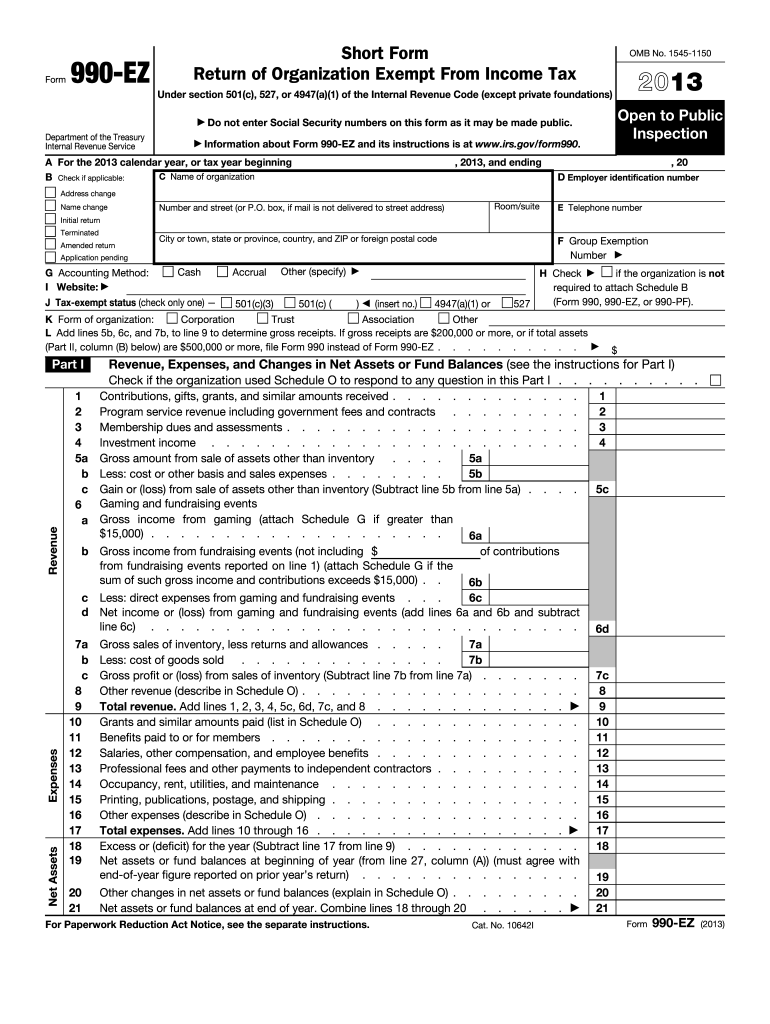

Definition & Meaning

The "EZ 2013 IRS form" typically refers to Form 1040-EZ, a simplified version of the standard federal income tax return form used in previous years. It was designed for taxpayers with straightforward tax situations. The form was used to report basic income, claim certain credits, and calculate owed taxes for the year 2013. This form was ideal for individuals with no dependents, simple taxable income, and those who did not itemize deductions. By offering a streamlined process, Form 1040-EZ reduced the complexity and time required for eligible taxpayers to file their federal taxes.

How to Use the EZ 2013 IRS Form

-

Determine Eligibility: Ensure you meet all requirements to use Form 1040-EZ. Key criteria include earning less than $100,000 annually, interest income of $1,500 or less, and filing as single or married filing jointly.

-

Collect Necessary Information: Gather your W-2 forms, interest statements, and any relevant tax documents.

-

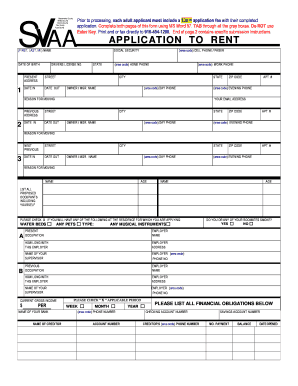

Fill Out Personal Information: Provide your name, Social Security number, and filing status at the top of the form.

-

Enter Income Details: Input your total income, including wages, salaries, and taxable interest, in the appropriate sections.

-

Calculate Taxable Income: Subtract the standard deduction and personal exemption from your total income to arrive at your taxable income.

