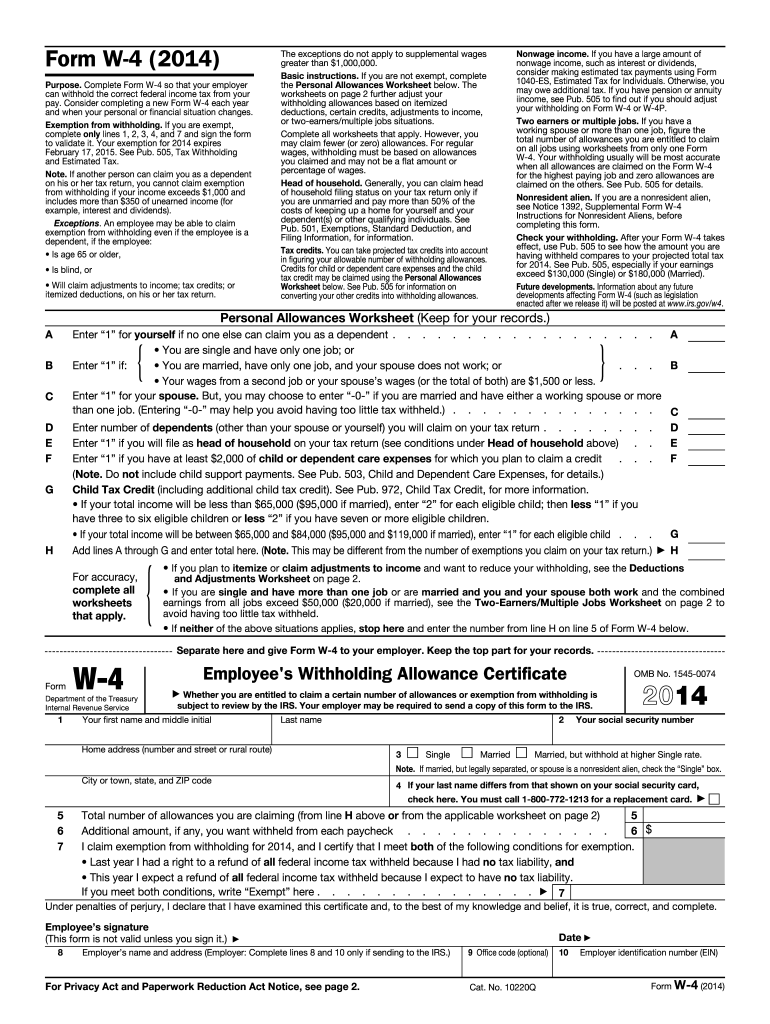

Definition and Meaning of the W-4 2014 Form

The W-4 2014 form, officially titled "Employee's Withholding Allowance Certificate," is a crucial document used by employees in the United States to inform their employers of their federal income tax withholding preferences. By filling out the W-4 form, employees can indicate their withholding allowances, which directly affects the amount of federal income tax deducted from their paychecks. The information provided on the W-4 is essential for employers to determine the correct amount to withhold in compliance with IRS regulations.

The primary purpose of the W-4 form is to ensure that individuals neither underpay nor overpay their federal taxes throughout the year. Accurate completion of the form reduces the likelihood of owing a large sum during tax season or receiving an excessive refund. Consequently, understanding how to complete the W-4 effectively is vital for financial planning and tax obligations.

Key Components of the W-4 Form

- Personal Information: Employees provide their name, Social Security number, and filing status.

- Allowances: Claiming various allowances based on personal circumstances (e.g., dependents, multiple jobs).

- Additional Withholding: The option to request extra amounts withheld for tax relief.

- Certification: Employees must sign and date the form, certifying the provided information is accurate.

Steps to Complete the W-4 2014 Form

Completing the W-4 2014 form involves several clear steps that ensure accurate tax withholding. Here’s a breakdown of how to efficiently fill out the form:

-

Provide Personal Information:

- Fill in your name, address, and Social Security number.

