Definition and Meaning of Form

A form is a structured document used for data collection, providing essential information in fields designated for responses. In various contexts, forms facilitate communication between individuals and organizations, streamline processes in legal and administrative functions, and standardize data input for record-keeping. Common types of forms include tax documents, applications, contracts, and surveys. For instance, IRS Form W-4 is used by employees to indicate tax withholding preferences, directly affecting their net pay.

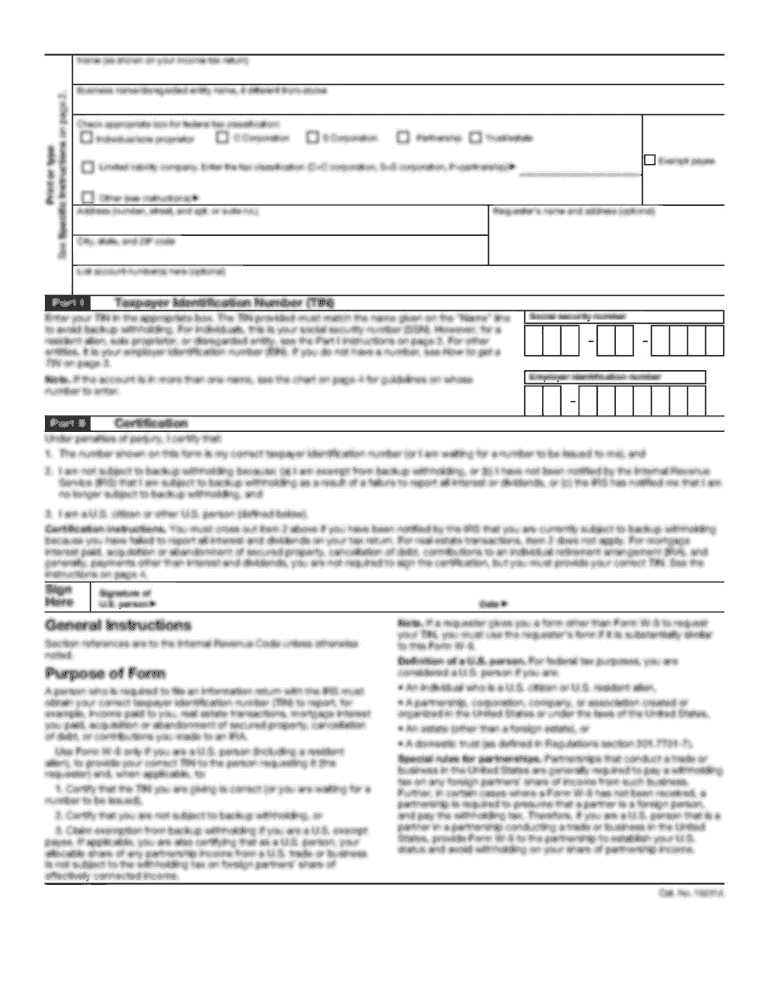

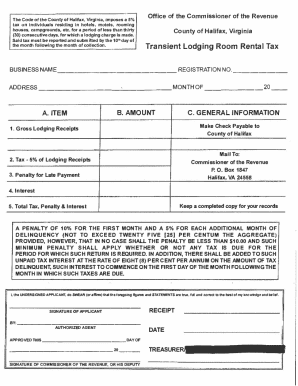

Form structures typically feature predefined fields, including text boxes, checkboxes, and dropdown menus, to guide users in providing information clearly and accurately. This format not only improves data quality but also ensures compliance with regulations where necessary. Users are encouraged to fill out forms meticulously, as inaccuracies can lead to delays, legal issues, or penalties.

Examples of Common Forms

- Tax Forms: Such as Form 1040 for individual income taxes or Form W-2 for wage and tax statement reporting.

- Employment Forms: Including job applications and onboarding documents like the I-9 for employment eligibility verification.

- Legal Forms: Like contracts, leases, and liability waivers, which establish clear agreements between parties.

- Health Care Forms: Used for patient registration and medical histories, ensuring comprehensive patient data collection.

