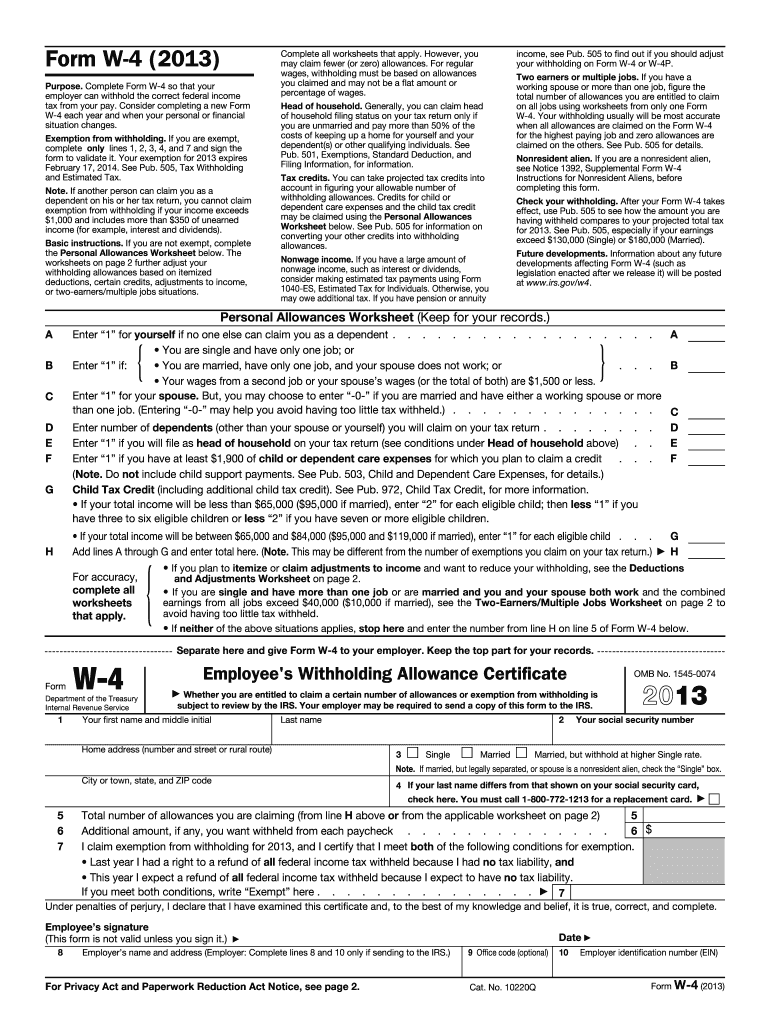

Definition and Meaning of the 2013 Form

The 2013 form, specifically Form W-4 (2013), is an essential document used by employees in the United States to communicate their federal income tax withholding preferences to their employers. This form helps determine the amount of federal income tax to be withheld from each paycheck based on personal circumstances. The W-4 includes vital sections for claiming exemptions, adjusting withholdings based on nonwage income or multiple jobs, and declaring additional withholding amounts as needed.

The form serves as a means to ensure that individuals pay the correct amount of taxes over the course of the year, thus avoiding owing taxes at the end of the tax season. Understanding and accurately completing the 2013 form can help prevent under-withholding or over-withholding, which can significantly affect an individual’s financial situation.

Legal Use of the 2013 Form

The 2013 form adheres to the guidelines outlined by the Internal Revenue Service (IRS) and is legally recognized for tax purposes. It is used exclusively for federal income tax withholding directives. All employees, regardless of their employment status—full-time, part-time, or contractual—must submit a W-4 to ensure their employers withhold the correct federal tax amount. Noncompliance with proper form submission or the use of outdated forms can lead to penalties or audits, making it crucial for employees to stay up-to-date.

Steps to Complete the 2013 Form

To effectively fill out the W-4 (2013), individuals should follow a step-by-step approach:

- Personal Information: Begin by entering your name, Social Security number, address, and marital status. This identifies your tax profile.

- Deductions: Use the worksheets provided on the form to determine the number of allowances you can claim based on your personal situation, such as dependents or other eligible deductions.

- Additional Withholding: If you wish to have extra money withheld from your paycheck, indicate this amount in the designated section.

- Signature and Date: Once all information is filled out accurately, sign and date the form to validate it.

It's important to regularly review and update your W-4, especially after life changes like marriage, divorce, or a change in job status, which could affect your tax situation.

Who Typically Uses the 2013 Form

The W-4 (2013) is primarily used by employees who earn wages subject to federal income tax withholding. This includes:

- Full-time employees: Those working a standard workweek and receiving salaried or hourly pay.

- Part-time employees: Individuals with variable hours whose income is still subject to federal withholding.

- Multiple job holders: Employees engaged in more than one job must submit a W-4 for each employer to accurately manage tax withholdings.

- Contract workers: Freelancers and independent contractors who choose to withhold federal income tax.

Additionally, employers are mandated to collect and maintain W-4 forms from their employees to ensure compliance with federal tax laws.

Important Terms Related to the 2013 Form

Understanding key terminology associated with the W-4 (2013) can enhance comprehension of how to utilize the form effectively. These terms include:

- Allowances: Clauses that reduce the amount of federal tax withheld; based on factors like dependency and financial obligations.

- Exemptions: Conditions under which a taxpayer may not be required to have federal taxes withheld.

- Withholding: The process where employers deduct taxes from employee paychecks and remit them to the IRS.

- Adjusted Gross Income (AGI): Total income before deductions and taxes, important for determining tax liability.

- Marital Status: Can impact the amount of tax withheld; individuals must select their status accurately on the W-4.

IRS Guidelines for the 2013 Form

Compliance with IRS guidelines when using the W-4 (2013) is crucial to ensure proper tax management:

- Keep the form updated to reflect current financial and employment situations.

- Review any IRS publications related to changes in tax law that may affect withholding rates, allowances, or deductions.

- Ensure the accuracy of personal information and calculations on the W-4 to prevent discrepancies during tax filing.

Following these guidelines can prevent unnecessary complications, ensuring that your tax withholdings align with your actual liability, thereby facilitating a smoother tax filing experience.