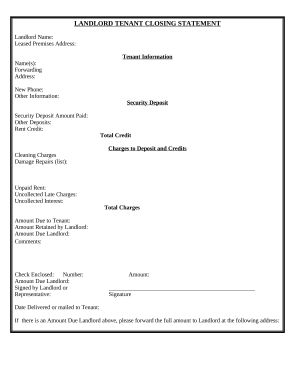

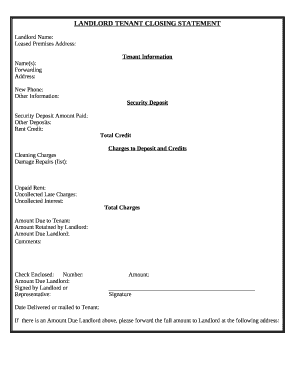

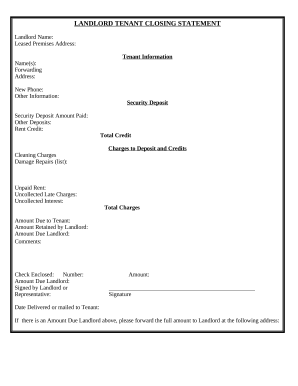

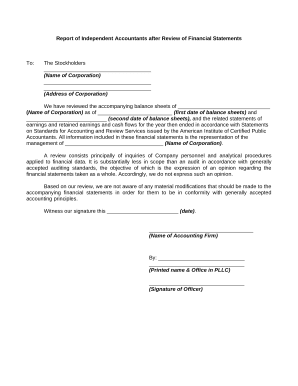

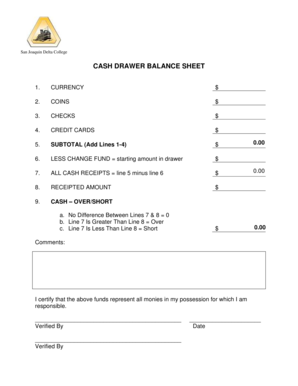

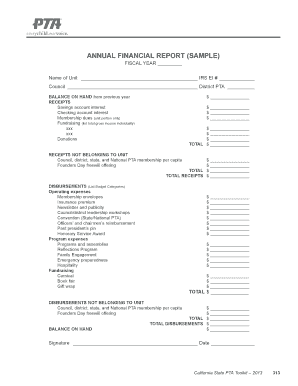

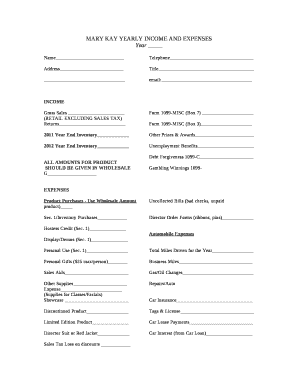

Browse Home closing Balance Sheet Templates and create a tailored financial statement. Edit, complete, eSign, and send your balance sheets without holdups.

Record management occupies to half of your business hours. With DocHub, it is possible to reclaim your office time and increase your team's efficiency. Get Home closing Balance Sheet Templates collection and check out all document templates related to your day-to-day workflows.

Easily use Home closing Balance Sheet Templates:

Boost your day-to-day file management using our Home closing Balance Sheet Templates. Get your free DocHub account today to discover all templates.