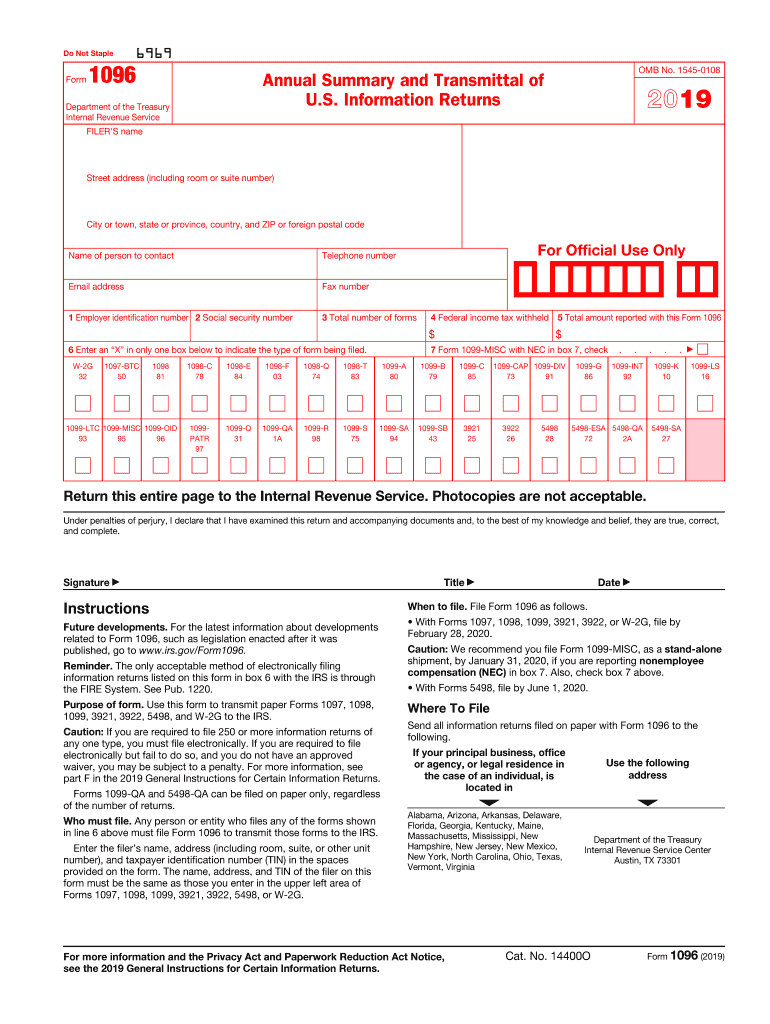

Definition and Purpose of Form 1096

Form 1096, known as the "Annual Summary and Transmittal of U.S. Information Returns," serves as a summary document that must accompany certain paper-filed returns submitted to the Internal Revenue Service (IRS). It primarily functions to transmit various types of IRS Forms, such as the 1099 series, 5498, and others, which are used by businesses and individuals to report income and various types of payments.

Key Elements and Purpose

- Summary Document: Form 1096 collects information from the accompanying forms and transmits it in a summarized format to the IRS.

- IRS Returns: Applicable for returns such as Forms 1099-MISC, 1099-INT, 1099-DIV, etc.

- Identification Information: Requires basic details such as the name, address, and Tax Identification Number (TIN) of the filer.

- Transmittal: It acts as a cover sheet when filing multiple information returns.

Understanding its role in ensuring compliance with IRS regulations is vital, as failing to file Form 1096 correctly may result in penalties.

Steps to Complete Form 1096

Properly filling out Form 1096 is crucial for ensuring that all associated IRS forms are processed without delay. Below is a step-by-step guide to completing it:

- Gather Information: Collect all specific information from the forms you are summarizing, including payer details and the total number of each form type.

- Complete Payers Information: Fill in the name, address, and TIN of the person or business in boxes on Form 1096.

- Enter Total Form Count: Indicate the total number of each type of return being sent with Form 1096.

- Aggregate Amounts: Provide the total amount reported using all attached information returns on the form.

- Specify IRS Box: Identify the appropriate box on Form 1096 that corresponds to the type of form being summarized (e.g., Form 1099-MISC).

- Sign and Date: Ensure the form is signed and dated by an authorized individual to verify the information is accurate.

Accurate completion adheres to IRS requirements and streamlines the submission process.

How to Obtain Form 1096

Obtaining Form 1096, a critical component in tax filing, can be accomplished through various methods:

- Order Forms Online: Official IRS forms can be ordered through the IRS website or obtained from a tax professional or office supply store.

- Digital Resources: Some tax software programs provide digital forms to complete and afford the option to print for submission.

- Physical Convenience: Physical copies are often available at local IRS offices.

Given its importance in tax filing, ensuring you have the correct version of Form 1096 is essential.

Submission Methods and Guidelines

Understanding the appropriate ways to submit Form 1096 is essential for compliance. Options include:

Electronic and Paper Filing

- Electronic Filing: E-filing is available for those submitting forms in bulk and is often mandatory for large quantities.

- Mail Submission: If using paper, mail Form 1096 along with the applicable returns to the address specified for the tax jurisdiction.

- Keep Copies: Retain copies for your records to address any future discrepancies.

Adhering to these guidelines ensures timely and correct filing with the IRS.

Who Typically Uses Form 1096

Form 1096 is commonly utilized by various entities and individuals in need of transmitting multiple information returns to the IRS:

- Businesses: Often required by businesses that issue payments reported on Forms such as 1099-MISC, 1099-INT.

- Self-Employed Individuals: Contractors and freelancers issuing 1099 forms must use Form 1096 for their returns.

- Financial Institutions: Banks are typical users for reporting interest income.

Recognizing the typical users can help determine if you need to file this form.

Important Terms Related to Form 1096

Familiarity with certain terms is crucial in effectively navigating Form 1096:

- Transmittal: The process of summarizing and submitting information returns.

- TIN (Taxpayer Identification Number): A crucial identifier for filing.

- Information Return: Forms that report income and various payments.

Understanding these terms facilitates an accurate and compliant filing process.

Penalties for Non-Compliance

Failing to file Form 1096 correctly or on time may incur penalties:

- Late Filing: Penalties increase based on the delay post-deadline.

- Incorrect Filings: Mistakes or omissions in the form may lead to financial penalties.

- Intentional Disregard: Heavier fines for intentional negligence in filing.

Being aware of these penalties underscores the importance of timely and accurate submissions.

IRS Filing Deadlines and Important Dates

To avoid penalties, being informed about important deadlines is crucial:

- General Deadline: Typically, Form 1096 should accompany paper returns and is due by the end of February each year for the previous tax year.

- Specific Forms: Deadlines may vary by form type; verify with the IRS for specific cases.

Maintaining awareness of these timelines ensures compliance and avoids potential fines.