Definition and Usage of the Form

The form, formally known as the Annual Summary and Transmittal of U.S. Information Returns, is utilized by businesses and other entities to transmit paper versions of various information returns to the IRS. These can include Forms 1097, 1098, 1099, and several others. It acts as a cover sheet summarizing the information contained in these forms and is crucial for maintaining compliance with federal regulations.

Steps to Complete the Form

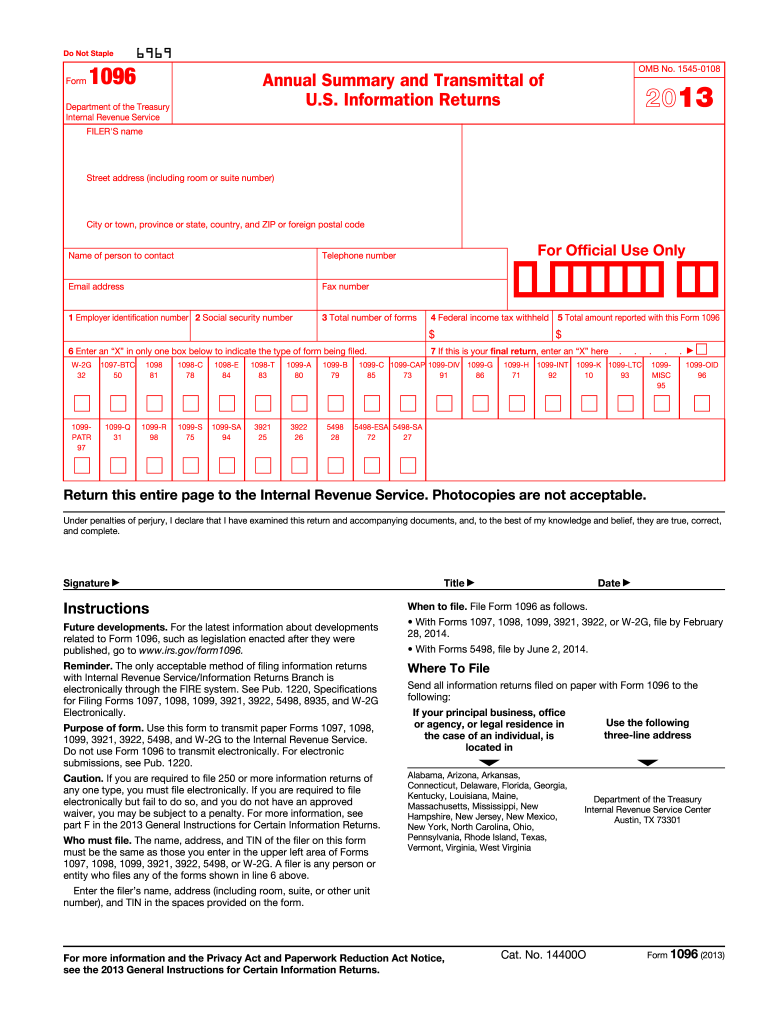

- Gather Required Information: Collect all relevant information returns (e.g., 1099-MISC), including the accompanying totals for each form type.

- Fill in Identifying Information: Enter your business name, address, and Employer Identification Number (EIN) as required.

- Select the Appropriate Form Type: Indicate the specific type of forms you are submitting by checking the corresponding box.

- Summarize the Information: Input the number of forms you are submitting and provide the total dollar amount reported on those forms.

- Sign and Date the Form: Ensure the form is signed by an authorized individual to validate the submission.

- Submit the Form: Send the completed 1096 form to the IRS using the address specified in the instructions.

Key Elements of the Form

- Filer Information: Required at the top of the form to identify the entity transmitting the information returns.

- Form Type Checkbox: Allows filers to indicate which type of returns are being summarized.

- Number of Forms: Specifies the total count of individual forms associated with each type checked.

- Total Amount: Sums all reported amounts from the attached information forms, which is critical for IRS processing.

- Signature Requirement: Validates the form, requiring a signature from an individual authorized to submit on behalf of the entity.

IRS Guidelines for the Form

The IRS provides specific guidelines that must be adhered to when filing the form. These include ensuring the information returns are properly attached, using the correct tax year version of the form, and adhering to IRS instructions for filing and delivery. Non-compliance can result in penalties or delays in processing.

Filing Deadlines and Important Dates

The deadline for submitting the form, and its associated information returns, typically falls on February 28th if filing on paper and March 31st if filing electronically. It is imperative for filers to keep track of these deadlines to avoid any late submission penalties.

Penalties for Non-Compliance

Failure to timely file the 1096 form or submitting inaccurate information can lead to significant penalties. These can range from monetary fines to increased scrutiny by the IRS. Ensuring accurate and timely submission is key to avoiding these penalties.

Who Typically Uses the Form

This form is mainly utilized by businesses and self-employed professionals who issued information returns, like 1099 forms, to vendors or contractors. It is essential for entities that report various types of income paid to non-employees throughout the year.

Obtaining and Submitting the Form

The 1096 form can be obtained from the IRS website or ordered by mail. Submission can be done via mail or electronically, depending on the filer's preference and quantity of filings. Businesses should ensure they are using the most current version to prevent processing issues.

Digital vs. Paper Version Considerations

Depending on the number of forms being filed, businesses may choose between digital or paper submissions. The paper form is not scannable, which can delay processing; hence, filers with many returns often opt for electronic filing to streamline the submission process and improve efficiency.