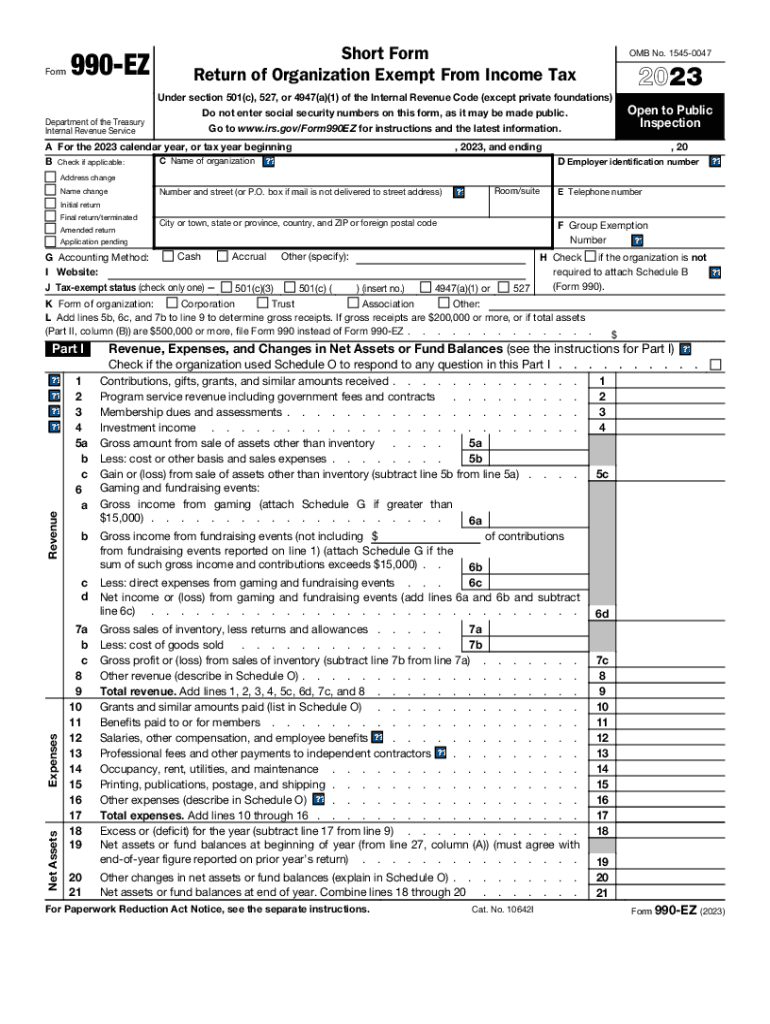

Definition & Meaning

Form 990-EZ, the Short Form Return of Organization Exempt From Income Tax, is a document used by organizations exempt from income tax under sections 501(c), 527, or 4947(a)(1) of the U.S. Internal Revenue Code. This form offers a streamlined version for eligible small- to mid-sized nonprofit organizations to report their financial details, including revenues, expenses, and program service accomplishments, to the Internal Revenue Service (IRS) annually. It is designed to gather comprehensive information on an organization’s operations and compliance while minimizing unnecessary inquiries from the IRS.

How to Use the 2023 Form 990-EZ Short Form Return of Organization Exempt From Income Tax

-

Determine Eligibility: Verify if your organization qualifies to use the 990-EZ form by considering factors like gross receipts and total assets. It is typically intended for organizations with gross receipts of less than $200,000 and total assets below $500,000 at the end of the year.

-

Gather Information: Collect data on your organization’s annual financial activities, including income, expenses, and net assets. Also, prepare a list of program accomplishments and any changes in governance or operational policies.

-

Complete the Form: Fill out each section of the form accurately. This includes the statement of program service accomplishments, revenue, expenses, and a balance sheet of assets, liabilities, and net assets.

-

Review and Authenticate: Double-check the completed form for accuracy, and ensure it is signed by an officer of the organization.

-

Submit to IRS: Process the filing either electronically through the IRS-approved e-file system or send a completed paper copy to the IRS address designated for your organization’s location.

Steps to Complete the 2023 Form 990-EZ Short Form Return of Organization Exempt From Income Tax

-

Organizational Information: Enter basic information such as the name of the organization, address, employer identification number (EIN), and tax year on the form.

-

Revenue Details: Provide details of the organization's gross receipts, contributions, gifts, grants, and other income sources in Part I.

-

Expense Reporting: Specify total expenses, including salaries, professional fees, office expenses, and program costs in Part II.

-

Net Assets: Present the organization's beginning and ending net assets or fund balances in Part I, section B.

-

Program Service Accomplishments: Describe major program activities and their worth in Part III while indicating how these activities furthered the organization’s exempt purpose.

-

Statement of Changes: Reflect any changes in financial position through a balance sheet in Part II.

-

Supplementary Schedules: Attach Schedule A for Public Charity Status and Public Support, along with any other required schedules and statements.

Eligibility Criteria

Organizations eligible to file Form 990-EZ must meet specific income and asset thresholds. Generally, a nonprofit with gross receipts under $200,000 and total assets at the year's end under $500,000 qualifies to use this short form. It is essential to verify qualification each tax year, as eligibility criteria can be subject to changes in tax law or IRS guidelines.

Filing Deadlines / Important Dates

The Form 990-EZ must be filed by the 15th day of the fifth month after the end of the organization’s accounting period. For calendar year filers, this deadline is May 15. It is crucial to mark this date to avoid late filing penalties. If an extension is necessary, Form 8868 can be submitted to request additional time to file.

IRS Guidelines

Organizations must adhere to the IRS’s strict filing guidelines for Form 990-EZ. This includes maintaining accurate financial records and ensuring that all reported activities and transactions align with the stated exempt purpose. The IRS provides publication 557, "Tax-Exempt Status for Your Organization," which outlines the regulatory landscape for nonprofit entities.

Who Typically Uses the 2023 Form 990-EZ Short Form Return of Organization Exempt From Income Tax

This form is customarily used by small-to-mid-sized nonprofits like local community foundations, educational charities, arts organizations, and social welfare entities. These organizations typically possess fewer complex financial interests and do not meet the size requirements that necessitate the full Form 990.

Key Elements of the 2023 Form 990-EZ Short Form Return of Organization Exempt From Income Tax

- Part I: Revenue, expenses, and changes in net assets or fund balances

- Part II: Balance sheets detailing assets, liabilities, and net assets or fund balances

- Part III: Statement of program service accomplishments

- Part IV: List of officers, directors, trustees, and key employees

- Schedule A: Document contributions and public support details

Penalties for Non-Compliance

Failing to file the Form 990-EZ timely or accurately can result in significant penalties for the organization. Penalties can accumulate daily and depend on the size and gross receipts of the organization. In extreme cases, persistent non-compliance can threaten the organization's tax-exempt status, which can be a severe detriment to its operations.