Definition & Purpose of Form 1096

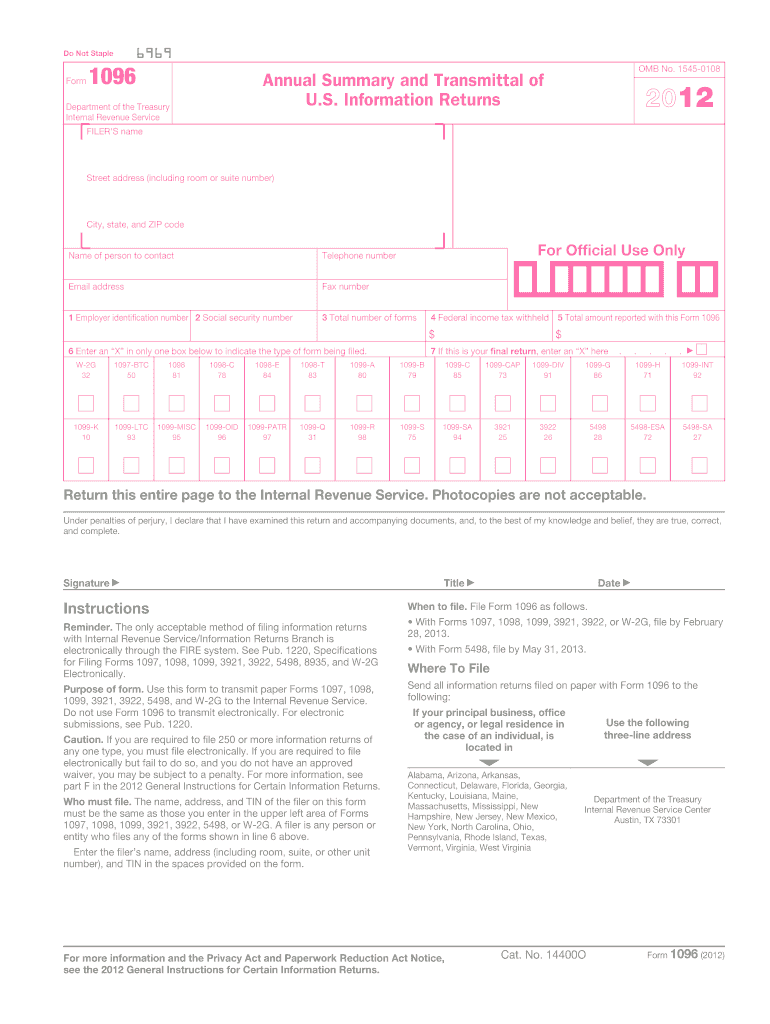

Form 1096, known as the Annual Summary and Transmittal of U.S. Information Returns, is a crucial document used to transmit paper forms to the IRS. Typically, it's employed alongside various information returns, including Forms 1099, 1098, and W-2G. It consolidates the total number of forms submitted and their corresponding dollar amounts. This form acts as a cover sheet for other information returns, facilitating the process of reporting income, profits, or other necessary financial data to the IRS.

How to Use Form 1096

Using Form 1096 requires the alignment of each information return form with its corresponding category, such as nonemployee compensation or certain real estate transactions. Each form type requires a separate Form 1096. To use it:

- Gather all relevant information return forms that apply to the tax year.

- Complete one Form 1096 per type of return.

- Fill in the required contact and identification details on Form 1096, including the payer's name, address, and the total number of forms.

- Ensure the accuracy of totals reflected on Form 1096, which must correspond to the submitted information returns.

How to Obtain Form 1096

Acquiring Form 1096 can be done through several means:

- Order from the IRS: You may request physical copies by visiting the IRS website and placing an order.

- Office Supply Stores: Some stores sell IRS forms for convenience.

- Tax Software: Many tax preparation software programs include Form 1096, allowing you to generate and print it as needed.

It's imperative to use official forms since the IRS does not accept copies printed from online sources.

Steps to Complete Form 1096

Completing Form 1096 involves a sequence of carefully executed steps:

- Top Section: Enter the tax year, along with either the EIN or SSN.

- Title: Specify the type of forms being transmitted.

- Box 1: Indicate the total number of forms enclosed.

- Box 2: Enter the total federal income tax withheld, if applicable.

- Box 3: Fill in the total amount reported with the Forms 1099 or other returns.

- Bottom Section: Add contact details and sign the form, certifying its completeness and accuracy.

Key Elements of Form 1096

Essential components to successfully completing Form 1096 include:

- Accurate Information: Verify all totals; mismatched numbers can lead to filing errors.

- Separate Form for Each Type: Use one Form 1096 per information return type.

- Signatures: The responsible party or an authorized representative must sign the form to ensure compliance.

IRS Filing Deadlines

Timing is critical with Form 1096:

- Regular Deadline: Typically due by February 28 if filing by paper or March 31 if filing electronically.

- Specific Deadlines: If using it with other specific forms, such as Form 1099-MISC for nonemployee compensation, earlier deadlines may apply, usually on January 31.

Sticking to the correct filing deadlines is essential to avoid penalties.

Penalties for Non-Compliance

Failing to file Form 1096 timely or accurately can result in IRS penalties. These penalties vary based on when the form is filed after the deadline, with separate tiers for returns filed within 30 days, after 30 days but before August 1, or after August 1. It underscores the importance of diligently following submission protocols.

Submission Methods: Digital vs. Paper

Understanding the preferred method for submitting Form 1096 is vital:

- Paper Submission: Mail completed forms directly to the IRS at the designated address provided in the form instructions.

- Electronic Filing: For entities submitting 250 or more information returns, electronic filing is mandated. Taxpayers below this threshold may choose electronic filing voluntarily.

Both methods have stipulations, with electronic submissions necessitating an IRS-approved e-file provider. If unsure of the best option, consult the latest IRS guidelines to ensure compliance.