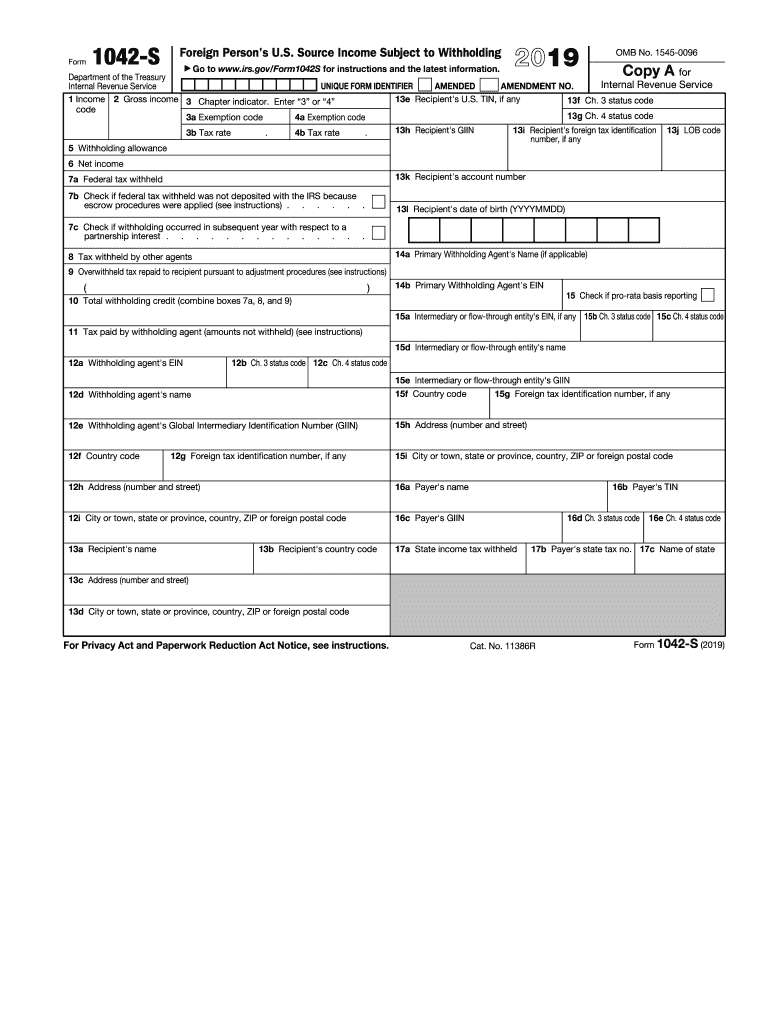

Definition and Purpose of Form 1042

Form 1042, known officially as the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, serves a crucial role in the U.S. tax system by reporting income subject to withholding for nonresident aliens and foreign entities. This form is essential for compliance with U.S. Internal Revenue Service (IRS) regulations. It outlines the income types that are subjected to withholding, ensuring foreign individuals and entities understand their tax obligations regarding U.S. source income.

- Types of Income Reported: Common examples include dividends, interest, royalties, and compensation for services. Understanding what types of income must be reported helps ensure compliance and proper withholding amounts.

- Withholding Tax Rates: The form provides guidelines on applicable withholding tax rates for different types of income, which can vary based on tax treaties between the U.S. and the foreign person's country of residence.

Understanding the definition and purpose of Form 1042 is essential for foreign persons and U.S. withholding agents to ensure correct tax reporting and remittance.

Steps to Complete the 1042

Filing Form 1042 involves several key steps to guarantee accurate completion. Proper diligence in completing each section of the form is critical to meeting IRS requirements and ensuring efficient processing.

-

Gather Necessary Documentation:

- Identify the U.S. source income amounts.

- Collect Form W-8 from foreign recipients to verify their foreign status and claim treaty benefits when applicable.

-

Input Recipient Information:

- Fill out details for each foreign recipient, including their name, address, and taxpayer identification number (TIN).

- If recipients are entities, additional documentation may be required to validate their status.

-

Report Income and Withholding Amounts:

- List the total U.S. source income that was paid to each foreign recipient.

- Specify the amounts withheld and remitted to the IRS based on applicable rates.

-

Sign and Date the Form:

- The individual responsible for the information must sign the form and indicate their title and the entity they represent.

-

Submit the Completed Form:

- File Form 1042 with the IRS by the specified deadline, usually March 15 of the year following the reporting year.

Following these steps helps ensure compliance with federal regulations and minimizes risks associated with inaccurate reporting.

Important Terms Related to Form 1042

Familiarity with key terminology associated with Form 1042 is crucial for understanding the intricacies of U.S. tax regulations as they pertain to foreign entities.

- Withholding Agent: This is any person or entity that has the obligation to withhold tax on behalf of the IRS. This can include banks, partnerships, or corporations paying U.S. source income to foreign persons.

- Nonresident Alien: An individual who is neither a U.S. citizen nor a resident for tax purposes. Nonresident aliens are subject to different tax rules compared to U.S. citizens.

- Tax Treaty: Agreements between the United States and foreign countries that reduce or eliminate U.S. taxes on certain types of income for residents of those countries.

Understanding these terms helps navigate the requirements and responsibilities associated with filing Form 1042.

Filing Deadlines and Important Dates for Form 1042

Timeliness is critical when it comes to submitting Form 1042. Missing deadlines can result in penalties or compliance issues.

- Annual Filing Deadline: Form 1042 must be filed with the IRS by March 15 of the year following the calendar year during which the income was paid.

- Submission for Form 1042-S: If issuing Form 1042-S to recipients, this must also be provided to them by March 15.

Filing within these deadlines ensures that withholding agents remain compliant with IRS regulations and avoid potential fines.

Who Typically Uses Form 1042

Form 1042 is primarily utilized by U.S. withholding agents, such as businesses and financial institutions that pay U.S. source income to foreign persons. Understanding the profile of users can clarify the applicability of the form.

- Businesses: Corporations that remunerate foreign contractors, consultants, or partners may frequently use Form 1042 to report payments.

- Financial Institutions: Banks and other financial entities handling investment income, such as dividends and interest, also utilize this form extensively to report earnings paid to foreign investors.

Recognizing the typical users of Form 1042 enables a clearer understanding of its application in various sectors.