Definition & Meaning

The 2013 Form 1099 encompasses a category of IRS forms, notably used for reporting various types of income other than wages, salaries, and tips. This form is crucial for taxpayers to report miscellaneous income received during the year, such as payments to independent contractors, interest and dividends, real estate transactions, and government payments. Understanding the purpose and necessity of this form assists individuals and businesses in adhering to tax regulations and ensuring accurate income reporting.

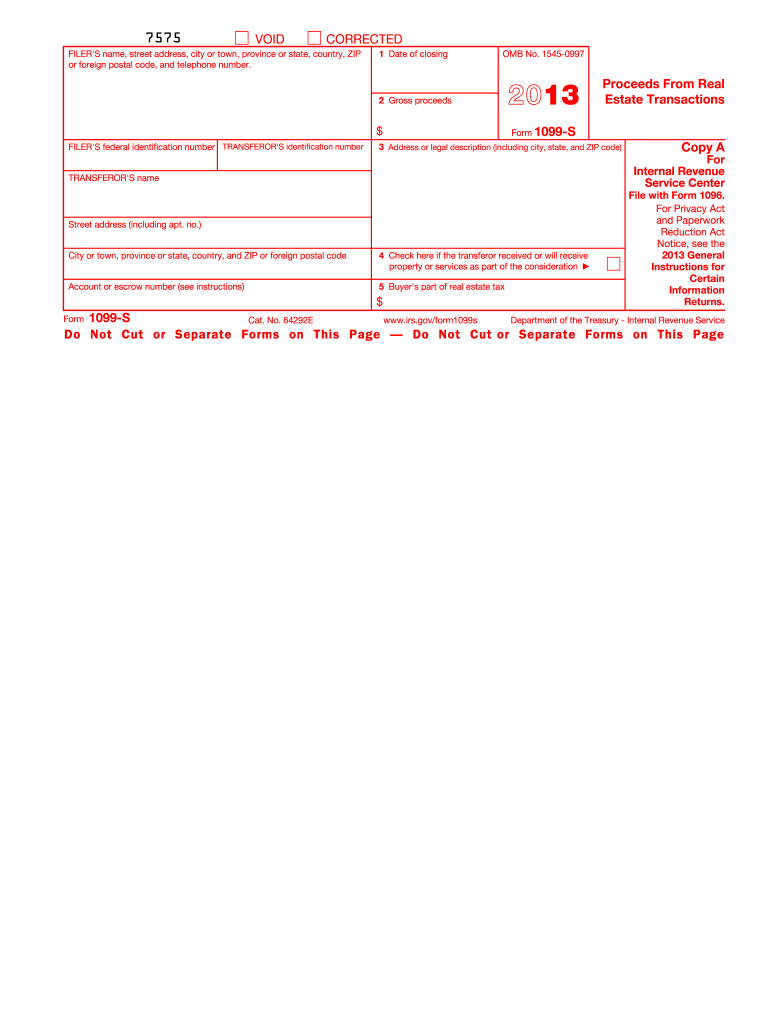

Key Elements of the 2013 Form 1099

A detailed understanding of the 2013 Form 1099's components can significantly aid in accurate completion and filing. Key elements include:

- Payer’s Details: Name, address, and taxpayer identification number of the entity making the payment.

- Recipient’s Details: Full name, address, and taxpayer identification number of the income recipient.

- Payment Information: Specific amounts paid, the type of payment, and associated codes indicating the payment category.

Accurate completion of these sections is imperative to prevent filing errors.

Steps to Complete the 2013 Form 1099

Completing the form accurately requires attention to detail. Follow these step-by-step instructions:

- Obtain and Review: Get the form from the IRS website or through authorized suppliers, and familiarize yourself with its sections.

- Enter Payer Information: Fill in the payer's full details, including a tax identification number.

- Enter Recipient Information: Input the recipient's full details accurately.

- Report Payment Amounts: Enter all payment amounts in the appropriate boxes, correlating with different income types.

- Check For Accuracy: Double-check all entered information for accuracy before submission.

- Submit Accordingly: Follow IRS guidelines for form submission, ensuring the recipient and IRS both receive copies.

Who Typically Uses the 2013 Form 1099

The form is predominantly employed by businesses and payers obligated to report the non-salary income of various individuals and entities. Common users include:

- Businesses making payments to freelancers or independent contractors.

- Financial institutions reporting interest or dividends.

- Government entities documenting certain types of payments to individuals.

Identifying whether you are required to use this form helps in fulfilling tax responsibilities.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial to avoid penalties. Key dates include:

- Recipient Copy Deadline: Typically January 31 of the subsequent year.

- IRS Submission Deadline: By the end of February for paper submissions, or March 31 if filing electronically, ensuring all information returns align with these timelines.

These deadlines ensure compliance with IRS requirements and prevent late filing penalties.

IRS Guidelines

The IRS provides detailed instructions for both filing and completing the 2013 Form 1099, outlining:

- Who Must File: Businesses making payments exceeding specified threshold amounts.

- Exemptions and Exclusions: Types of payments not required to be reported.

- Submission Details: Address and methods for submitting completed forms.

Staying informed on IRS guidelines ensures accurate and compliant filings.

Penalties for Non-Compliance

Failing to comply with filing requirements can result in significant penalties. Penalty amounts depend on the filing delay:

- Late Filing: Penalties increase with the delay period, ranging from a nominal fee per form for a few days late to a substantial fee for delays over 30 days.

- Intentional Disregard: A much higher penalty per form if the filer intentionally disregards filing requirements.

Understanding these repercussions underscores the importance of timely and accurate submissions.

Form Submission Methods (Online / Mail / In-Person)

Multiple submission methods accommodate different preferences and software capabilities:

- Electronic Filing: Recommended for faster processing, especially for large volumes, through IRS-approved e-file providers.

- Mail Submission: Suitable for small quantities or those without electronic access, utilizing approved IRS addresses.

- In-Person: Generally limited to specific IRS locations; verify before attempting.

Choosing the appropriate method simplifies the filing process and can reduce processing times.

Digital vs. Paper Version

Both digital and paper versions of the 2013 Form 1099 offer distinct advantages:

- Digital Version: More efficient, with features like automated calculations and easier record-keeping. Offers quick updates for regulatory changes.

- Paper Version: Beneficial for those preferring traditional methods or lacking digital infrastructure.

Understanding these differences helps in selecting the most suitable filing format based on individual or business needs.

Software Compatibility (TurboTax, QuickBooks, etc.)

Leverage software tools to streamline form completion and filing:

- TurboTax: Allows users to import financial data and automatically fill in relevant sections.

- QuickBooks: Facilitates tracking of payments, making data transfer to the form seamless.

Utilizing compatible software reduces errors and enhances efficiency in the filing process.

Eligibility Criteria

Determining who qualifies for Form 1099 filing is based on payment amounts and types. Typically, payments exceeding $600 require reporting, though some exceptions exist:

- Contractors and Freelancers: Payments for services provided.

- Interest and Dividends: Thresholds specified under respective reporting guidelines.

Review eligibility criteria to ensure form necessity and accurate reporting obligations.