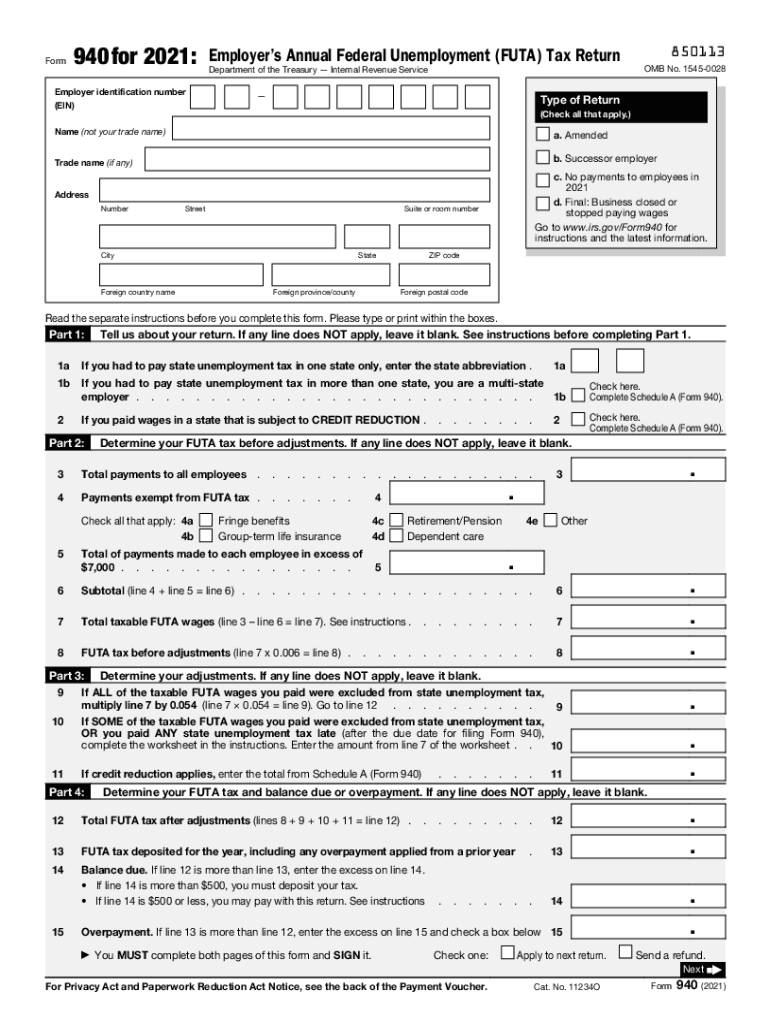

Definition & Purpose of Form 940 for 2021

Form 940 for 2021, officially titled the Employer's Annual Federal Unemployment (FUTA) Tax Return, serves a critical role for employers in the United States. This form ensures compliance with Federal Unemployment Tax Act requirements by reporting an employer's annual FUTA tax liability. Employers who pay significant amounts in wages must complete this form to detail various financial data points, including total payments to employees and state unemployment taxes paid. As a result, Form 940 facilitates the accurate calculation and reporting of unemployment taxes, contributing to the consistent funding of unemployment benefits for workers across the nation.

How to Use Form 940 for 2021

Employers utilize Form 940 for 2021 to accurately report their FUTA tax obligations. The form requires comprehensive data, such as the total wages paid to employees, adjustments, and any unemployment taxes already paid to states. To ensure accurate reporting, employers should:

- Collect and organize wage data from payroll systems.

- Review state unemployment tax payments to determine applicable credits.

- Complete the form, ensuring all calculations for tax liability are accurate.

- Review the completed form for any errors or omissions before submission.

By following these steps, employers can ensure compliance and avoid errors that could result in penalties or additional taxes.

Steps to Complete Form 940 for 2021

Completing Form 940 requires meticulous attention to detail. Below is a step-by-step guide tailored to support employers in accurately finishing the form:

- Enter Basic Information: Include the employer identification number (EIN), trade name, and address.

- Compute FUTA Tax Liability: Detail total payments made to employees, and subtract payments exempt from FUTA tax.

- Calculate Tax Credits: Find if eligible credits apply based on state unemployment tax payments, decreasing overall liability.

- Report Adjustments: Note any required adjustments, such as shortfalls in state tax payments.

- Verify Calculations: Double-check all entries and math to ensure accuracy.

- Completion and Submission: Attach payment voucher (Form 940-V) if necessary, and choose a submission method.

Employers must observe these steps meticulously to prevent errors and ensure the smooth filing of their tax return.

Key Elements of Form 940 for 2021

Understanding the key components of Form 940 ensures precise completion. Major sections include:

- Employer Identification Number (EIN): A unique identifier for tax purposes.

- Wages, Tips, and Other Compensation: Total wages subject to FUTA.

- Tax Liability: Calculated based on the wages after accounting for unemployment tax exclusions.

- State Unemployment Tax Contributions: Credits that offset the federal tax amount.

- Adjustments: Any necessary accounting for underpayment of state taxes.

Employers should familiarize themselves with these elements to accurately report and calculate FUTA tax obligations.

Legal Use and Importance of Form 940 for 2021

Legal compliance is a pivotal reason for using Form 940. Employers must file this form to legally satisfy federal regulations under the FUTA. Properly filing Form 940:

- Demonstrates compliance with federal unemployment requirements.

- Ensures that unemployment benefits receive adequate funding through tax collection.

- Protects employers from legal consequences such as audits and fines.

Remaining informed about their legal obligations helps employers maintain regulatory compliance and secure business operations.

Filing Deadlines and Important Dates

Timely submission of Form 940 is critical. The standard deadline for filing is January 31 following the end of the tax year. If all FUTA tax payments have been submitted on time and in full throughout the year, employers may qualify for a 10-day extension, moving the deadline to February 10. Employers should maintain records of all submission deadlines to ensure timely filing and avoid penalties.

Penalties for Non-Compliance with Form 940 Requirements

Failing to file Form 940 can result in significant complications and financial penalties for employers. Penalties may include:

- Late Filing Penalties: accrue if the form is not submitted by the deadline.

- Accuracy-related Penalties: ensue from incomplete or incorrect reporting.

- Non-payment Fines: apply when FUTA tax balances aren't paid on time.

To avoid these penalties, employers should ensure that all form information is complete, accurate, and submitted by the specified deadlines.

Digital vs. Paper Format Options

Employers can file Form 940 both digitally and in paper format. Each method has advantages:

-

Digital Filing:

- Offers convenience and speed.

- Provides electronic confirmation of submission.

-

Paper Filing:

- Accessible for businesses without digital resources.

- May be preferable for companies requiring hard copy records.

Select the method that best supports your business operation, considering access to resources and preference for technology use.

Taxpayer Scenarios: Business Types Benefiting from Form 940

Form 940 is pertinent to various business types across industries. Those most likely to file include:

- Corporations: Due to larger employee counts and wage distribution.

- Partnerships: Required to report unemployment tax for partner compensation.

- Limited Liability Companies (LLC): Depending on structure and employee numbers.

Understanding how Form 940 applies to these business kinds helps companies manage tax liability efficiently.