Definition & Meaning

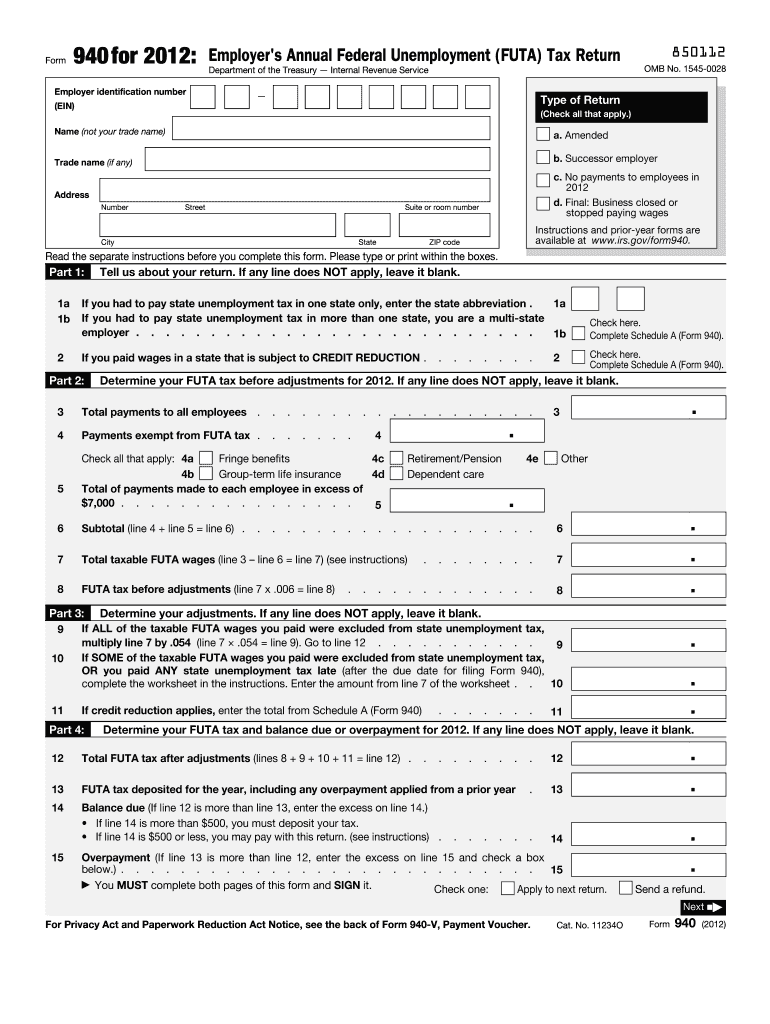

The 2012 IRS Form 940, officially titled the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a critical document required by the Internal Revenue Service for reporting federal unemployment taxes. Employers use this form to report their FUTA tax liability, which helps fund state workforce agencies. The form ensures compliance with the law by requiring the disclosure of certain employment and wage-related information. Understanding its purpose is essential for any business liable for FUTA tax, as it facilitates the correct allocation of unemployment resources to assist unemployed workers.

Key Elements of the 2012 IRS Form 940

Employer Identification Information

The form begins by collecting the employer's details, including the Employer Identification Number (EIN), name, and address. Accurate entry of this information is crucial to ensure the tax return is correctly attributed to your business operation. Incorrect details can lead to processing delays or even penalties.

Total Payments and Taxable Wages

Form 940 requires employers to report total payments made to employees throughout the year. From this, companies must calculate the taxable FUTA wages. Only the first $7,000 of wages paid to each employee is subject to FUTA tax, so understanding how to identify and separate these wages is a key step in correctly completing the form.

Steps to Complete the 2012 IRS Form 940

-

Gather Required Information: Before filling out the form, employers must collect all payroll records from the tax year, as well as any records of FUTA tax deposits already made.

-

Fill in Employer Information: Enter your business details, including the EIN and contact information accurately to avoid misfiling or penalties.

-

Calculate Total Payments and Taxable Wages: Use payroll records to determine total wages paid and identify how much of each employee’s wages are subject to FUTA tax.

-

Compute the FUTA Tax Owed: The standard FUTA tax rate is 6%, but employers may be eligible for a credit up to 5.4% if they paid state unemployment taxes, resulting in an effective rate of 0.6%.

-

Complete the Form Sections: Follow the instructions for each section of Form 940 to report the calculated figures and additional details such as adjustments, credits, and deposits.

-

Review and Submit: Double-check all entries for accuracy before filing with the IRS by the specified deadline.

Who Typically Uses the 2012 IRS Form 940

Form 940 is primarily utilized by employers subject to the Federal Unemployment Tax Act. This includes most corporations, partnerships, single proprietors, and non-profit organizations that have paid at least $1,500 in wages during any calendar quarter or had at least one employee during twenty different weeks in the current or previous year. Understanding whether your business meets these criteria is essential for compliance.

Important Terms Related to the 2012 IRS Form 940

- FUTA: Acronym for Federal Unemployment Tax Act, which mandates employers to contribute to the federal unemployment fund.

- Taxable Wages: Refers to the portion of wages paid to an employee that are subject to FUTA tax, capped at the first $7,000 of earnings.

- Credits: Employers may qualify for tax credits against their FUTA tax liability based on state unemployment contributions.

Filing Deadlines / Important Dates

The IRS mandates that employers must submit their Form 940 by January 31st of the year following the tax year in question. For example, for the 2012 tax year, the form should have been filed by January 31, 2013. If all FUTA tax is deposited on time, the employer may have an additional ten days to file the return.

Penalties for Non-Compliance

Failing to file Form 940 on time or inaccurately reporting information can result in IRS penalties. Late filings may incur financial penalties, while erroneous entries could lead to additional scrutiny or audits. Moreover, failing to pay the full FUTA tax amount on time subjects the employer to interest charges on the unpaid tax balance.

Form Submission Methods

Employers can choose to submit Form 940 via mail or electronically. The IRS provides a digital submission option through its e-File system, which offers an efficient, secure method for filing returns. Manual submissions are still possible, but they require mailing the completed form to the respective IRS address based on the employer’s location.

State-Specific Rules for the 2012 IRS Form 940

While Form 940 is a federal tax form, the state unemployment tax systems can influence the completion process. Employers who operate across multiple states need to understand that FUTA tax credits may vary depending on state-level contributions. It's vital to account for differences in state rules to ensure that the correct credits are claimed and compliance with all legal requirements is maintained.