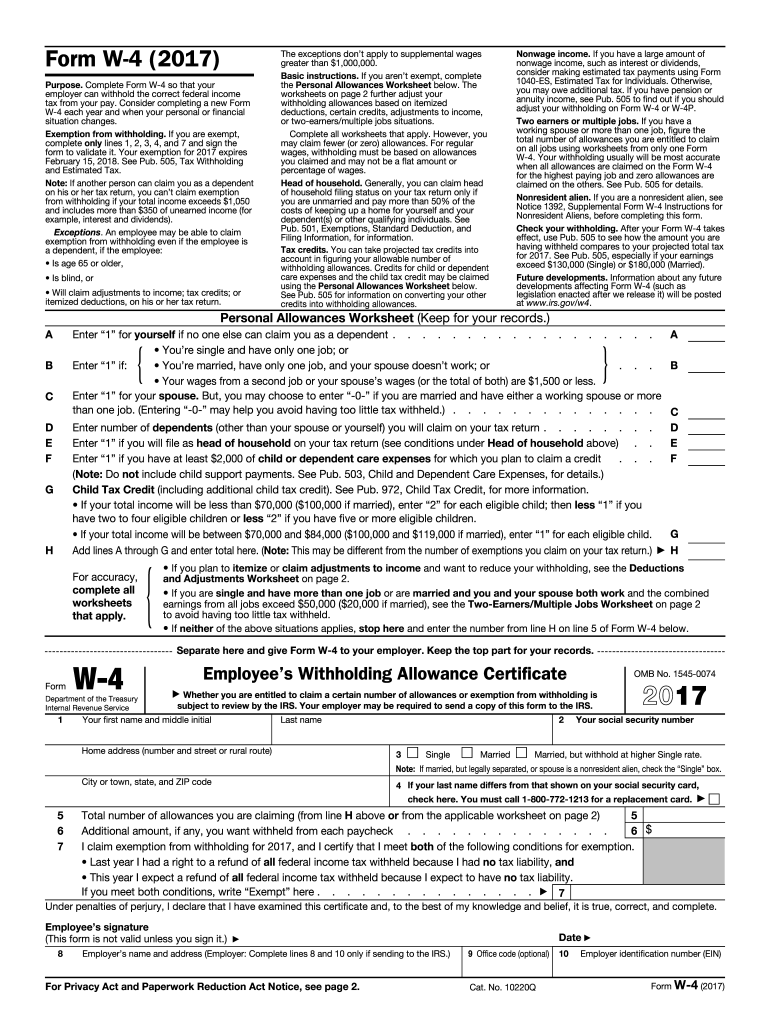

Definition and Meaning of Form 2017

Form 2017 refers to a specific tax form used during the 2017 tax year, designed to manage federal tax withholdings and declarations. This form is often integral for documenting income, claiming deductions, and adjusting withholdings to reflect accurate tax responsibilities. Many taxpayers use it to inform employers about withholding adjustments due to life changes such as having multiple jobs or experiencing modifications in income.

Understanding the Form's Structure

-

Taxpayer Identification: Requires personal information, which includes the taxpayer's name, Social Security Number, and address.

-

Allowances and Deductions: Guidance for claiming exemptions and allowances based on dependents and personal circumstances.

-

Adjustments for Nonwage Income: Spaces where additional income information unrelated to wages, like dividends or interest, is documented.

How to Use Form 2017

This form is used primarily to indicate federal income tax withholding for employees. It is essential in ensuring the correct amount is taken from an employee's paycheck. Below are steps for completing the form accurately:

-

Personal Details: Fill in personal information, including name, Social Security Number, and address.

-

Allowance Adjustments: Use the IRS-provided worksheets accompanying the form to determine the number of allowances you’re eligible for.

-

Additional Withholding: Specify additional amounts to withhold from each paycheck if necessary.

Examples of Use

-

Multiple Job Adjustments: Employees with more than one job may need to adjust withholdings to accommodate their combined income.

-

Dependents: Claiming allowances for dependents to ensure appropriate withholding amounts.

Steps to Complete Form 2017

Completing this form involves several crucial steps to ensure that it is filled out correctly:

-

Gather Information: Have personal and income-related documents on hand.

-

Review IRS Guidelines: Study the guidelines to understand the form’s requirements and how to apply exemptions.

-

Complete Worksheets: Use the included worksheets to determine the necessary adjustments to withholdings.

-

Submit to Employer: Once completed, submit the form to your employer for accurate payroll processing.

Variations in Completion

-

Single vs. Married Flexible Allowance: Married individuals may have different allowances compared to single individuals.

-

Nonwage Income Adjustments: Declare income not directly related to employment for accurate tax purposes.

Importance of Form 2017

Form 2017 is pivotal in ensuring that employees don't face large tax liabilities at the end of the year. Proper withholding prevents underpayment and the surprise of a large tax bill. It helps manage cash flow by distributing tax payments throughout the year.

Real-World Implications

-

Consistent Withholding: Ensures precise tax distribution through regular payroll deductions.

-

Avoiding Penalties: Helps in avoiding underpayment penalties by ensuring proper withholding adjustments are made.

Key Elements of Form 2017

Several components are critical to the form and how it is used by taxpayers:

-

Exemptions and Deductions: Defining these elements shapes the form’s financial implications for the taxpayer.

-

Allowances Section: Dictates how much is withheld from income, influencing annual tax returns.

Important Related Terms

-

Exemptions: Reductions available under specific conditions impacting the withheld amount.

-

Allowances: Number claimed affects the withholding amount and reflects personal situations.

Penalties for Non-Compliance

Failing to submit or incorrectly filing Form 2017 can lead to significant fines and interest. The IRS monitors compliance closely, and inaccuracies can result in audits or additional financial penalties.

Non-Compliance Scenarios

-

Underreporting Income: Leads to incomplete tax liabilities and potential fines.

-

Improper Allowances: Over or under-claiming allowances results in adjustment necessities and possible penalties.

Software Compatibility with Form 2017

Several software solutions accommodate the requirements of Form 2017, streamlining the completion process:

-

TurboTax: Supports Form 2017 filing and provides guidance for accurate submissions.

-

QuickBooks: Integrates payroll data with tax filing for seamless form completion.

Benefits of Digital Filing

-

Efficiency: Digital filing software simplifies form submission with built-in error checks.

-

Accessibility: Allows for quick adjustments and real-time submissions without physical documentation.

Final Notes on the Legal Use of Form 2017

Form 2017 must be used in accordance to IRS guidelines to ensure all information is reported correctly. It acts as a legal document substantiating taxpayers’ financial positions and withholding accuracy. Misuse or misinterpretation can have significant legal repercussions and impacts on future documentations during audits or compliance checks.