Definition and Purpose of the 2 Form

The 2 form is a tax document used by the Internal Revenue Service (IRS) to report various types of income that are not earned through traditional employment. This form is crucial for individuals and businesses to accurately declare income and ensure compliance with federal tax regulations. The form serves several purposes, including reporting income such as rent, royalties, dividends, and non-employee compensation, which is vital for taxpayers to correctly file their tax returns.

Types of 1099 Forms

- 1099-MISC: Commonly used for reporting miscellaneous income.

- 1099-INT: Used for interest income.

- 1099-DIV: Reports dividends and distributions.

Each variation of the 1099 form is tailored to specific types of income, providing a framework for both payers and recipients to exchange and report necessary information effectively.

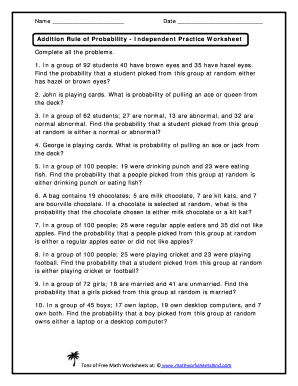

Steps to Complete the 2 Form

Filing the 2 form requires attention to detail and adherence to specific guidelines set by the IRS. The following steps outline the process:

- Obtain the Correct Form: Ensure you have the appropriate version of the 1099 form, typically the 1099-MISC for miscellaneous income.

- Fill Out Payer Information: Include your name, address, and taxpayer identification number (TIN).

- Gather Recipient Data: Collect the necessary information of the individual or business receiving the payment, including their name, address, and TIN.

- Report Income Amounts: Accurately report the amount paid in the designated boxes on the form. Different types of income will be reported in different boxes (e.g., box 7 for non-employee compensation).

- Check for Accuracy: Review all entries on the form to ensure that there are no errors, as inaccuracies could lead to penalties.

- Submit the Form: Depending on your mode of filing (online or mail), submit the completed form to the IRS and provide copies to the recipient.

Following these steps ensures compliance with tax regulations and helps maintain accurate records for both the payer and recipient.

Important Terms Related to the 2 Form

Understanding specific terminology associated with the 2 form is essential for accurate reporting and compliance. Here are key terms to be familiar with:

- Payer: The individual or entity that makes the payment and is responsible for filing the 1099 form.

- Recipient: The individual or entity receiving the payment.

- TIN (Taxpayer Identification Number): A unique number assigned to taxpayers for reporting income and taxes.

- Non-Employee Compensation: Payments made to independent contractors or freelancers for services rendered, reported in box 7 of the 1099-MISC.

Familiarizing yourself with these terms can simplify the filing process and improve understanding of the reporting requirements.

IRS Guidelines for the 2 Form

The IRS sets forth specific guidelines for completing and submitting the 2 form. Adhering to these guidelines is crucial for legal compliance and avoiding penalties:

- Filing Deadlines: Typically, forms must be submitted to the IRS by the end of January, with recipient copies due by the same date.

- Electronic Filing: Taxpayers who file more than two 1099 forms must file electronically, which streamlines the submission process and minimizes errors.

- Correcting Errors: If an error is identified after submission, an amended 1099 form must be filed promptly, along with an explanation of the changes.

Following IRS guidelines helps ensure forms are filled out correctly and submitted on time.

Filing Deadlines and Important Dates

Understanding filing deadlines is critical for ensuring compliance with tax laws. The due dates for the 2 form submission are as follows:

- January 31, 2012: Deadline for sending recipient copies.

- February 28, 2012: Deadline for paper submissions to the IRS.

- March 31, 2012: Deadline for electronic submissions.

Meeting these deadlines is essential to avoiding penalties and ensuring that all income is accurately reported.

Who Typically Uses the 2 Form

Various individuals and organizations utilize the 2 form, depending on the types of income being reported. Some common users include:

- Freelancers and Independent Contractors: Report non-employee compensation received for services.

- Landlords: Report rental income received throughout the year.

- Businesses: Report payments made to independent service providers, ensuring that all non-wage payments are documented.

Understanding who uses the 1099 form helps clarify its role in income reporting and tax compliance.

Penalties for Non-Compliance with the 2 Form

Failing to file the 2 form or submitting it inaccurately can result in significant penalties. The IRS imposes fines based on how late the form is submitted:

- $50 per form if filed within 30 days late.

- $100 per form if filed more than 30 days late but by August 1.

- $260 per form if filed after August 1, with possible maximum fines for intentional disregard.

Being aware of these penalties emphasizes the importance of timely and accurate reporting, helping taxpayers avoid costly mistakes.