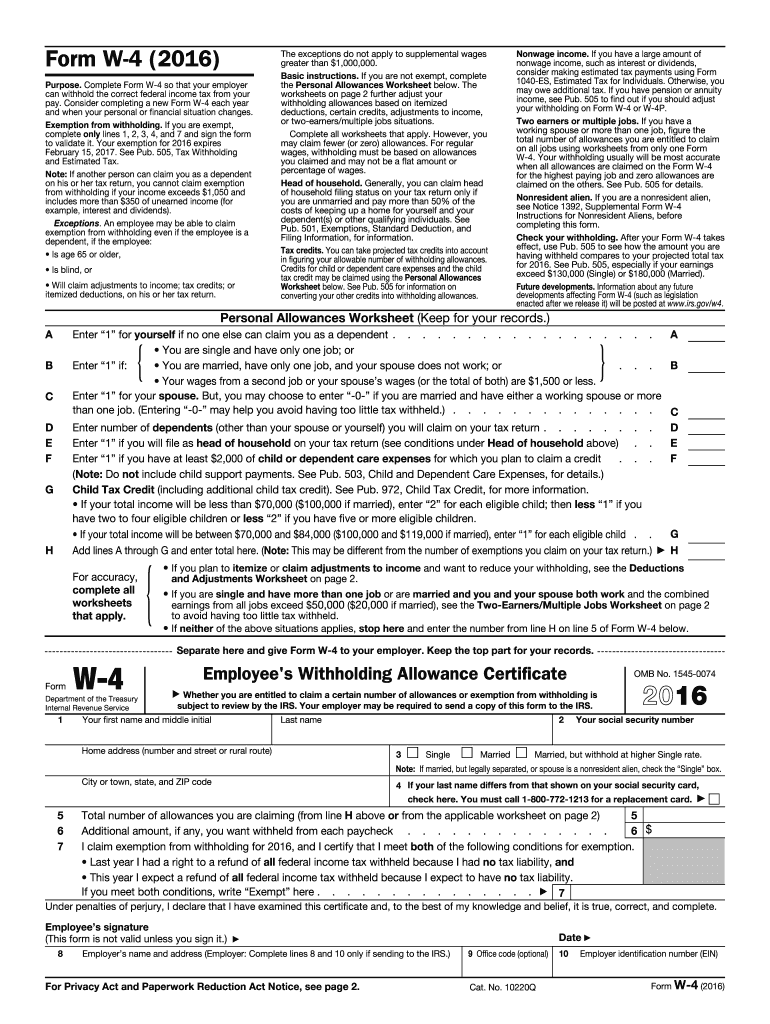

Definition and Purpose of the 2016 W-4 Form

The 2016 W-4 form, officially titled the "Employee's Withholding Allowance Certificate," is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. By submitting this form, employees communicate their tax situation to their employer, which helps ensure that appropriate federal taxes are deducted from their earnings. The correct withholding amount is essential in preventing underpayment or overpayment of taxes at the end of the year.

The 2016 W-4 form features several sections where employees can indicate their filing status, claim allowances, and communicate any additional amount they wish to withhold from their paycheck. There are schedules and worksheets attached to the W-4 to assist employees in accurately calculating the number of allowances based on their financial situation and family circumstances.

How to Use the 2016 W-4 Form

Using the 2016 W-4 form is a straightforward process that ensures accurate tax withholding. Here are the key steps involved in using this form:

-

Obtain the Form: The 2016 W-4 form can be acquired from the IRS website or requested from your employer.

-

Fill Out Personal Information:

- Enter your name, address, Social Security number, and filing status (single, married, or head of household).

-

Determine Allowances:

- Use the worksheet provided on the form to calculate your number of allowances based on factors such as your filing status, number of dependents, and eligibility for tax credits.

-

Additional Withholding:

- If you anticipate owing more taxes than your withholding will cover, you can specify an additional amount to be withheld from each paycheck.

-

Sign and Submit:

- Once completed, sign and date the form, and submit it to your employer’s payroll department.

By following these steps, employees can ensure that their tax withholding aligns with their financial situation, potentially reducing the risk of tax surprises.

Steps to Complete the 2016 W-4 Form

Completing the 2016 W-4 form involves several clear steps to maximize accuracy in tax withholding. Each section plays a vital role:

Personal Information Section

- Name and Address: Clearly print your legal name and current address.

