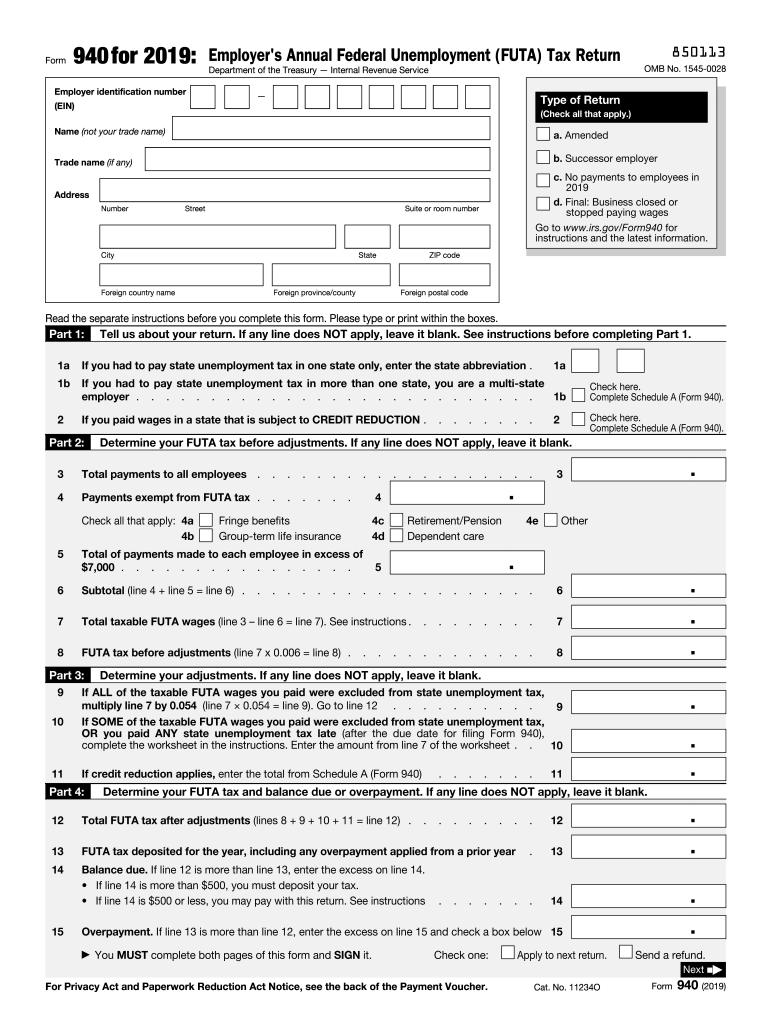

Definition and Meaning of Form 940

Form 940, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is utilized by employers in the United States to report their annual unemployment tax liability. The FUTA tax is part of a federal program that supports state unemployment insurance programs and assists in covering the costs of unemployment benefits for workers who lose their jobs. Unlike Social Security and Medicare taxes, the FUTA tax is paid solely by employers; employees do not contribute to this tax through payroll deductions.

Purpose of Form 940

- To report FUTA tax liability: Employers report the amount of unemployment tax they owe to the federal government.

- Facilitate unemployment compensation: Helps fund unemployment programs at both the state and federal levels.

- Ensure compliance: Filing the form demonstrates compliance with federal regulations regarding unemployment taxes.

How to Use Form 940

Using Form 940 requires employers to gather specific payroll information from the tax year. The form includes various sections where employers report wages paid, tax rates, and potential adjustments or credits.

- Gather necessary payroll records: Collect information about wages paid to employees during the tax period.

- Calculate taxable wages: Determine which wages are subject to FUTA tax. Only the first $7,000 of each employee’s wages is taxable.

- Complete the form: Fill out each section as per IRS instructions, providing details about wages, tax liability, and any credits.

- Submit: After completion, the form should be submitted to the IRS by the deadline.

Important Considerations

- Employers must account for any state unemployment tax credits, which can reduce the federal tax rate.

- It's critical to ensure accuracy in wage calculations to avoid penalties or adjustments later.

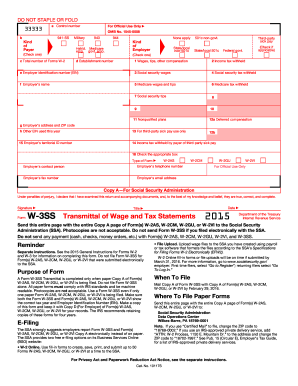

Steps to Complete Form 940

Preparing Your Data

- Compile Payroll Information: Ensure all wage data is accurate and up-to-date.