- Indicate your filing status (Single, Married, or Head of Household).

-

Claim Allowances:

- Use the worksheet included with the W-4 to calculate the number of allowances you qualify for. Factors that affect your allowance count include:

- Dependents.

- Multiple jobs or a spouse who also works.

- Tax credits you expect to claim.

- Use the worksheet included with the W-4 to calculate the number of allowances you qualify for. Factors that affect your allowance count include:

-

Total Allowances:

- Write the total number of allowances you are claiming on line 5 of the form.

-

Additional Withholding:

- If you believe you will owe a significant amount when filing, you can specify an additional dollar amount to be withheld from each paycheck.

-

Sign and Date:

- Finally, sign and date the form to certify that all information is accurate. Without your signature, the form is invalid.

Example of Allowance Calculation

- If you are married, filing jointly, and have two children under the age of 17, you may claim:

- One allowance for yourself.

- One allowance for your spouse.

- Two allowances for your children.

- This makes a total of four allowances.

How to Obtain the W-4 2014 Form

Obtaining the W-4 2014 form is a straightforward process, easily accessible through several avenues:

-

IRS Website: The Internal Revenue Service (IRS) offers a downloadable PDF version of the W-4 2014 form on its official website. This is the most recommended method as it ensures you are using the correct and official version.

-

Employer: Many employers provide W-4 forms directly to their employees during onboarding or upon request. It is good practice to ask your HR department for the form if you cannot access it online.

-

Tax Preparation Software: Some tax preparation software, such as TurboTax or H&R Block, provide templates and tools to help you fill out the W-4 form digitally.

Important Notes

- Always ensure you’re using the correct year’s form, such as the 2014 version, as tax laws can change and previous forms may become obsolete.

Important Terms Related to the W-4 2014 Form

Understanding key terminology related to the W-4 2014 form can enhance comprehension and ensure correct usage:

- Withholding Allowance: A deduction that reduces the amount withheld from your paycheck for federal taxes.

- Filing Status: Your tax classification (e.g., Single, Married, Head of Household) that affects your tax rate and deductions.

- Additional Withholding: A specified amount that an employee can request to be withheld from their paycheck beyond standard withholding.

Further Clarification of Terms

- Dependents: Individuals for whom you provide care and support, qualifying you for additional allowances.

- Exemptions: Certain individuals may qualify to be exempt from withholding taxes altogether if they meet specific criteria as defined by IRS guidelines.

Legal Use of the W-4 2014 Form

The W-4 form is legally recognized by the IRS as the official method for employees to communicate their tax withholding preferences to employers. Proper completion and submission of this form are essential for compliance with federal tax laws.

Compliance Guidelines

- Accuracy: All information must be truthful and accurate to avoid penalties.

- Timely Submission: Employees should submit the W-4 promptly after starting a new job or when experiencing significant life changes (e.g., marriage, divorce, having a child).

Implications of Non-Compliance

Failure to comply with W-4 regulations may lead to under-withholding, resulting in additional taxes owed at the end of the year, potential penalties, and interest charges.

Examples of Using the W-4 2014 Form

Using the W-4 2014 form appropriately can greatly affect one’s tax situation. Here are a few practical examples to illustrate:

-

Newly Married Individuals: A couple should complete a new W-4 to reflect their married status and possibly claim additional allowances due to shared expenses and dependents.

-

Parents with Children: A single parent can adjust their withholding to account for dependents, which may significantly reduce their taxable income and the withholding amount.

-

Multiple Jobs: For individuals working more than one job, accurate completion of the W-4 is crucial to prevent over-withholding, which can cause cash flow issues throughout the year.

Real-World Scenario

An employee who recently got a promotion and expects a higher salary might want to adjust their W-4 to reflect this change. By recalculating their allowances, they can ensure they are not over-withholding, allowing them to maximize their take-home pay.

By engaging with the W-4 2014 form correctly, employees can align their withholding with their financial situations and avoid surprises come tax time.