Definition & Meaning

The "2009 3 form" refers to a specific document used for tax or legal purposes, often linked to activities or regulations from the year 2009. Its designation suggests it might be a less commonly known form possibly replaced or updated since then. This form's primary function depends on its context within tax filing, legal documentation, or business operations. Understanding its role in its original context is crucial for proper usage today.

How to Obtain the 2009 3 Form

Accessing the "2009 3 form" typically involves downloading it from official government websites, such as the IRS or state-specific departments, depending on its exact nature. You might also find it through archival sections of legal document providers or tax preparation software. Physical copies could be requested from local tax assistance centers or law offices if available.

Steps to Complete the 2009 3 Form

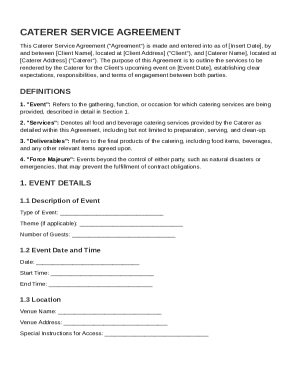

- Gather Necessary Information: Collect all relevant personal, financial, and business details required for the form.

- Enter Identifying Information: Fill out basic details such as your name, Social Security number, and address.

- Provide Specific Data: Depending on the form's requirements, include income figures, deductions, or other relevant metrics.

- Review for Accuracy: Double-check all entries for any errors or omissions.

- Sign and Date: Ensure the form is signed by all required parties before submission.

Important Terms Related to the 2009 3 Form

- Filing Status: Your legal status affecting tax calculations, such as single, married, or head of household.

- Deductions: Allowances that reduce taxable income.

- Compliance: Adhering to guidelines and legal mandates associated with filing the 2009 3 form.

- Submission Deadline: The final date by which the form must be filed to avoid penalties.

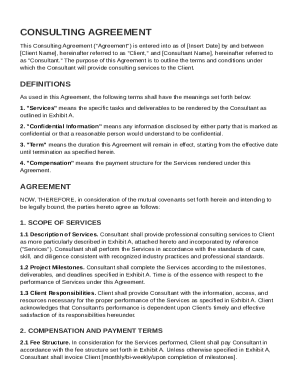

Legal Use of the 2009 3 Form

The form must be used within legal boundaries, following IRS guidelines or applicable state laws. It’s crucial to adhere to established rules to ensure the form's legitimacy, preventing any legal repercussions due to incorrect filing or misuse.

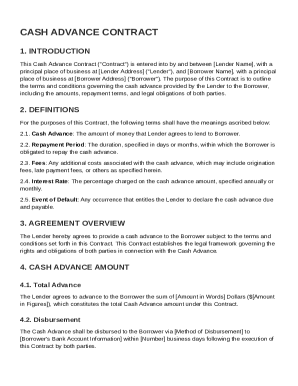

Key Elements of the 2009 3 Form

- Header Information: Includes instructions and IRS/state department references tied to 2009 regulations.

- Main Sections: Features areas for financial details, personal data, and pertinent tax or legal specifics.

- Signature Lines: Notation spots for parties involved to validate the document formally.

IRS Guidelines

The IRS typically provides detailed instructions on forms such as the "2009 3 form," including the purpose, who should file it, and how to compute any relevant figures. Staying updated with IRS publications ensures compliance and understanding of any form changes over time.

Filing Deadlines / Important Dates

- Annual Filing Deadline: Usually aligns with the standard tax filing date, often April 15 for individuals.

- Extension Requests: Procedures to request additional time, if eligible, by filing an application by the standard deadline.

- Amendment Window: Period during which amendments can be made without penalties, typically extending a few months post-filing.

Penalties for Non-Compliance

Failing to file the "2009 3 form" correctly or on time can result in penalties. These may include fines, interest on unpaid taxes, or further legal actions. Awareness of submission requirements and deadlines minimizes risk.

Software Compatibility

Modern tax software like TurboTax or QuickBooks may still have reference capabilities to the "2009 3 form" through historical databases, allowing for electronic records management and ensured compatibility in digital filing processes.

Who Issues the Form

The issuing authority for a form like the "2009 3 form" likely includes the IRS for federal forms or individual state departments for state-specific documents. Verifying the source ensures you’re using the correct and most recent version when required.

Digital vs. Paper Version

- Digital Form: Offers the convenience of easy editing, real-time error checks, and electronic submissions.

- Paper Form: Preferred by those with limited internet access or needing physical copies for personal records. Submitting by mail often takes longer processing time.

Eligibility Criteria

Understanding who should file the "2009 3 form" is essential. Eligibility often includes thresholds like income levels, specific business engagements, or special tax considerations impacted by events in 2009.

State-Specific Rules for the 2009 3 Form

Certain states may have unique stipulations for using the "2009 3 form," affecting additional filing requirements or benefits. Reviewing state resources ensures compliance with local mandates and maximizes any applicable incentives.