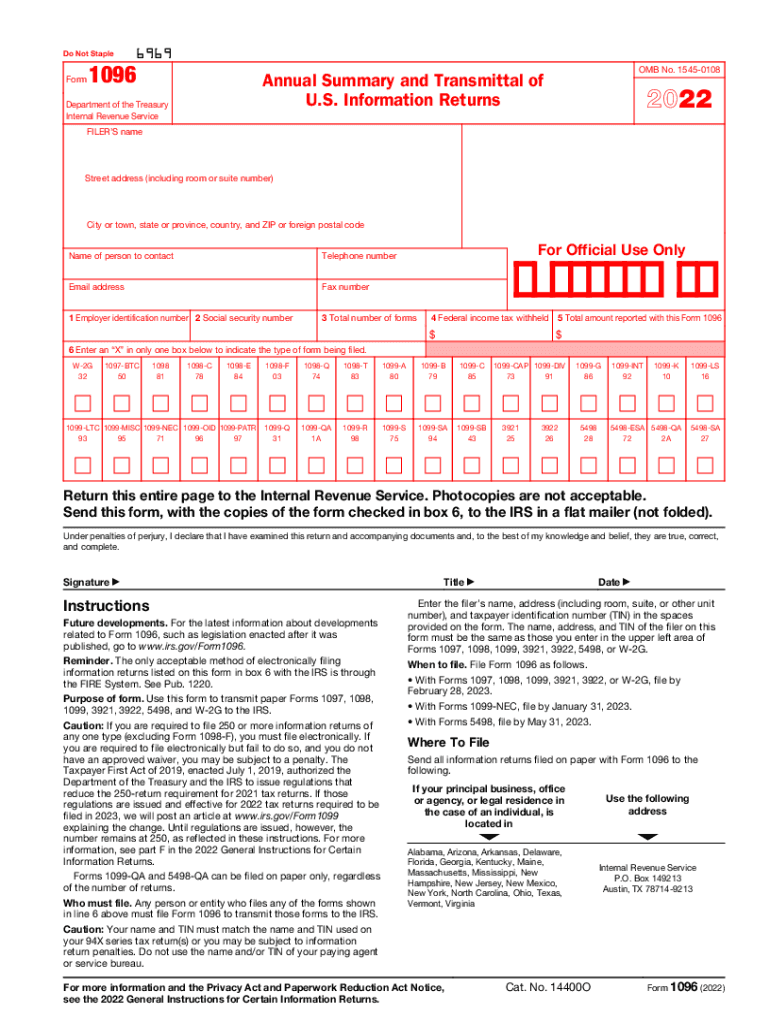

Definition & Purpose of Form 1096

Form 1096, officially titled "Annual Summary and Transmittal of U.S. Information Returns," is an essential IRS tax document. It serves the purpose of summarizing and transmitting various information returns, such as Forms 1099-MISC, 1099-INT, and others, to the Internal Revenue Service. This form acts as a cover sheet for paper filing of information returns and is necessary for organizations or individuals who submit physical copies of these forms. Understanding the purpose of Form 1096 is crucial for maintaining compliance with IRS regulations and ensuring that all financial activities are reported accurately.

Key Elements to Include in Form 1096

Form 1096 requires specific information that correlates with the attached information returns. Key elements include:

- Filer’s Information: Name, address, and identification number (either Social Security Number or Employer Identification Number).

- Total Number of Forms: The total quantity of information returns being transmitted with the Form 1096.

- Total Amount Reported: The total dollar amount reported on the attached information returns.

- Correct Form Identification: Properly marking the correct information return form that is being reported (such as Form 1099-MISC or Form 1099-INT).

Accurate completion of these elements helps in avoiding errors which might lead to penalties or the need for corrections after submission.

Steps to Complete Form 1096

Completing Form 1096 involves a series of steps that need to be followed carefully to ensure accuracy and compliance. The typical process includes:

- Gathering Necessary Information: Collect all information returns that need to be summarized in Form 1096.

- Filling the Filer Information: Enter the complete name, address, and either the Social Security Number or Employer Identification Number.

- Calculating and Entering Totals: Record the total number of returns and the total dollar amount on line 5.

- Specifying the Correct Form: In box 6, mark the type of form you are transmitting, such as 1099-MISC or 1099-INT.

- Reviewing the Form: Double-check all entered details for accuracy to ensure they match the attached forms.

- Submitting to the IRS: Send the completed Form 1096 with the attached information returns to the IRS address specified in the instructions.

IRS Guidelines for Filing Form 1096

The IRS provides explicit guidelines for filing Form 1096, primarily centered on paper submissions. Highlighted guidelines include:

- Submission Address: Always ensure the form is sent to the correct IRS location, as per the regional instructions.

- Physical Copies Only: Form 1096 cannot be filed electronically; it must accompany paper forms.

- Deadline Compliance: Typically due by February 28 for the prior calendar year’s returns unless otherwise specified by the IRS.

Non-compliance with these guidelines can result in penalties, making it vital to adhere to the outlined procedures.

Penalties for Non-Compliance

Failure to file Form 1096 by the due date or inaccuracies on the form may result in IRS penalties. The penalty structure is graduated based on how late the form is submitted and the level of inaccuracy:

- Late Submission: Penalties start from $50 per return and can increase if delays exceed 30 days.

- Incorrect Information: Filing forms with incorrect information without correction can lead to fines of up to $270 per return.

Recognizing and avoiding these penalties is essential for financial compliance and can prevent future audits or legal challenges.

Digital vs. Paper: Understanding Submission Methods

Although Form 1096 itself is not submitted electronically, understanding the difference between digital and paper submission aligns with broader filing strategies:

- Paper Filing: Form 1096 must be filed physically alongside paper copies of information returns.

- Electronic Alternative: Eligible filers may opt for electronic submissions of individual information returns directly through the IRS FIRE system, eliminating the need for Form 1096.

Choosing the appropriate filing method can streamline the process and provide compliance assurance, particularly in high-volume filing scenarios.

Real-World Scenarios & Common Users of Form 1096

Entities that frequently use Form 1096 include small business owners, accounting departments, and financial institutions. The form is typically used in scenarios involving:

- Freelancers and Contractors: Issuing multiple Form 1099-MISC to independent workers requires summarized reporting through Form 1096.

- Financial Institutions: When reporting dividends and interest amounts via Forms 1099-DIV or 1099-INT.

- Business Entities: Engaging in widespread transaction reporting needing a hard copy submission.

Understanding these scenarios helps users identify when and why Form 1096 is necessary, often correlating with the issuance of multiple information returns.

Software Compatibility for Tax Preparation

For users leveraging tax preparation software, efficient management of Form 1096 and related returns is critical. Popular software options typically include:

- TurboTax and QuickBooks: Often incorporate features that assist in the preparation of information returns, easing the accumulation of data needed for Form 1096 without direct electronic submission of the form itself.

These tools are instrumental in managing records accurately, reducing errors, and simplifying the overall reporting process for businesses of all sizes.