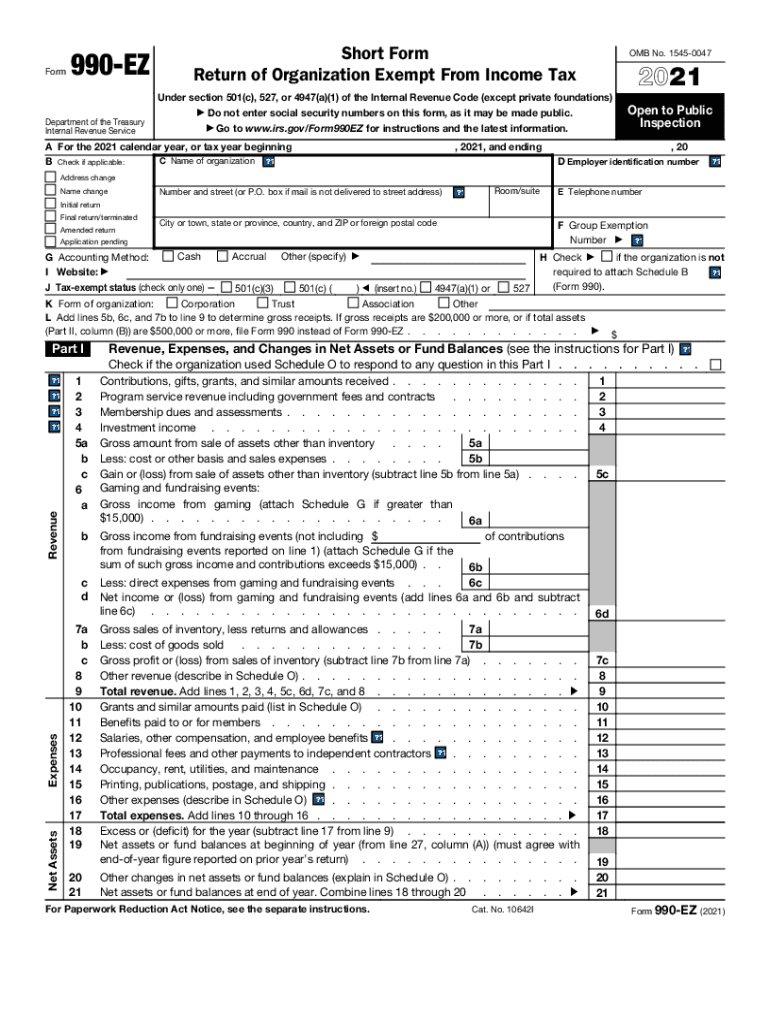

Purpose and Function of the 990-EZ Form

The 990-EZ Form serves as a short-form return for organizations operating as nonprofits under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. Primarily used by smaller organizations, this form simplifies the reporting process while maintaining compliance with IRS requirements. It collects financial information and records organizational activities and governance structures, ensuring transparency and accountability. The 990-EZ provides essential data about an organization’s revenue, expenses, net assets, and service accomplishments.

Steps to Complete the 990-EZ Form

- Gather Required Financial Information:

- Compile records of the organization’s income, expenses, and net assets.

- Include detailed descriptions of program services and accomplishments.

- Fill Out the Revenue and Expenses Section:

- Report all sources of income, including donations, grants, and earned revenue.

- Break down expenses into categories such as salaries, administrative costs, and program expenses.

- Provide Governance, Management, and Disclosure Information:

- Detail the organization’s board members and key staff.

- Disclose any potential conflicts of interest and compliance with regulatory requirements.

- Complete the Balance Sheet Section:

- Include data related to assets, liabilities, and net assets at the beginning and end of the reporting period.

- Provide Supplemental Information:

- Add schedules or attachments for additional details on certain items, if applicable.

Eligibility Criteria for the 990-EZ Form

Organizations eligible to file the 990-EZ include nonprofit entities with annual gross receipts of less than $200,000 and total assets under $500,000. Organizations must ensure that they meet these financial thresholds to qualify for the simplified filing process. Larger entities are required to submit the more comprehensive Form 990 instead.

Importance of Filing the 990-EZ Form

Filing the 990-EZ Form is critical for maintaining tax-exempt status. It demonstrates compliance with federal regulations and keeps the organization’s financial and governance practices transparent to the public. Failing to file or inaccuracies in filing can lead to penalties, fines, and potentially the loss of tax-exempt status.

Obtaining the 990-EZ Form

The 990-EZ Form can be downloaded directly from the IRS website. Many tax software programs, such as TurboTax and QuickBooks, also offer support for completing and submitting the form electronically. Organizations may choose to complete the form online or print and send a paper version through the mail.

IRS Guidelines and Compliance for the 990-EZ Form

The IRS provides specific instructions and guidance on completing the 990-EZ Form. Adherence to these guidelines is crucial to prevent errors and ensure accurate reporting. Key areas include accurate income and expense reporting, proper categorization of financial information, and complete disclosure of governance practices.

Filing Deadlines and Important Dates

The 990-EZ Form is due on the 15th day of the fifth month after the close of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can request an automatic six-month extension by submitting Form 8868 before the original deadline.

Consequences of Non-Compliance

Organizations failing to submit the 990-EZ Form on time may face financial penalties. The penalty starts at $20 per day for revenue under $1 million, up to a maximum of $10,000 or 5% of the organization’s gross receipts. Continual failure over three years may result in the revocation of tax-exempt status by the IRS.