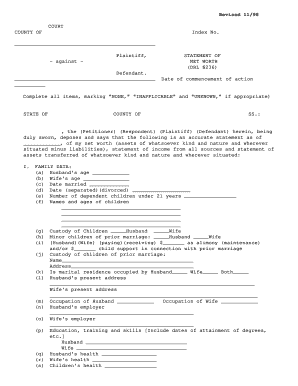

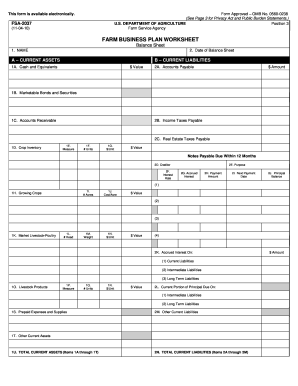

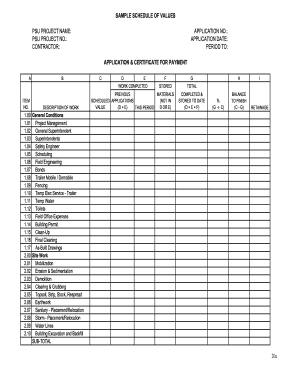

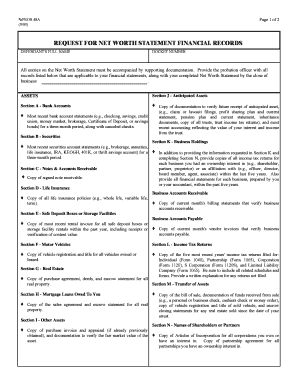

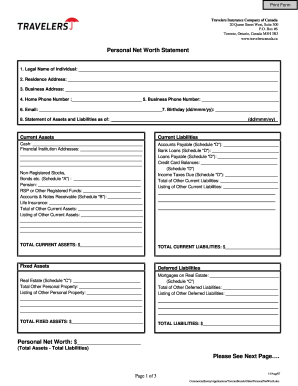

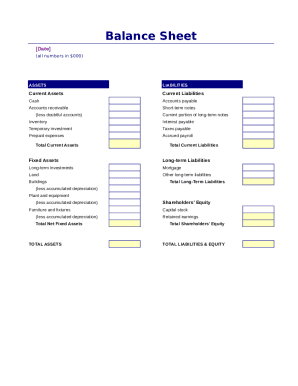

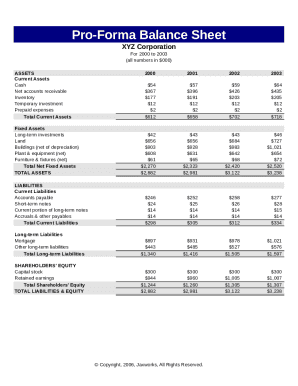

Obtain the best up-to-date Market value Balance Sheet Templates with DocHub online catalog. Customize and collaborate on your financial statements with your team in real-time without losing important data.

Document managing can overwhelm you when you can’t discover all the forms you require. Fortunately, with DocHub's substantial form collection, you can find all you need and swiftly take care of it without changing among applications. Get our Market value Balance Sheet Templates and start utilizing them.

The best way to manage our Market value Balance Sheet Templates using these easy steps:

Try out DocHub and browse our Market value Balance Sheet Templates category easily. Get your free account right now!