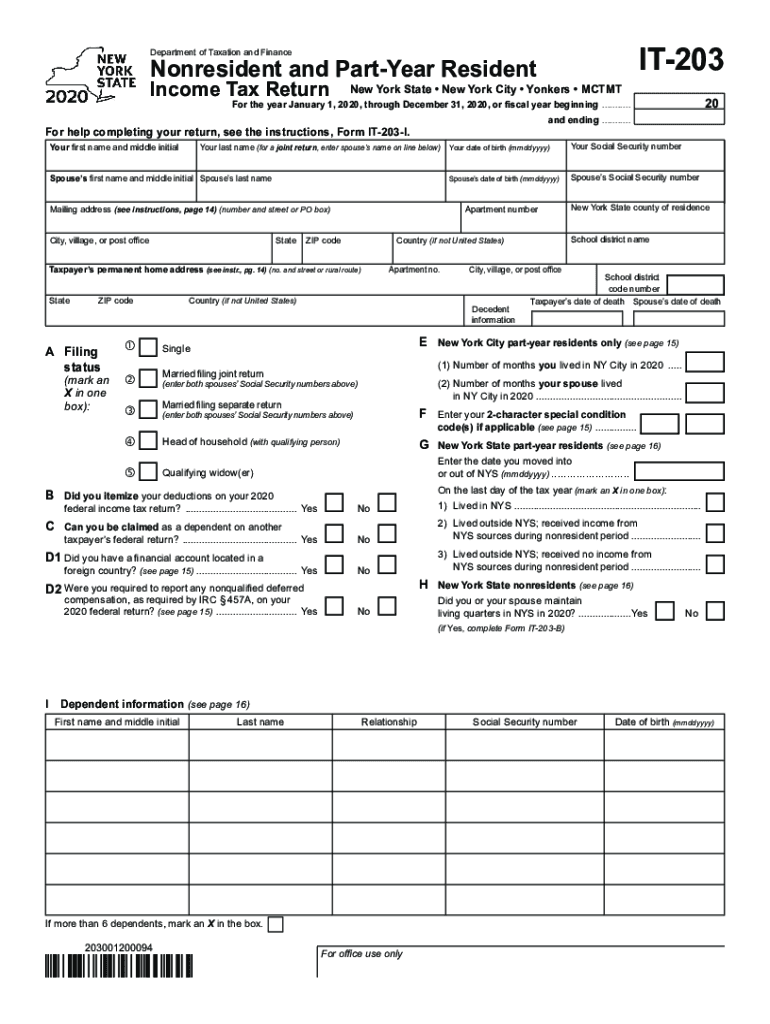

Definition and Meaning of IT-203

Form IT-203, recognized as the New York State Nonresident and Part-Year Resident Income Tax Return, is utilized by individuals who reside outside New York State yet generate income from New York sources. This document allows these taxpayers to accurately report their income, claim any deductions or credits, and fulfill their tax obligations in the state. Understanding the nuances of IT-203 is crucial for compliance, especially for those who might not be familiar with New York tax laws or who have complex income situations.

Key Features of IT-203

- Target Audience: Specific for nonresidents and part-year residents.

- Income Reporting: Designed to help individuals report all income sources originating from New York, ensuring that taxpayers pay the correct amount of tax based on their New York-sourced income.

- Deductions and Credits: Enables the claiming of state-specific deductions and credits that reduce overall tax liability.

How to Use the IT-203

To effectively use Form IT-203, taxpayers need to gather the necessary financial information and ensure all data is accurate before submission. Here’s how to navigate the form effectively:

- Gather Required Information: Collect documentation for all income earned in New York, including W-2 forms, 1099 forms, and any other relevant income records.

- Understand Filing Requirements: Ensure that your filing status is accurately reflected on the form, as this will influence your tax obligations.

- Complete All Sections: Fill out each section of the form methodically, paying special attention to areas designated for income, deductions, and credits.

- Review and Submit: After thoroughly checking for errors, submit the completed form either online or via mail based on your preference or requirements.

Steps to Complete the IT-203

Completing the IT-203 involves a structured approach to ensure all necessary details are accurately reported. The following steps provide a clear guideline:

- Download the Form: Access the IT-203 from the New York State tax website or obtain a physical copy.

- Fill in Personal Information: Provide your name, address, and Social Security number on the designated lines.

- Select Filing Status: Indicate your filing status, choosing from options like single, married filing jointly, or head of household.

- Report Income: Document all sources of income, including wages, unemployment benefits, and business income, specifically highlighting amounts earned within New York.

- Claim Deductions and Credits: Identify and enter any applicable deductions or credits to minimize your tax obligation.

- Calculate Tax Liability: Use the instructions provided with the form to compute the actual amount of tax owed based on your reported income and applicable deductions.

- Sign and Date the Form: Ensure that you sign and date the form prior to submission to validate the accuracy of the information provided.

Important Terms Related to IT-203

Familiarizing oneself with key terminology used in Form IT-203 is essential for proper completion and understanding of tax obligations. Some relevant terms include:

- Nonresident: An individual who does not reside in New York but earns income from New York sources.

- Part-Year Resident: A taxpayer who is a resident for part of the year and a nonresident for the remaining months.

- Deductions: Specific expenses that can be subtracted from total income to reduce taxable income.

- Credits: Benefits that reduce the overall tax liability dollar-for-dollar.

Filing Deadlines and Important Dates

Timely submission of Form IT-203 is critical to avoid penalties and interests. Key deadlines include:

- Annual Filing Deadline: Generally, Form IT-203 must be filed by April 15 of the year following the tax year being reported, similar to federal income tax deadlines.

- Extensions: Taxpayers can apply for an automatic extension to file their IT-203, typically extending the deadline by six months; however, any taxes owed must still be paid by the original deadline.

Importance of Adhering to Deadlines

Failing to meet the filing deadlines can lead to penalties, late fees, and interest accrual on unpaid taxes. To remain compliant, it is advisable to maintain a calendar for all tax-related dates and submit documents promptly.

Required Documents for IT-203

When preparing to file Form IT-203, certain documents must be gathered to substantiate the information reported on the form. These may include:

- Income Documents: W-2 forms, 1099 forms, and any other tax statements proving income earned in New York.

- Proof of Residency: Documents indicating your residency status during the tax year, such as rental agreements or utility bills.

- Deduction and Credit Documentation: Receipts or forms that substantiate claims of deductions and credits.

By compiling these documents, taxpayers can expediently complete the IT-203 with accurate information, minimizing the risk of errors during submission.