Definition and Meaning

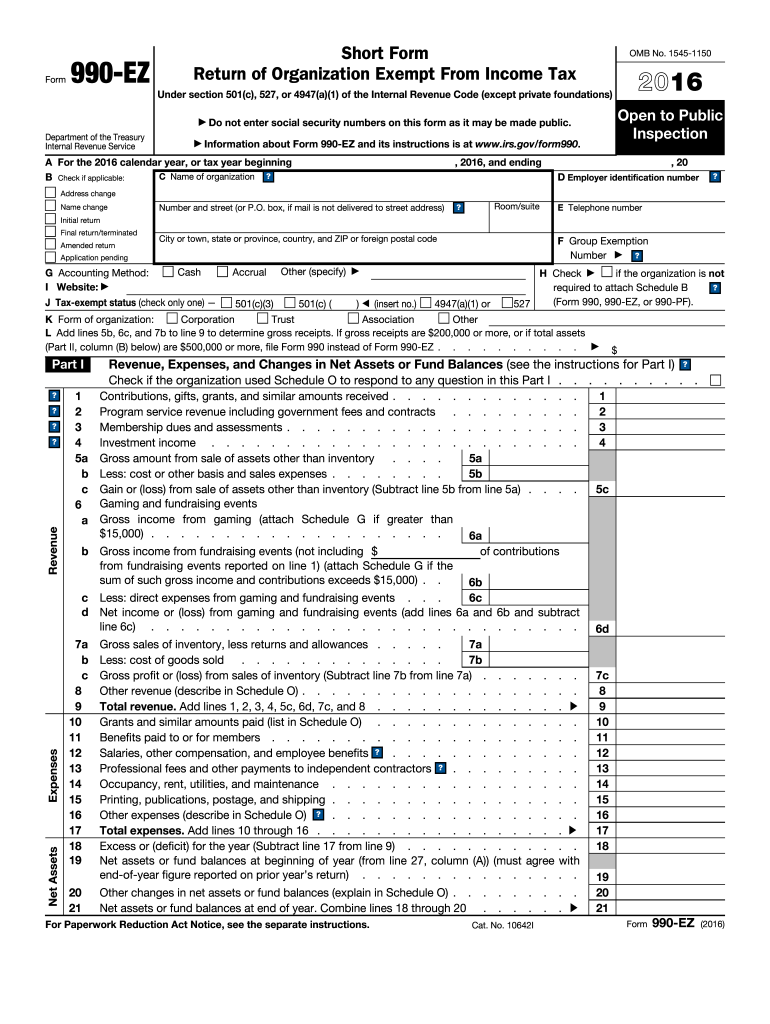

Form 990-EZ, officially known as "IRS Form 2016 990-EZ," is a short form return for organizations exempt from income tax under specific sections of the Internal Revenue Code. This form is primarily used to provide a structured format for reporting financial information about these organizations, including their revenue, expenses, and net assets. Filing this form is mandatory for eligible organizations to comply with IRS requirements and ensure transparency in their financial activities.

Form 990-EZ serves as a simplified alternative to Form 990. It is commonly used by smaller tax-exempt organizations that meet certain gross receipt thresholds, allowing them to present their financial operations in a less complex manner. Proper understanding and completion of Form 990-EZ help organizations maintain good standing with the IRS and communicate essential financial data to the public and governmental entities.

Why Use IRS Form 2016 990-EZ

Understanding why organizations opt for Form 990-EZ is crucial for ensuring compliance and efficiency in financial reporting. This form is particularly useful for smaller tax-exempt organizations that require a more straightforward filing process than the standard Form 990.

- Simplified Reporting: Form 990-EZ offers a less complex alternative, making it easier for organizations to meet reporting requirements without navigating the intricacies of the longer Form 990.

- Eligibility for Small Organizations: It caters specifically to smaller nonprofits, generally those with gross receipts less than a certain threshold, allowing them to fulfill legal obligations efficiently.

- Transparency and Accountability: By using Form 990-EZ, organizations provide clear and accessible financial information, promoting accountability and transparency essential for public trust and regulatory compliance.