-

Determine Tax Liability: Use the accompanying tax tables to figure out your federal tax liability.

-

Input Credits and Payments: Include any eligible credits and payments you've made throughout the year.

-

Calculate Refund or Amount Owed: The difference between your tax liability and payments plus credits will determine if you receive a refund or owe additional taxes.

Who Typically Uses the EZ 2013 IRS Form

The Form 1040-EZ was primarily used by:

- Single Filers: Individuals who did not have dependents or complex financial situations.

- Married Couples Filing Jointly: Couples with straightforward income sources and no dependents.

- Young Taxpayers: Those new to filing taxes with simple credit situations.

- Low-Income Earners: Individuals with annual incomes below $100,000 who didn’t benefit from itemized deductions.

This form was particularly beneficial for individuals who fit these criteria, offering them an uncomplicated tax filing solution.

Steps to Complete the EZ 2013 IRS Form

-

Start with Basic Information: Fill in your basic details, including names and Social Security numbers.

-

Record Income:

- List wages from W-2s.

- Include any additional taxable interest.

-

Apply the Standard Deduction and Exemption:

- Use standard deduction values applicable for the 2013 tax year.

-

Calculate Taxes Owed:

- Refer to the provided tax tables to determine federal taxes on taxable income.

-

Account for Tax Credits:

- Enter any refundable or non-refundable credits, such as the Earned Income Credit.

-

Finalize the Return:

- Compute the final total to see if a refund is due or if additional tax is owed.

-

Sign the Form: Ensure both you and your spouse (if filing jointly) sign the completed form before submission.

-

Submit the Form: Choose the appropriate submission method, either by mail or electronically.

Important Terms Related to EZ 2013 IRS Form

- Taxable Income: The portion of income subject to taxation after deductions.

- Standard Deduction: A set amount deducted from income, simplifying tax calculations.

- Personal Exemptions: Specific amounts deductible for taxpayer and spouse.

- Earned Income Credit (EIC): A refundable tax credit for low-to-moderate-income working individuals and couples, particularly those with children.

- Filing Status: Determines the tax bracket and rates applicable.

Understanding these terms helps in accurately filling out the EZ 2013 form and ensuring compliance with tax regulations.

Examples of Using the EZ 2013 IRS Form

- Scenario 1: A young professional with no children who earns $35,000 annually used Form 1040-EZ to file taxes quickly without worrying about itemized deductions.

- Scenario 2: A retired couple on a fixed income, receiving modest pension payments and Social Security, filed jointly using the simplified form to minimize paperwork.

- Scenario 3: A college student working part-time without any dependents found this form useful for declaring limited income from a W-2 job and a small amount of interest from a savings account.

These examples illustrate the form's utility for diverse taxpayer profiles.

Filing Deadlines / Important Dates

- Standard Filing Deadline: Typically due by April 15th each year unless a weekend or holiday delays the deadline.

- Extension Request Deadline: Taxpayers had until April 15th to request an extension, extending the filing deadline to October 15th.

- Amendment Submission: Taxpayers needing to amend returns had up to three years from the original filing date or two years from the tax payment date, whichever was later, to file amended returns using Form 1040-X.

Understanding these dates ensures timely and accurate submission, avoiding penalties.

Key Element of the EZ 2013 IRS Form

- W-2 Wage Statement: Essential for documenting earned income.

- Standard Deduction and Exemptions: Key factors in determining taxable income.

- Interest Income: Must be reported and affects total income calculations.

- Signature Section: Reinforces form authenticity and compliance.

- Tax Credits: Opportunities to reduce tax liability, crucial for accurate filing.

Knowledge of these elements is vital for preparing a precise tax return using the EZ form.

Form Submission Methods (Online / Mail / In-Person)

- Online Submission: Utilizing e-file services for direct submission to the IRS, offering speed and convenience.

- Mail: Traditional method using postal services; requires ensuring the correct IRS address and postage are used.

- In-Person: For a more hands-on approach, delivering the form at IRS offices (less common for the EZ form but an option).

Each method has specific benefits depending on the taxpayer's preference for convenience or confirmation of receipt.