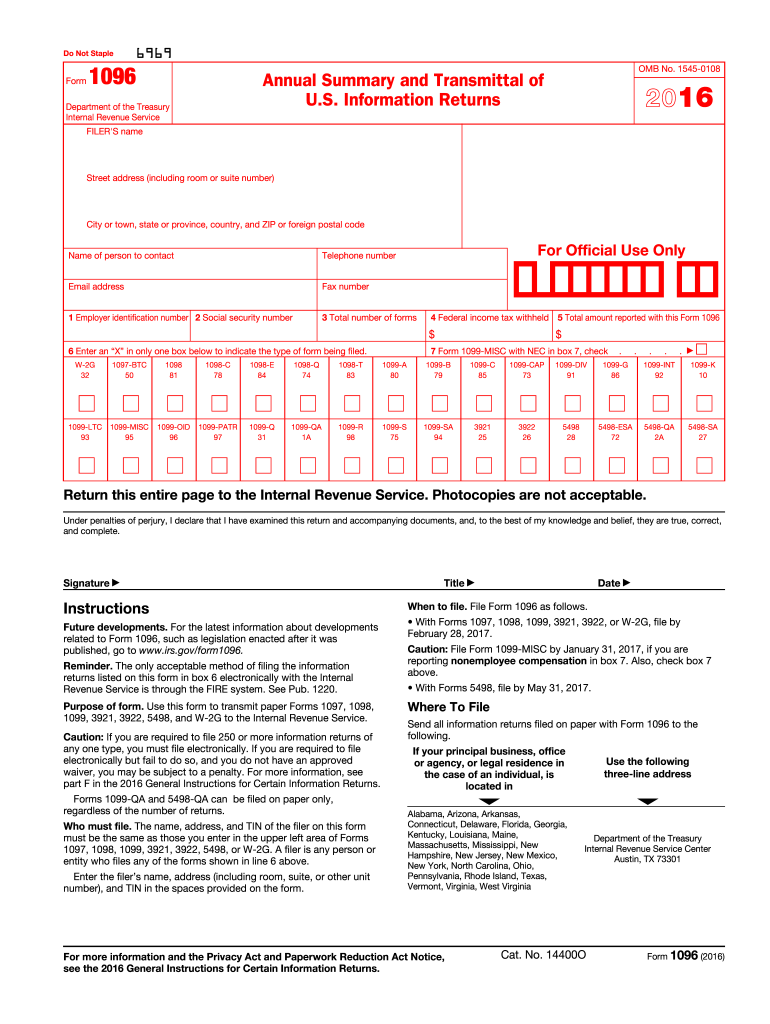

Definition and Purpose of Form 1096

Form 1096, also known as the "Annual Summary and Transmittal of U.S. Information Returns," serves as a cover sheet for transmitting various IRS forms. It consolidates and reports information about multiple information returns like Forms 1099, 3921, 3922, 5498, and others to the IRS. The 2016 version of Form 1096 is specific to reporting information for that tax year. It is crucial for businesses and organizations to summarize and submit their non-employee compensation, dividends, interest, sale of property, and other types of income payments made to individuals or entities.

Key Information Required

Businesses need to provide:

- Filer's name, address, and TIN (Taxpayer Identification Number).

- Total number of forms being submitted alongside each type.

- Total federal income tax withheld, as applicable.

- Instructions concerning which box to check, corresponding to each type of form attached.

Who Typically Uses Form 1096

Form 1096 is primarily used by businesses, both large and small, nonprofits, and other organizations that have issued information returns. It is commonly relevant for:

- Corporations and Partnerships

- Self-employed professionals

- Accountants and tax preparers managing filings for multiple clients

- Any businesses issuing more than 250 information returns, where electronic filing becomes mandatory

Taxpayer Scenarios

This form is particularly pertinent for:

- Businesses who paid subcontractors for services

- Financial institutions reporting dividends

- Landlords reporting rental income

How to Obtain Form 1096

Official copies of Form 1096 can be ordered through the IRS or procured from authorized resellers since downloadable versions are not scannable. Here is the procedure to follow:

- IRS Website: Navigate to the official IRS online ordering page to request a copy by mail.

- By Phone: Call the IRS forms ordering hotline.

- In Person: Visit a local IRS office or approved tax professional who may have the form on hand.

Additional Considerations

Keep in mind:

- The form cannot be filed electronically nor downloaded for printing and filing.

- It must be physically obtained and used for submission.

Steps to Complete the Form

When completing Form 1096, attention to detail is essential to avoid processing errors and penalties.

- Enter Filer’s Details: Input your name, address, contact number, and TIN.

- Summary of Records: Fill in the total number of forms being transmitted.

- Federal Income Tax Details: Report total federal income tax withheld, if applicable.

- Identification Codes: Check the appropriate box corresponding to the forms submitted, such as Forms 1099-MISC or 1099-DIV.

- Affix Signature: Make sure a responsible party signs and dates the form.

Common Errors to Avoid

- Misreporting TIN or number of forms.

- Filing old versions of the form.

- Omissions in required fields like tax withheld details.

Important Deadlines for Form 1096

Submitting Form 1096 on time is imperative to avoid IRS penalties. The deadlines differ based on the type of information returns:

Filing Deadlines

- February 28th when mailing forms and 1096 to the IRS.

- March 31st if filed electronically (though Form 1096 itself is not eligible, these deadlines apply to the information return it summarizes).

Practical Tip

- Mark calendars well ahead of these dates to ensure all preparations and submissions are done timely.

Legal Implications of Form 1096

Ignoring the requisite completion of Form 1096, or failing to file by the specified deadlines, can lead to severe penalties and interest. Business organizations are legally obligated to submit this form to support information return filings and meet tax compliance requirements.

Penalties

- Fines for late submission can be substantial, escalating with the length of the delay.

- Incorrect information or failure to submit can prompt an audit or further investigations.

Integration with Document Management Systems

DocHub supports processing and managing Form 1096 through digital workflow solutions. While these forms are not scannable, businesses can use DocHub to organize and annotate documents, ensuring all necessary details align accurately before physical filing.

Software Compatibility

- Platforms like QuickBooks or TurboTax may aid in preparing the data to input on Form 1096, although they don't facilitate the actual filing.

- Digital document management tools allow for the electronic organization of data that feeds into Form 1096.

Conclusion

Form 1096 serves as a critical tool for U.S. businesses to consolidate different information returns into a single submission to the IRS. By understanding its importance, procurring the necessary copies, accurately completing entries, and respecting filing deadlines, businesses can significantly enhance their tax compliance posture and avoid costly penalties.