Definition & Meaning of Form 1042-S

Form 1042-S is a critical tax document used by U.S. withholding agents to report income paid to foreign persons, including nonresident aliens and foreign entities. This form is primarily used for reporting U.S. source income that is subject to withholding, such as interest, dividends, rents, and royalties. When income is paid to foreign individuals or entities, U.S. tax laws require that withholding agents deduct taxes at a prescribed rate, which is why this form is essential for compliance with federal tax regulations.

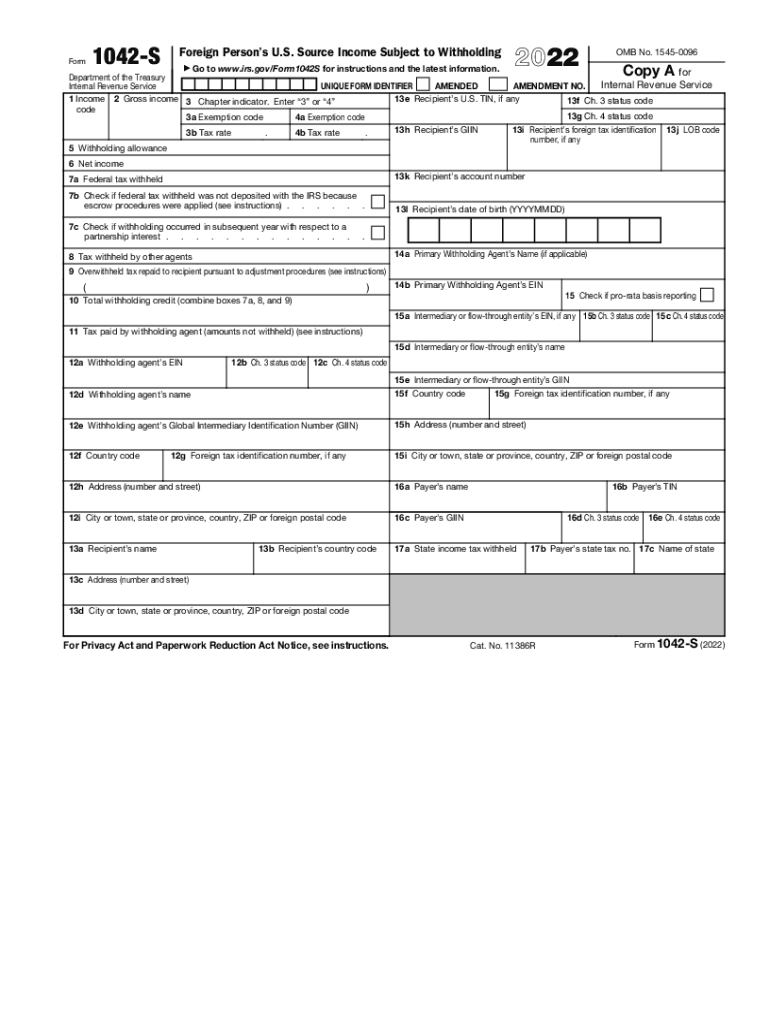

This form includes important details such as the type of income, the withholding tax rates applied, and the total amounts withheld, thereby providing a complete overview of the tax implications for the foreign payee. It is a foundational instrument for foreign taxpayers who need to report U.S. income while ensuring they comply with tax law requirements.

How to Use the 1042-S Form

To effectively utilize Form 1042-S, it's essential to understand its specific functions and requirements. The process begins when a U.S. entity or individual makes a payment to a foreign person and must determine the appropriate withholding rate.

- Identify Income Types: The form is categorized by different types of income, like dividends and interest.

- Gather Recipient Information: Collect detailed information about the foreign recipient, including their name, address, and taxpayer identification number (if available).

- Complete the Form: Accurately fill in the required fields on Form 1042-S, ensuring that the type of income and the withholding amounts are reported correctly.

- File the Form: Submit Form 1042-S to the IRS along with Form 1042, which summarizes the total withholdings for the year.