- Social Security Number: Input your nine-digit SSN to identify your account with the IRS.

- Filing Status: Choose one of the filing statuses (Single, Married, or Head of Household).

Claiming Allowances

- Worksheet Completion: Use the accompanying worksheet to determine the number of allowances you can claim. This calculation considers dependents, tax credits, and other deductions.

- Adjust if Necessary: Consider your financial circumstances, such as additional income or reduced expenses, which may necessitate an adjustment of the allowances claimed.

Additional Amounts and Signature

- Additional Withholding: If applicable, specify any additional amount you want withheld from each paycheck to cover potential tax liabilities.

- Signature: Sign and date the form, validating the information you provided.

These steps ensure that the submitted 2016 W-4 form accurately reflects your tax situation, aiding in proper federal tax withholding.

Important Terms Related to the 2016 W-4 Form

Understanding key terms associated with the 2016 W-4 form can clarify its components and procedures. Here are some essential terms:

- Withholding: The portion of an employee's earnings withheld by their employer for tax purposes.

- Allowances: A reduction of the taxable income based on certain personal factors, such as dependents or financial situation.

- Filing Status: The category (such as single or married) that determines the tax rate and deduction eligibility.

- Tax Credits: Amounts that reduce your overall tax liability, which may be considered when calculating allowances.

- IRS: The Internal Revenue Service, the U.S. federal agency responsible for tax collection and enforcement.

Familiarity with these terms helps in understanding how the 2016 W-4 form impacts tax withholding accurately.

IRS Guidelines for Completing the 2016 W-4 Form

The IRS provides detailed guidelines for completing the 2016 W-4 form to assist employees in making informed withholding decisions. Here are the main points to follow:

- Annual Review: The IRS recommends that employees review their W-4 form at least annually or when significant life events occur, such as marriage, divorce, or the birth of a child, which may affect tax responsibilities.

- Estimate your Tax Liability: Use the IRS's tax withholding estimator, available online, to help determine an appropriate amount of withholding, factoring in income, deductions, and credits.

- Changes in Employment: If you have multiple jobs or your spouse works, you may need to adjust your W-4 allowances to avoid under-withholding.

- Employer Responsibilities: Employers are obligated to implement the withholding information provided by the employee on the W-4 form accurately.

Following these IRS guidelines helps ensure compliance and aids in tax planning effectively.

Who Typically Uses the 2016 W-4 Form

The 2016 W-4 form is primarily used by employees who receive wages, salaries, or other types of compensation from their employers. Here are some specific groups that typically utilize the form:

- Full-Time Employees: Workers in permanent employment positions who receive regular paychecks.

- Part-Time Employees: Individuals who work less than full-time but still earn wages that require federal tax withholding.

- Seasonal Workers: Employees working temporary positions during peak seasons.

- Multiple Job Holders: Individuals with more than one source of income who need to manage their tax withholding across various employers.

Each of these groups can leverage the information provided on the 2016 W-4 form to ensure their withholding accurately reflects their overall tax situation.

Key Elements of the 2016 W-4 Form

Understanding the key elements of the 2016 W-4 form is essential for effective usage. The form consists of the following critical components:

- Personal Information Section: Collects the employee's details and filing status.

- Allowances Section: Provides worksheets for employees to calculate their allowable tax exemptions based on their circumstances.

- Additional Withholding Specification: Allows employees to indicate extra amounts they wish to withhold for tax purposes.

- Employer Information: Spaces designated for employers to note the employee's information for payroll records.

Each element serves a specific purpose in conveying accurate withholding information to help manage tax liabilities effectively.

Examples of Using the 2016 W-4 Form

Practical examples can illustrate how to use the 2016 W-4 form in everyday scenarios:

-

First Job Scenario: A recent college graduate starts their first job. They fill out the W-4, claiming one allowance as they are single and have no dependents. This reflects in their paycheck, ensuring the appropriate amount of federal tax is withheld.

-

Change in Marital Status: An individual gets married and needs to adjust their W-4. They update their filing status to married, potentially increasing their allowances, thus decreasing the amount withheld to better align with their joint financial situation.

-

Multiple Income Streams: A person working multiple part-time jobs uses the W-4 to adjust withholding across employers. They calculate that they should claim zero allowances on one job and two on another to balance their total withholding for the year, ensuring they do not underpay their taxes.

These examples illustrate practical applications of the 2016 W-4 form and the impact of personal circumstances on tax withholding decisions.