Definition & Meaning

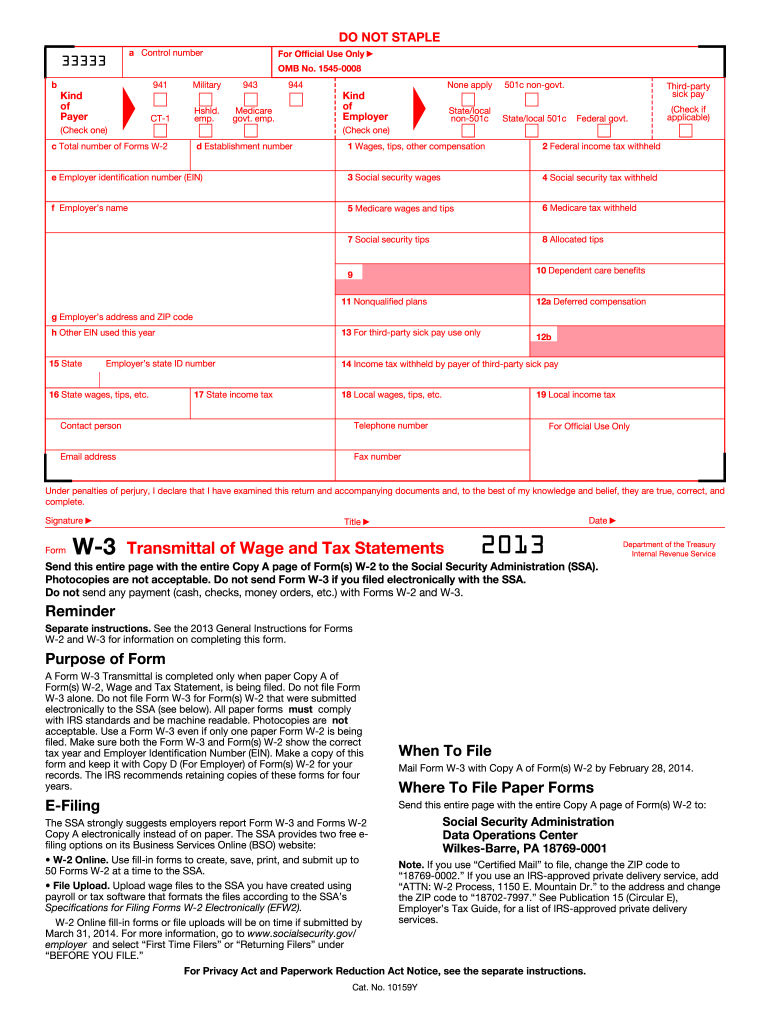

"W 2013 forms" generally relates to annual tax forms used for reporting income and tax information to the Internal Revenue Service (IRS) for the year 2013. These forms are critical documents for individuals and businesses to report earnings, calculate taxes owed, or claim refunds. Common forms include W-2 for wage reporting and W-3 for transmitting W-2 data to the Social Security Administration (SSA).

How to Use the W 2013 Forms

Using the W 2013 forms involves various steps:

-

Gather Required Information: Collect personal and financial information pertinent to the tax year, such as Social Security numbers, employer details, and income data.

-

Complete the Appropriate Sections: Fill in each form's sections accurately. For example, the W-2 form includes wage and withholding details, while the W-3 form summarizes data from multiple W-2 forms.

-

Review for Accuracy: Double-check entries to ensure all figures and personal details are correctly reported.

-

Submit Forms: W-2 forms are distributed to employees and filed with the IRS, while W-3 forms are sent to the SSA along with the corresponding W-2 forms.

Steps to Complete the W 2013 Forms

Completing the W 2013 forms requires meticulous attention:

-

Identify the Correct Form: Understand the purpose of each form, such as W-2 for employees and W-3 for employers.

-

Enter Personal Details: Provide accurate personal information, including name, address, and Social Security number.

-

Report Financial Data: Record wages, tips, and other compensation, as well as tax withholdings.

-

Verify Calculations: Ensure calculations are correct to avoid discrepancies that could delay processing.

-

Sign and Date the Form: Finalize the forms with appropriate signatures and dates where needed.

Important Terms Related to W 2013 Forms

Familiarity with key terminology is essential:

- Withholding: The portion of an employee’s wages that is withheld for taxes.

- Filer: The individual or entity completing the form.

- EIN: Employer Identification Number used by businesses for tax purposes.

- SSA: Social Security Administration, the agency involved in managing Form W-3 submissions.

Legal Use of the W 2013 Forms

Legal compliance is crucial when handling W 2013 forms:

- Purpose: These forms facilitate legal tax reporting and compliance.

- Penalties: Misreporting or failure to file can lead to fines or audits.

- Data Protection: Ensures that sensitive financial information is managed according to federal guidelines.

IRS Guidelines

The IRS provides clear instructions for these forms:

- Filing Instructions: Detailed guidelines on filling out and submitting forms.

- Amendments and Corrections: Procedures for correcting errors found after submission.

- Record Keeping: Recommendations for maintaining documentation post-filing.

Filing Deadlines / Important Dates

Adhering to deadlines is essential:

- January 31: Employers must provide W-2 forms to employees.

- February 28 (paper) / March 31 (electronic): Deadline for employers to submit W-3 to the SSA.

Penalties for Non-Compliance

Failure to handle the forms properly may lead to:

- Monetary Fines: Vary depending on the lateness and extent of non-compliance.

- Legal Action: Potential audits or legal inquiries from the IRS.

- Reputational Damage: Impact on business operations and employee trust.

Key Elements of the W 2013 Forms

Understanding the components of each form is vital:

- Employee Details: Name, address, tax identification number.

- Income Information: Wages, tax withholdings, retirement plan contributions.

- Employer Information: Business name, address, and EIN.

- Tax Year: Clearly indicated as 2013 to avoid confusion with other filings.