By following these steps, withholding agents can ensure proper reporting and compliance with IRS regulations related to foreign payments.

Steps to Complete the 1042-S Form

Completing Form 1042-S involves a series of specific actions. Here’s a meticulous guide to navigate through the process:

- Obtain the Form: Download Form 1042-S from the IRS website or access it through approved tax software.

- Provide Payer Information: Enter the withholding agent's name, address, and EIN.

- Fill in Recipient Details: Include the recipient's name, address, and any identifying information, such as a foreign taxpayer identification number or U.S. SSN.

- Report Income Type and Amount: Accurately state the type of income (e.g., interest, dividends) and the gross amount paid.

- Enter the Withholding Amount: Specify the total tax withheld from the payment made to the foreign payee.

- Complete the Certification Section: Include any necessary certification regarding the tax treatment of the income.

- Review and Submit: Cross-check all entries for accuracy before submitting the completed form to the IRS.

This systematic approach reduces errors and ensures that all relevant information is provided on the form.

Important Terms Related to Form 1042-S

Familiarity with key terminology associated with Form 1042-S is vital for accurate reporting and compliance. Here are several important terms to know:

- Withholding Agent: The individual or business responsible for withholding taxes on payments made to foreign persons.

- U.S. Source Income: Income that is earned from sources within the United States, which is subject to taxation regardless of the recipient's residency.

- Nonresident Alien: An individual who is not a U.S. citizen and does not meet the green card test or the substantial presence test.

- Tax Treaty Rate: A tax rate established by an agreement between the U.S. and another country that may reduce or eliminate withholding requirements on certain types of income.

- EIN (Employer Identification Number): A unique identifier used for tax purposes by individuals and businesses in the U.S.

Understanding these terms enhances clarity when navigating Form 1042-S and helps in achieving compliance with U.S. tax laws.

Who Typically Uses the 1042-S Form

Form 1042-S is extensively used across various sectors and individuals who engage financially with foreign entities. Key users include:

- U.S. Financial Institutions: Banks and investment companies that pay interest or dividends to foreign investors often use this form to report taxes withheld on those payments.

- Real Estate Companies: Firms involved in rental income payments to foreign landlords will file Form 1042-S to report withholding amounts on rents.

- Companies with Foreign Employees: Businesses that employ foreign nationals or pay foreign freelancers may need to report payments on Form 1042-S.

- U.S. Tax Professionals: Tax advisors and accountants who assist foreign clients in understanding their U.S. financial obligations utilize Form 1042-S for compliance.

These users play a crucial role in the reporting process, ensuring that all transactions comply with applicable tax laws.

Filing Deadlines for Form 1042-S

Adhering to the filing deadlines for Form 1042-S is essential to avoid penalties. Key dates include:

- Annual Filing Deadline: Form 1042-S must be filed with the IRS by March 15 of the year following the calendar year the income was paid. For example, for income reported for the year 2022, the deadline is March 15, 2023.

- Recipient Copies: Copies of Form 1042-S must be provided to recipients by the same date as the IRS filing deadline, ensuring that foreign recipients have the necessary documentation for their tax obligations.

Timely filing can help mitigate penalties associated with late submissions, emphasizing the importance of adherence to these deadlines.

Examples of Using the 1042-S Form

Real-world scenarios effectively illustrate the application of Form 1042-S:

- Dividend Payments: A U.S. corporation distributes dividends to a foreign shareholder. The corporation must withhold the appropriate percentage based on the type of income and file Form 1042-S to report both the distribution and the amount withheld.

- Rental Payments for Foreign Landlords: A property management company rents out real estate owned by foreign investors. The company withholds tax on the rental income and files Form 1042-S to detail the income and withholding for each Foreign landlord.

- Interest Payments: A bank pays interest to nonresident account holders. The bank must report these payments on Form 1042-S, detailing the amounts and taxes withheld according to the applicable IRS regulations.

These examples highlight the various contexts in which Form 1042-S is utilized, underscoring its importance in facilitating compliance with U.S. tax law.