Definition & Meaning

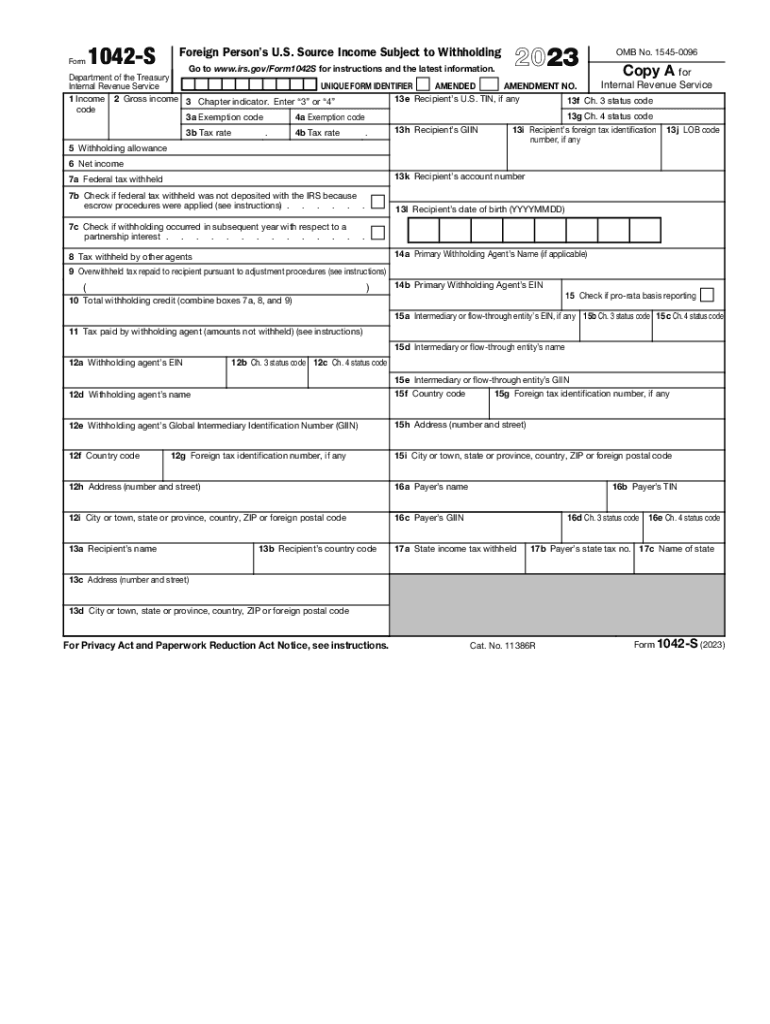

Form 1042, also known as the Annual Withholding Tax Return for U.S. Source Income, is a critical document used by withholding agents to report income payments made to foreign persons, which are subject to U.S. taxation. This form is specifically designed for reporting income types, including dividends, interest, rents, and royalties, that are sourced from within the United States. It ensures compliance with Internal Revenue Service (IRS) regulations regarding tax withholding for foreign entities or individuals.

The term "withholding agent" refers to any person or entity that has control over payments made to foreign individuals or entities. The withholding agent is responsible for ensuring that the correct amount of tax is withheld and reported on Form 1042 or its appendices. This report includes details such as the total amount of income paid, the tax withheld, and the various income categories. The submission of Form 1042 is essential for the IRS to track foreign income and taxation effectively.

How to Obtain the About Form 1042, Annual Withholding Tax Return for U.S. Source Income

Obtaining Form 1042 can be done through several means, ensuring that users have access to the most updated version of the form, specifically the 2023 form 1042.

-

IRS Website: The primary source for the most current Form 1042 and associated instructions is the IRS website. The form is available for direct download in PDF format.

-

Tax Professionals: Tax practitioners or financial advisors who specialize in international tax matters typically have copies of Form 1042 as part of their resources.

-

Preparation Software: Tax software packages, such as TurboTax or QuickBooks, often include Form 1042 alongside their suite of tools. These platforms provide guided assistance in completing the form effectively and accurately.

-

Libraries and Government Offices: Public libraries and IRS offices may maintain physical copies of tax forms for local access.

Individuals and businesses are encouraged to ensure they are using the correct and most up-to-date version, particularly for the 2023 filing year.

Steps to Complete Form 1042

Filling out Form 1042 involves a series of defined steps that ensure proper reporting for U.S.-sourced income.

-

Identify Your Role: Determine whether you are the withholding agent responsible for completing and filing Form 1042.

-

Gather Required Information: Collect all necessary documentation, such as:

- Payee information (foreign persons receiving payments)

- Amounts paid and applicable withholding tax for each type of income

-

Fill in Basic Details: Complete the header section of the form, which includes identifying the withholding agent's name, address, and employer identification number (EIN).

-

Report Payments: Each type of income will be categorized in separate sections:

- Total payments made to foreign persons

- Total tax withheld based on the applicable rates

-

Certifications and Signatures: Ensure the form is certified and signed by an authorized representative of the withholding agent, affirming the accuracy of the information reported.

-

Double-check for Accuracy: Review all entries for accuracy before submission to prevent issues with compliance.

-

File the Form: Submit Form 1042 electronically or by mail to the appropriate IRS address based on your EIN.

-

Maintain Records: Retain a copy of the submitted form and all related documents for at least three years, as IRS audits can occur.

Following these steps will help ensure that Form 1042 is completed accurately, complying with U.S. tax laws pertaining to foreign payments.

Important Terms Related to Form 1042

Understanding specific terms associated with Form 1042 can simplify the filing and compliance process:

-

Withholding Agent: The entity or individual that pays U.S.-sourced income and is responsible for withholding taxes on such payments.

-

U.S. Source Income: Income generated from sources within the United States, subject to U.S. tax laws regardless of the recipient's residency status.

-

Tax Treaty: An agreement between the U.S. and other countries that can limit the amount of tax withheld on certain types of income.

-

Foreign Person: Includes non-resident aliens, foreign partnerships, foreign corporations, and foreign estates or trusts.

-

Qualified Intermediary (QI): A financial institution that may enter into a withholding agreement with the IRS, relieving them of certain tax withholding responsibilities.

These terms clarify the context under which Form 1042 is utilized and help users navigate the complexities of U.S. tax regulations.

Filing Deadlines / Important Dates

The timely filing of Form 1042 is crucial to avoid penalties and ensure compliance with IRS regulations. Key deadlines include:

-

Annual Filing Deadline: Form 1042 is generally due on March 15 of the year following the calendar year for which the income was paid. For instance, the 2023 Form 1042 is due by March 15, 2024.

-

Extension Requests: If additional time is needed, withholding agents can file Form 7004 to request an extension for filing Form 1042. This extension generally allows for an additional six months but does not extend the payment deadline for the withheld taxes.

-

Tax Payment Deadlines: The taxes withheld on U.S. source income must be submitted to the IRS on a quarterly or annual basis, depending on the withholding agent's filing frequency.

Staying aware of these deadlines ensures timely compliance and avoids potential penalties associated with late or inaccurate filings.