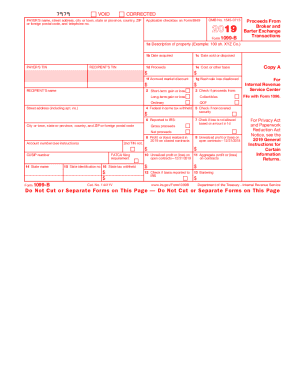

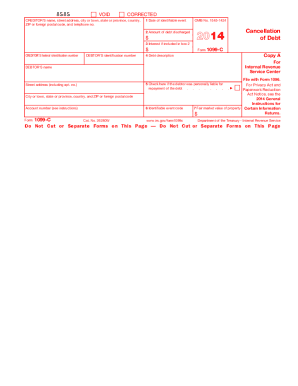

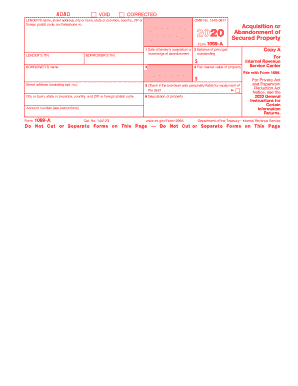

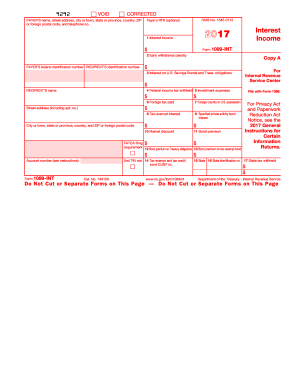

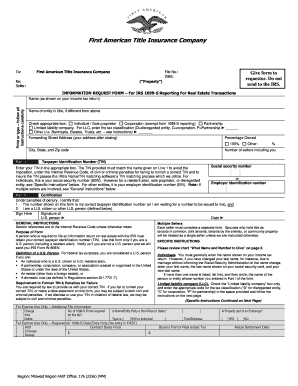

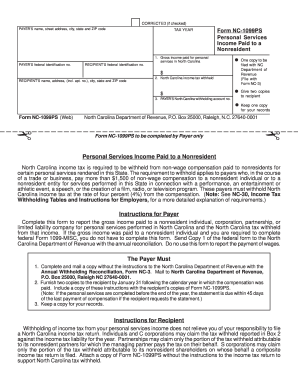

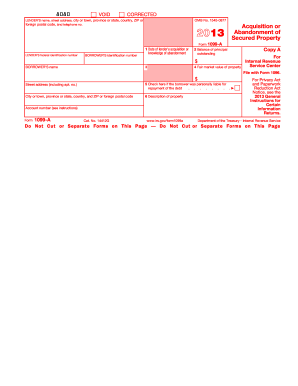

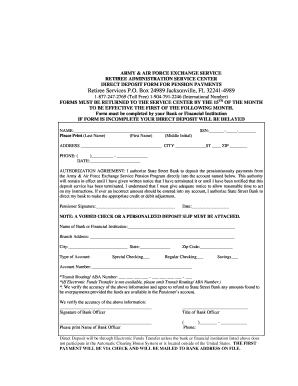

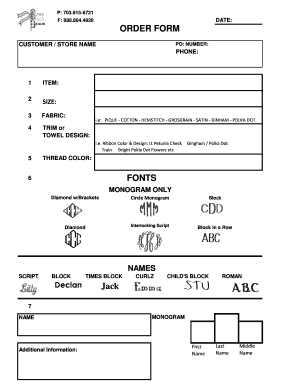

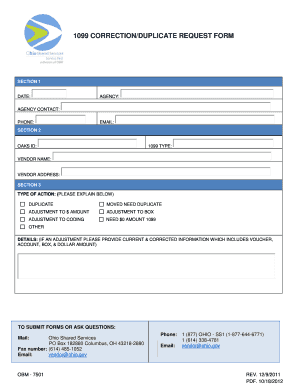

Ensure your company's productivity with 1096 and 1099 Order Forms templates. Choose order forms, adjust and send them with your customers in a few clicks.

Document management can overwhelm you when you can’t discover all of the documents you require. Fortunately, with DocHub's extensive form library, you can discover all you need and quickly handle it without the need of changing among apps. Get our 1096 and 1099 Order Forms and start utilizing them.

Using our 1096 and 1099 Order Forms using these simple steps:

Try out DocHub and browse our 1096 and 1099 Order Forms category without trouble. Get a free profile today!