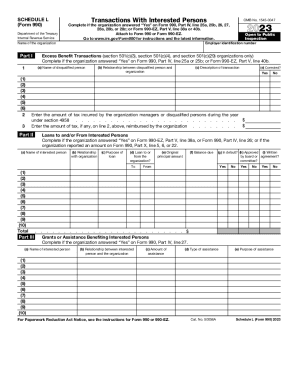

Choose and preview Schedule l Balance Sheet Templates online. Obtain a document relevant to your situation, modify and sign it, and safely send it with your business partners and financial institutions.

Document management can stress you when you can’t discover all of the forms you require. Fortunately, with DocHub's vast form categories, you can discover all you need and swiftly manage it without the need of changing among software. Get our Schedule l Balance Sheet Templates and start working with them.

How to use our Schedule l Balance Sheet Templates using these easy steps:

Try out DocHub and browse our Schedule l Balance Sheet Templates category easily. Get a free profile right now!