- Understand Taxable Wage Base: Know that FUTA only applies to the first $7,000 of wages.

Detailed Completion Process

- Part 1: Enter employer details and federal identification number.

- Part 2: Calculate the total FUTA liability.

- Part 3: Determine if you qualify for a reduced tax rate based on timely state unemployment tax payments.

- Part 4: Calculate adjustments for any state plan credits.

- Part 5: Total up your FUTA liability, taking into account any reductions.

- Part 6: Sign and date the form for certification.

Finalizing the Submission

- Review for Accuracy: Double-check all figures and calculations.

- File Electronically: Consider electronic filing options for faster processing.

Who Typically Uses Form 940

Employers subject to FUTA tax in the United States typically use Form 940. This includes:

- Businesses with employees: Any entity employing people for wages must determine if they meet the filing requirements for Form 940.

- Agricultural employers: Those paying $20,000+ in wages in any quarter or employing ten or more workers on at least some days across 20 or more weeks.

- Household employers: If paying $1,000+ in wages in any calendar quarter.

Eligibility Criteria

Employers must annually assess their eligibility based on employment status and wage thresholds to determine if filing is necessary.

Filing Deadlines and Important Dates

Form 940 is due on January 31st following the end of the tax year. If an employer has deposited all FUTA taxes when due, they are granted an automatic 10-day extension to February 10th.

Implications of Missing the Deadline

Failure to file Form 940 by its due date can result in penalties based on the amount owed and the length of delay, accompanied by interest charges on unpaid taxes.

IRS Guidelines and Instructions

The IRS provides detailed instructions that accompany Form 940, ensuring that employers accurately calculate and report their FUTA tax liability. These guidelines include:

- Understanding adjustments for state credits: Helps employers reduce federal tax by accounting for state unemployment contributions.

- Common errors to avoid: Ensures full compliance and accurate filing to avoid penalties or audits.

Penalties for Non-Compliance

Non-compliance with Form 940 requirements can lead to significant penalties. Specific infractions include:

- Late filing or payment: Leads to fines based on the unpaid amount and the length of delay.

- Inaccurate reporting: Potential fines and interest charges if the IRS identifies discrepancies or underreporting.

Legal Consequences

Besides financial penalties, willful failure to comply can result in legal action against the business or its responsible officials.

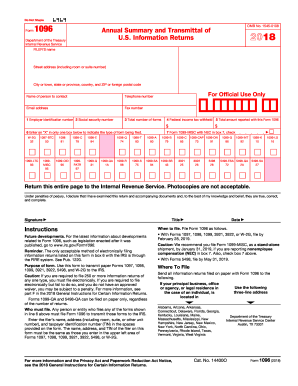

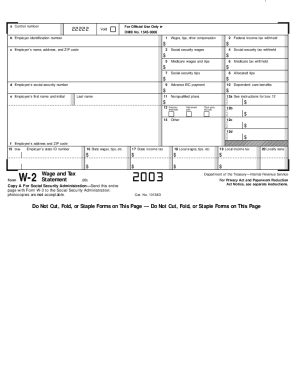

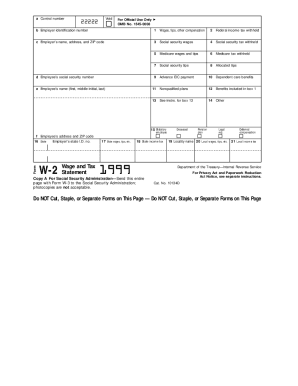

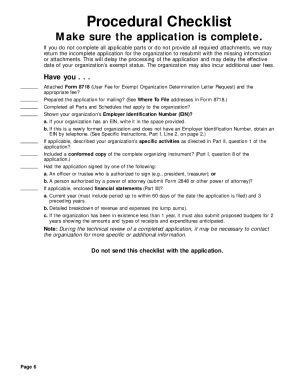

Required Documents for Filing Form 940

Essential Documentation for Accurate Filing

To properly complete Form 940, employers must prepare:

- Detailed payroll records: Include wage information for each employee.

- State unemployment tax records: Document any contributions made, which might offset federal liability.

Having thorough documentation ensures accurate completion and can serve as evidence if issues arise regarding the reported liability.