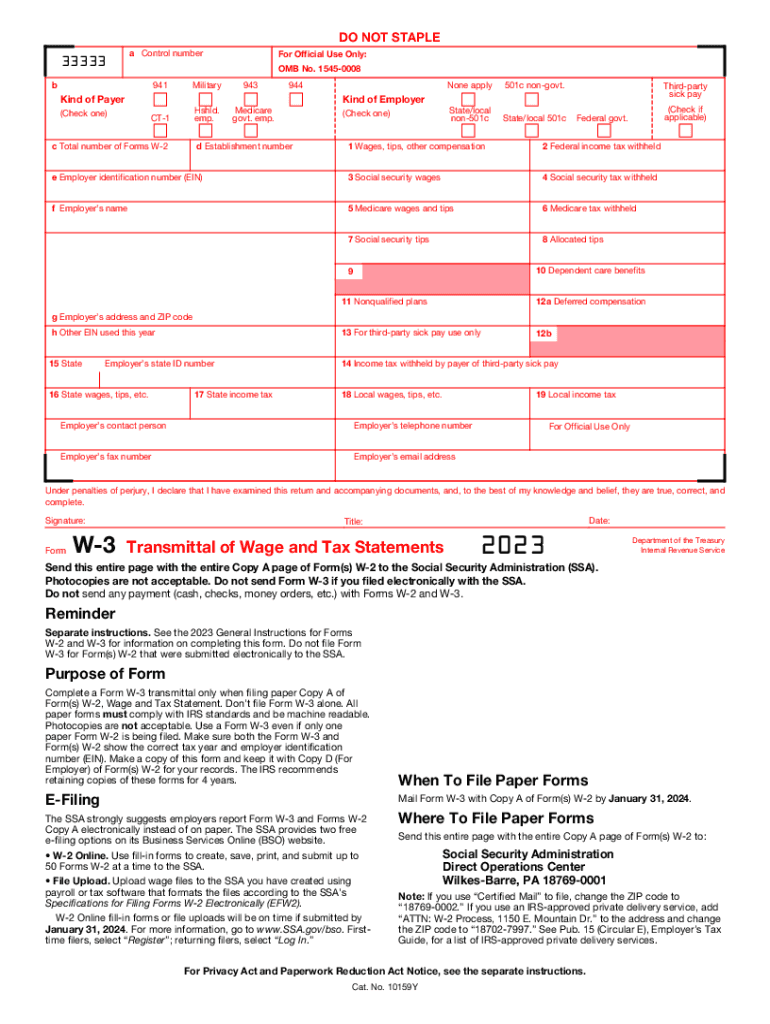

Definition and Purpose of the 2018 W-3 Fillable Form

The 2018 W-3 form, officially known as the "Transmittal of Wage and Tax Statements," is used by employers in the United States to transmit Form W-2, Wage and Tax Statement, information to the Social Security Administration (SSA). This form summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees in a calendar year. The fillable version simplifies data entry by allowing employers to input required information electronically before printing and submitting them, reducing the likelihood of errors associated with manual entries.

Key Elements of the 2018 W-3 Fillable Form

The primary sections of the 2018 W-3 fillable form focus on employer identification and payroll data. Essential fields include:

- Employer Information: Business name, address, and Employer Identification Number (EIN) which are crucial for identification.

- Employee Summary: Total number of W-2 forms being transmitted.

- Wage and Tax Reporting: Aggregated totals of wages, tips, Social Security wages, and Medicare wages, along with their respective withholding amounts.

Understanding these elements ensures that the data accurately reflects the year’s payroll activities, aiding in compliance with tax obligations.

Steps to Complete the 2018 W-3 Fillable Form

Completing the 2018 W-3 fillable form involves several specific steps:

- Gather Necessary Information: Collect all W-2 forms issued throughout the year.

- Enter Employer Details: Input the company's name, address, and EIN.

- Provide Wage and Tax Information: Summarize employee wages and taxes withheld as reported on the W-2 forms.

- Verify Data: Check the accuracy of all input data to prevent discrepancies.

- Finalize and Print the Form: Once complete, print the form on the required official paper for submission.

Following these steps ensures completeness and compliance with SSA requirements.

How to Obtain the 2018 W-3 Fillable Form

The 2018 W-3 fillable form can be acquired directly through the IRS website or authorized software providers. Additionally, tax software like TurboTax or QuickBooks often includes the fillable form as part of their business tax modules, streamlining the process of preparing and submitting tax documents. These platforms offer electronic versions that are continually updated to reflect current IRS regulations, facilitating easier compliance.

Filing Methods: Online vs. Mail

Employers can submit the 2018 W-3 form via electronic filing or through the mail:

- Electronic Filing: Preferred for its speed and accuracy, electronic filing allows employers to upload forms directly to the SSA's system, reducing processing time.

- Mail Submission: Employers that opt for traditional mailing must ensure forms are printed correctly on scannable forms sourced from the IRS or authorized providers.

Both methods require adherence to submission deadlines to avoid penalties.

Who Typically Uses the 2018 W-3 Fillable Form

The 2018 W-3 form is primarily used by employers in various sectors, including corporations, LLCs, partnerships, and other business entities that have payroll obligations and issue multiple W-2 forms annually. In cases where multinational companies operate within the U.S., they must use this form to report wages paid to all their U.S. employees.

IRS Guidelines and Compliance

The IRS provides specific guidelines dictating the proper completion and submission of the W-3 form. It emphasizes the importance of accuracy in wage and tax reporting, timelines for submission, and the requirement to maintain records for a specified duration. Adhering to these guidelines helps minimize the risk of audits and ensures alignment with federal payroll tax laws.

Legal Use and Implications

The W-3 form carries legal implications for employers, given that it is a mandated document under U.S. tax law for reporting employee taxes. Incorrect or late submissions can lead to penalties. Employers must ensure that all information reported aligns with the data provided on individual W-2 forms to avoid discrepancies and potential legal challenges.

Penalties for Non-Compliance

Failure to file the W-3 form or incorrect submissions can lead to substantial fines for employers. Penalties are based on the severity of the error and the timeliness of correction, ranging from a few hundred to thousands of dollars. Compliant submission is essential to avoid these financial repercussions and maintain smooth business operations.