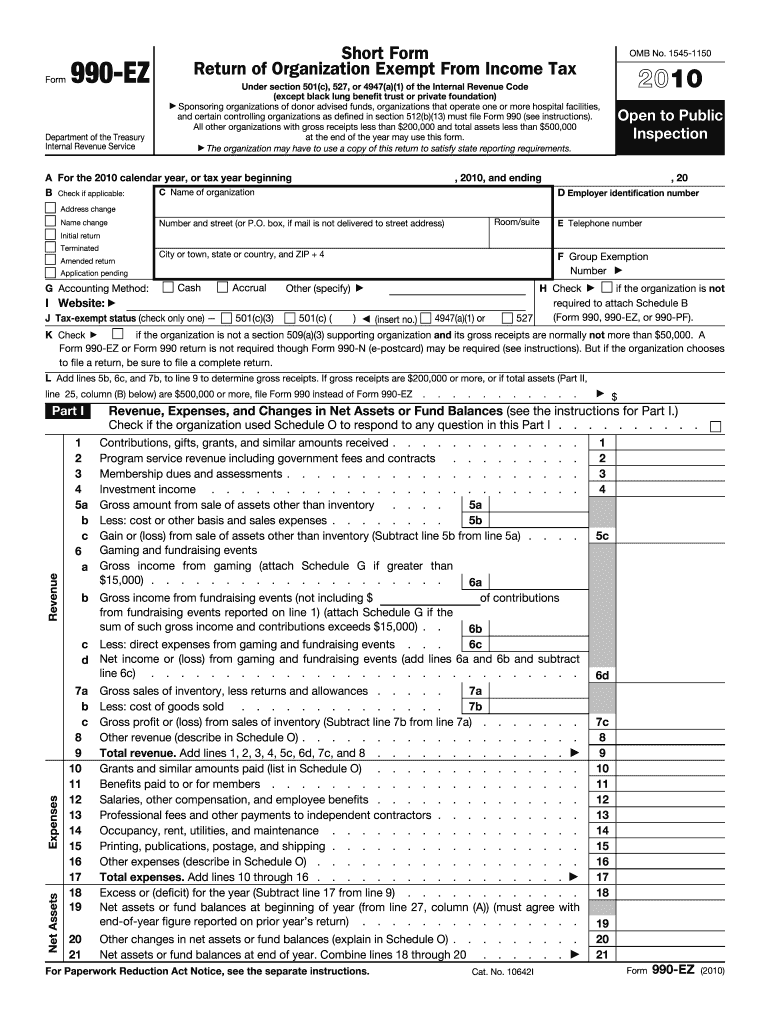

Definition and Purpose of Form 990-EZ

Form 990-EZ, specifically for the year 2010, is a short-form return filed by organizations that are exempt from income tax under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. This form is specifically designed for organizations that meet certain financial thresholds—those with gross receipts under $200,000 and total assets under $500,000. It facilitates the reporting of critical financial information, including revenue, expenses, net assets, and program service accomplishments. Additionally, it captures details about an organization’s officers and any major changes to the entity.

- Purpose: Enables non-profit organizations to disclose their financial activities and compliance with tax regulations transparently.

- What it Clarifies: Provides an overview of an organization’s financial health, guiding both the IRS and public evaluations.

How to Use the 2010 Form 990-EZ

Ensuring accurate use of Form 990-EZ requires a methodical approach, understanding both the input requirements and the format for filling out the form.

- Step-by-Step Completion:

- Understand the Eligibility Criteria: Confirm your organization’s gross receipts and total assets meet the required limits.

- Section Breakdown:

- Report Organization Details: Name, EIN, address, and fiscal period.

- Financial Details: Revenue, expenses, and net assets.

- Program Accomplishments: Summarize and quantify the impact of your core projects.

- Compliance Checks: Respond to questions about tax compliance and governance.

- Review and Verify All Entries: Double-check figures and narratives to ensure accuracy before submission.

How to Obtain the 2010 Form 990-EZ

Acquiring Form 990-EZ involves simple access steps to ensure you retrieve the correct document for your needs.

- Methods:

- Direct Download: Access the IRS website for free download in PDF format.

- Request by Mail: Organizations can order physical copies from IRS offices.

- Tax Software: Some platforms may offer direct linking for form retrieval.

Steps to Complete the 2010 Form 990-EZ

Completing Form 990-EZ precisely is crucial for compliance and transparency. Here’s a comprehensive guide:

- Prepare Necessary Documentation: Gather records of all financial activities, including income, grants, donations, and expenses.

- Input Financial Data: Clearly enter revenue details under different categories provided in the form.

- Detail Functional Expenses: Categorize expenses by program, management, and fundraising operations.

- Completion of Balance Sheet: Precisely capture your organization's assets, liabilities, and net assets.

- Finalize Program Service Accomplishments: Describe program activities and their outcomes comprehensively.

Key Elements of the 2010 Form 990-EZ

Several sections stand out as fundamental components of Form 990-EZ, essential for accurate filing:

- Revenue Section: Detailed breakdown of income sources, ensuring transparency in earnings.

- Expenses: Categorization of functional expenses helps assess an organization's cost management.

- Net Assets: Reflects financial stability and future operational capacity.

- Supplementary Details: Includes information on governance, officers, and stakeholder activities.

Filing Deadlines and Important Dates

Awareness of critical deadlines is vital for the timely submission of Form 990-EZ to avoid penalties.

- Standard Deadline: The original due date is the 15th day of the 5th month after the fiscal year ends.

- Extensions: Organizations can apply for a 3-month extension using Form 8868 if more time is needed.

Penalties for Non-Compliance

Failing to comply with Form 990-EZ filing requirements can lead to severe consequences.

- Financial Penalties: Daily penalties apply for late filing, rate based on the organization’s gross receipts.

- Loss of Tax-Exempt Status: Repeated or severe non-compliance could risk the revocation of tax-exempt status.

IRS Guidelines and Compliance

Following the IRS guidelines for Form 990-EZ is crucial to maintain good standing and ensure effective compliance.

- Detailed Instructions: The IRS provides comprehensive guidance on filling the form correctly.

- Compliance Checks: The form includes sections specifically designed to verify tax compliance and sustainability of operations.

By unfolding these aspects, organizations can ensure their Form 990-EZ is completed accurately and aligned with required regulations, providing an authentic account of their financial and operational status.