Definition & Meaning

The W-3 form, officially known as the Transmittal of Wage and Tax Statements, serves as a summary document issued by employers to the Social Security Administration (SSA) in the United States. It acts as a cover page for the W-2 forms, grouping together all employee earnings, withheld taxes, and other payroll-related information from a given year. This form ensures that the totals reported on individual W-2 forms align with the summary data provided, facilitating accurate tracking and assessment of tax liabilities and contributions.

- The W-3 form consolidates information from all the W-2 forms generated by an employer.

- It is crucial for ensuring the correct Social Security and Medicare withholding.

- It supports SSA in reconciling wage data with tax returns filed by employees.

How to Obtain the W-3 Form

Employers can procure the W-3 form from multiple sources, including the Internal Revenue Service (IRS) and the Social Security Administration (SSA). It is available in both paper format and electronically for ease of use.

- SSA Website: You can download the W-3 form electronically via the SSA's Business Services Online (BSO) portal. This platform also allows employers to file electronically.

- IRS: Forms can be ordered in bulk from the IRS’s website or retrieved from local IRS offices.

- Tax Software: Many tax preparation software like TurboTax and QuickBooks automatically generate the W-3 form as part of their comprehensive payroll services.

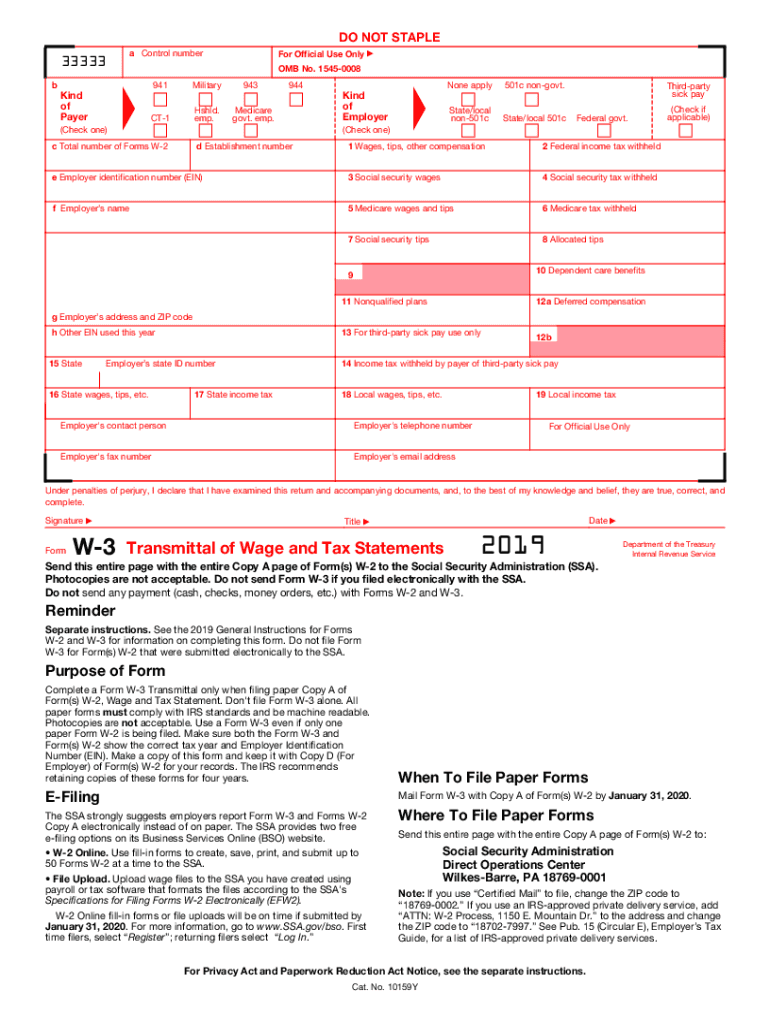

Steps to Complete the W-3 Form

Completing the W-3 form involves several detailed steps, ensuring all relevant wage and tax information aligns with the individual W-2 forms.

- Collect Employee Data: Gather all W-2 forms issued over the tax year.

- Enter Basic Information: Start with the company’s name, address, EIN (Employer Identification Number), and contact information.

- Fill in Earnings Totals: Enter the cumulative wages paid, withholding for federal income tax, and Social Security and Medicare taxes, encompassing all employees.

- Reconcile Figures: Ensure totals match the sum of all W-2 forms submitted.

- Sign and Date: The form should be signed by the employer or an authorized representative before submission.

- Submit to SSA: Send the completed form electronically via the SSA’s BSO or mail it if using the paper version.

Importance of the W-3 Form

The W-3 form is not just a bureaucratic requirement; it serves several key purposes:

- Verification Tool: Ensures the IRS and SSA have a complete and verified summary of wage and tax payments.

- Compliance Requirement: Mandated by federal law for all employers issuing W-2 forms.

- Audit Trail: Provides a documented audit trail for both the employer and SSA, ensuring transparency and accuracy.

Who Typically Uses the W-3 Form

The W-3 form is essential for a wide range of business entities across the United States:

- Small and Medium Enterprises (SMEs): Compliance with payroll tax regulations.

- Large Corporations: Consolidate extensive employee tax data.

- Nonprofits and Educational Institutions: Ensure proper submission of employee earnings.

- Government Agencies: Fulfill federal tax obligations efficiently.

IRS Guidelines

The IRS provides specific guidelines outlining how to accurately complete and submit the W-3 form. The process may include:

- E-Filing Requirements: Employers filing 250 or more W-2 forms must submit the W-3 electronically.

- Amendments: Corrections can be submitted by marking the W-3c form for changes.

- Deadlines: The deadline for submitting the form usually coincides with the W-2 deadline, often by January 31st each year.

Filing Deadlines / Important Dates

Adherence to submission timelines is critical to avoid penalties and ensure compliance.

- Annual Deadline: Typically set for January 31st of the following year for the tax period ending December 31st.

- Extension: While limited extensions are available, they must be requested ahead of the original deadline.

Penalties for Non-Compliance

Failure to file the W-3 form correctly or by the deadline can result in significant penalties.

- Missed Deadlines: Late submissions can incur fees increasing with the delay duration.

- Incorrect Information: Errors or mismatches with W-2s may result in penalties unless corrected promptly.

- Failure to File Electronically: Businesses required to e-file but fail to do so may incur additional fines.

By understanding the W-3 form’s intricacies and ensuring precise completion and submission, employers can maintain payroll accuracy, compliance, and foster trust with their employees and federal agencies.