How to Obtain the Form

Acquiring the necessary form depends on its specific purpose and source. For most official forms, individuals can download them from relevant government or organizational websites, where they are typically provided in PDF format for easy printing.

Steps to Obtain a Form

- Identify the Required Form: Determine which specific form is needed based on the task or purpose (e.g., IRS Form W-4 for tax purposes).

- Visit the Official Source: Navigate to the relevant website, such as the IRS for tax forms.

- Download the Form: Locate the form on the site, select the appropriate version (e.g., a fillable version versus a printable PDF), and download it.

- Review for Updates: Check if any recent updates or changes apply to the version you are obtaining to ensure compliance.

Additionally, forms can often be requested directly from organizations or filed physically at designated locations such as tax offices or libraries.

Steps to Complete the Form

Completing a form accurately is critical to ensure its validity and effectiveness. Each form will come with specific instructions, which should be carefully followed. Here are the steps generally involved in completing a form:

General Steps to Fill Out a Form

- Read the Instructions: Thoroughly review any provided guidelines to understand how to properly fill out the form.

- Gather Necessary Information: Assemble all information and documents required to answer the questions accurately, such as identification numbers or financial details.

- Fill Out Each Field: Enter information in designated fields, ensuring clarity and accuracy—use black or blue ink for paper forms and type where required for digital ones.

- Review for Errors: After completion, double-check the form for typos or omissions that could lead to processing issues.

- Sign and Date: Where necessary, provide a signature and date to verify the information is accurate and complete.

In some cases, certain fields may require additional documentation as proof of information, which should also be prepared and attached correctly.

Legal Use of the Form

The legal use of forms is significant in various sectors, ensuring actions taken through forms are recognized and enforceable. It is vital to use the correct version and type of form for specific transactions to meet legal standards.

Legal Considerations

- Compliance: Many forms must follow specific rules set by governing bodies, like the IRS or state regulatory agencies, to be legally binding.

- Recordkeeping: Completed forms often serve as official records of actions taken, such as tax filings, job applications, or legal agreements.

- Enforceability: In legal contexts, properly executed forms, including signed contracts and agreements, are enforceable in court.

Understanding the implications of the information provided in forms ensures that individuals and organizations maintain compliance and protect their rights.

Examples of Using the Form

Understanding real-world applications of forms is essential for grasping their significance. Practical examples highlight how forms facilitate various processes in both personal and business contexts.

Common Use Cases

- Tax Filing: An employee uses IRS Form W-4 to determine how much federal income tax their employer should withhold from their paycheck based on their personal financial situation.

- Lease Agreements: A landlord and tenant use a lease form to outline terms of occupancy, protecting both parties’ rights and responsibilities.

- Medical Records: A patient completes a health history form to assist healthcare providers in delivering appropriate care and treatment.

These examples illustrate how forms streamline communication and establish clear agreements in diverse aspects of daily life.

Filing Deadlines and Important Dates

Filing deadlines are crucial for various forms, particularly tax and legal ones. Missing these deadlines can have severe consequences, including penalties or legal ramifications.

Key Dates for Filing Forms

- Tax Forms: For most individuals, the filing deadline for annual tax returns, such as IRS Form 1040, is typically April 15 of the following year.

- Employment Forms: Employees may need to submit Form W-4 at the start of new employment or during any significant financial changes.

- Legal Documents: Different forms related to contracts, agreements, or lawsuits often have specific filing deadlines that must be adhered to avoid complications.

It’s essential to keep track of relevant deadlines to ensure compliance and avoid unnecessary issues.

Required Documents for Completing the Form

Depending on the type of form being completed, various supporting documents may be required to ensure accuracy and validity.

Typical Required Documents

- Identification: Government-issued ID or Social Security number for tax forms and some legal documents.

- Financial Information: Pay stubs or tax returns to complete forms related to income, such as W-2s or W-4s.

- Proof of Residency: A utility bill or lease agreement for forms requiring proof of address.

Having these documents ready can streamline the process of completing and submitting forms effectively.