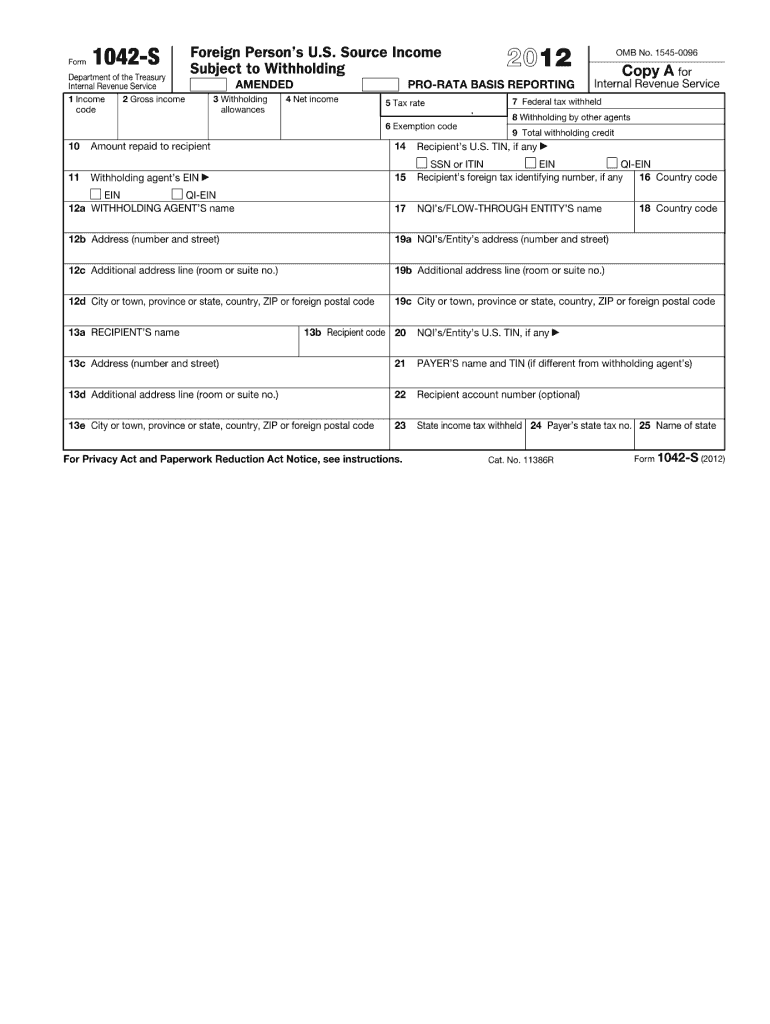

Definition and Meaning of Form 1042-S

Form 1042-S is a document issued by the Internal Revenue Service (IRS) for reporting U.S. source income that has been paid to foreign persons, including nonresident aliens and foreign entities. This form is essential for complying with U.S. withholding tax obligations, as it details the income, tax withheld, and the recipient's information. Common examples of income that would require reporting on this form include interest, dividends, rents, royalties, and certain types of compensation. It is crucial for entities making payments to foreign individuals or corporations to understand how to complete and file Form 1042-S properly to ensure compliance with tax regulations.

Key Components of Form 1042-S

- Income Details: The form requires specific sections for detailing the type of income paid.

- Withholding Allowances: Entities must report the amount withheld for tax purposes to ensure compliance.

- Recipient Information: Correct details about the recipient must be included, including name, address, and tax identification number.

How to Obtain the 2012 Form 1042-S

To acquire a copy of the 2012 Form 1042-S, taxpayers have several options. The IRS website provides downloadable PDF versions of the form, which can be printed and filled out manually. It is important to ensure that you are using the correct version pertaining to the tax year, as prior versions may contain outdated information that is not applicable.

- IRS Website: The official source for the most recent form updates and guidance.

- Tax Preparation Software: Many tax software programs also allow users to generate and file Form 1042-S electronically, which can streamline the process considerably.

Steps to Complete the 2012 Form 1042-S

Completing Form 1042-S involves several distinct steps. Each component of the form must be filled out accurately to avoid penalties and ensure that tax obligations are met.

- Gather Necessary Information: Collect details such as the recipient's name, address, and taxpayer identification number (TIN).

- Specify the Type of Income: Clearly indicate the income type using the appropriate codes listed in the instructions for Form 1042-S.

- Calculate Withholding Amount: Determine the amount of U.S. tax that has been withheld from the payment to the foreign recipient.

- Fill out the Form: Enter the gathered information onto Form 1042-S in the designated sections.

- Review for Accuracy: Double-check all entries to ensure correctness, as errors can lead to compliance issues.

Important Sections to Review

- Box 1: Report the U.S. income amount.

- Boxes 13-15: Include withholding allowances and the total tax withheld.

Filing Deadlines for the 2012 Form 1042-S

Filing deadlines for Form 1042-S are critical for compliance. The form must be filed with the IRS by March 15 of the year following the payment of income. Additionally, copies of the form must be provided to recipients by the same date to ensure they can accurately report the income on their tax returns.

Key Dates to Remember

- Recipient Copy Deadline: March 15

- IRS Submission Deadline: March 15

- Penalties for Late Filing: Late filing may incur substantial penalties depending on the duration of the delay.

Important Terms Related to Form 1042-S

Understanding the terminology associated with Form 1042-S can aid in better comprehension and accuracy during the filing process.

- Withholding Tax: A tax levied on income payments that are not paid to U.S. taxpayers.

- Nonresident Alien: An individual who is not a U.S. citizen and does not meet the residency requirements for tax purposes.

- Qualified Intermediary: An entity that helps foreign investors understand tax obligations related to U.S. income.

IRS Guidelines for Using Form 1042-S

The IRS provides comprehensive guidelines for filling out Form 1042-S, which clarify the responsibilities of the withholding agent. It is crucial for entities to familiarize themselves with these guidelines to maintain compliance with applicable tax laws.

Key Guidelines Include

- Determination of Withholding Tax Rates: Understand how to determine the applicable tax rate based on the income type and the recipient's residency.

- Filing Requirements: Know who must file, including businesses that pay U.S.-source income to foreign persons.

- Recordkeeping: Maintain extensive records of the payments made and the withholdings, as these will be essential for audits or inquiries from the IRS.

Penalties for Non-Compliance with Form 1042-S

Noncompliance with Form 1042-S reporting requirements can result in significant penalties. The IRS imposes strict measures to ensure that withholding agents accurately report and withhold taxes on payments made to foreign individuals.

- Failure to File: There are penalties for not filing Form 1042-S on time, even if the income has been reported elsewhere.

- Inaccurate Information: Filing incorrect or incomplete information may lead to additional penalties or increased scrutiny from the IRS.

Possible Consequences

- Financial Penalties: Late filing or inaccurate filing can incur fines ranging from $50 to $530 per form, depending on the delay.

- Legal Repercussions: Depending on the severity of noncompliance, other legal actions may also be taken by tax authorities.

Who Typically Uses the 2012 Form 1042-S

Form 1042-S is primarily utilized by entities making payments to foreign individuals or entities. This includes various types of organizations such as:

- Corporations: Businesses paying dividends or interest to foreign shareholders.

- Partnerships: Partnerships that distribute income to foreign partners.

- Financial Institutions: Banks and financial services that process payments to non-U.S. clients.

The application of Form 1042-S is vital in ensuring that proper tax liabilities are reported and managed for these foreign entities, thereby maintaining compliance with U.S. tax laws.