Steps to Complete IRS Form 2016 990-EZ

Filing Form 990-EZ involves several key steps that organizations need to follow to ensure accurate and timely submission. Here's a comprehensive guide to completing the form:

- Gather Required Documents: Collect all necessary financial records, including income statements and expense details for the relevant tax year.

- Review Eligibility Criteria: Ensure your organization qualifies to use Form 990-EZ based on its revenue and other factors. This verification prevents filing errors and non-compliance penalties.

- Complete the Form Sections:

- Part I: Fill out financial details such as total revenue and expenses.

- Part II: Provide balance sheet information, showing assets and liabilities.

- Part III: State your organization's mission and any program accomplishments.

- Part IV: Answer questions regarding other IRS filings and tax compliance.

- Attach Schedules as Needed: Depending on your responses, attach relevant schedules (e.g., Schedule A for public charity status).

- Review and Sign: Double-check all entries for accuracy, and ensure the form is signed by an authorized officer of the organization.

- File by the Deadline: Submit the completed form to the IRS by the designated due date to avoid late penalties.

Key Elements of IRS Form 2016 990-EZ

Form 990-EZ consists of several essential components that organizations must address thoroughly. Each part provides critical insight into the financial and operational aspects of the nonprofit:

-

Revenue and Expenses (Part I): This section requires detailed reporting of the organization’s financial activities, including program service revenue, contributions, grants, and other income.

-

Balance Sheet (Part II): Organizations must disclose their assets and liabilities, providing a snapshot of their financial health at the end of the fiscal year.

-

Program Service Accomplishments (Part III): Here, entities describe their mission and report on each program’s success, illustrating how funds were utilized to fulfill the nonprofit's objectives.

-

Statements and IRS Filings (Part IV): This section requires answers about compliance with other IRS requirements, foreign investments, and unrelated business income.

Eligibility Criteria for IRS Form 2016 990-EZ

An organization's eligibility to file Form 990-EZ is determined by specific criteria that simplify the filing process for certain nonprofits:

-

Gross Receipts Threshold: Organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the tax year typically qualify to use this form.

-

Type of Organization: Only tax-exempt organizations such as charities, nonprofit associations, and other qualifying entities are eligible to file Form 990-EZ.

Understanding these criteria helps ensure correct filing, facilitating smoother interactions with the IRS and reducing the risk of penalties due to filing the wrong form.

Filing Deadlines and Important Dates

Meeting IRS deadlines is crucial for avoiding penalties associated with late submissions. Here are key dates relevant to Form 990-EZ:

-

Standard Filing Deadline: Form 990-EZ is due by the 15th day of the 5th month after the end of the organization’s accounting period. For calendar year filers, this is typically May 15.

-

Extensions: Organizations can request an automatic six-month extension by submitting Form 8868 before the original deadline, giving them additional time to ensure accuracy in reporting.

Timely filing ensures compliance and helps organizations maintain transparency and good standing with the IRS.

Important Terms Related to IRS Form 2016 990-EZ

Navigating through Form 990-EZ requires familiarity with several specific terms and concepts:

-

Gross Receipts: Total income an organization receives from all sources before subtracting costs.

-

Public Charity Status: Classification affecting eligibility and tax treatment, typically based on funding sources and the nature of the organization’s activities.

-

Program Service Revenue: Income earned from activities related to an organization’s tax-exempt purpose, such as educational events or publications.

Understanding these terms enhances accuracy when completing the form, aiding in effective communication of financial operations to the IRS.

Software Compatibility and Digital Submission

While Form 990-EZ can still be submitted in paper form, leveraging digital tools can streamline the process:

-

Compatible Software: Solutions like QuickBooks and TurboTax often include features that assist in organizing financial data and populating IRS forms, including Form 990-EZ.

-

E-Filing Benefits: Online submission via the IRS's authorized e-filing systems ensures timely delivery, minimizes errors, and simplifies record-keeping through digital storage.

Adopting digital tools for form preparation not only saves time but also enhances the accuracy and efficiency of the filing process.