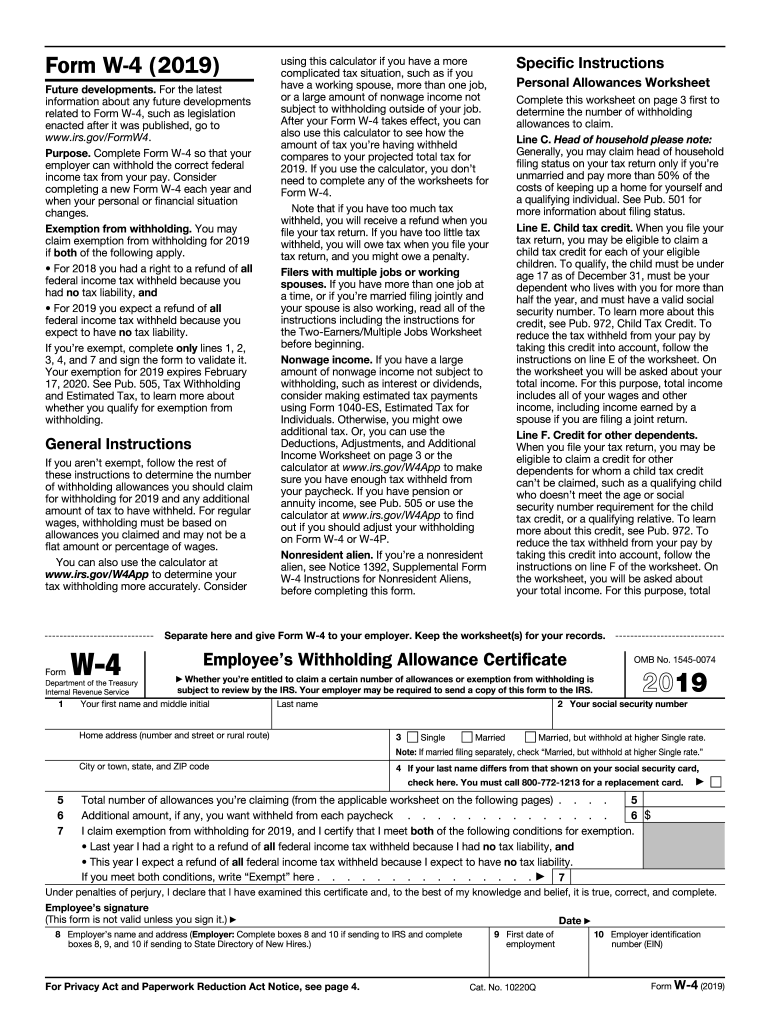

Definition and Meaning of "Form"

In the context of DocHub, a "form" is a digital document that can be filled, signed, edited, and shared online. Forms are typically used to collect structured information from users. They can include a variety of fields, such as text boxes, checkboxes, and signature areas, which facilitate efficient data collection and management. Forms can be created from scratch or by converting existing documents into interactive formats.

Steps to Complete the Form

Completing a form on DocHub is a streamlined process. Follow these steps:

-

Import or Create a Form: Start by importing a document from your computer or connected cloud service, or by creating a new form using DocHub's tools.

-

Add Fillable Fields: Use the Form Fields manager to insert necessary fields like text boxes, dropdowns, and signature areas.

-

Assign Recipients: Specify which sections are to be completed by each participant, ensuring the correct individuals fill in the appropriate information.

-

Review and Edit: Go through your form, making any necessary adjustments to fields to ensure clarity and accuracy.

-

Finalize the Form: Make fields mandatory if essential information is required before submission.

-

Share the Form: Once complete, share it with recipients through email or a shareable link, allowing them to fill, sign, and return it directly.

Who Typically Uses Forms

Forms are utilized by a wide range of individuals and organizations:

- Businesses: For contracts, employment applications, and client forms.

- Educators: For quizzes, surveys, and consent forms.

- Government Agencies: For applications, reporting, and compliance documents.

- Healthcare Providers: For patient intake and consent forms.

- Freelancers: For client proposals and project agreements.

Key Elements of a Form

When designing a form, consider including these elements:

- Title: Clearly indicate the purpose of the form.

- Instructions: Provide guidance on how to complete the form.

- Form Fields:

- Text boxes for name, address, and other personal information.

- Dropdown menus for selectable options.

- Checkboxes for agreements or multiple choices.

- Signature areas for authentication.

- Submission Details: Include information on how and where to submit the form.

Legal Use of Forms

Forms completed and signed through DocHub are legally binding, adhering to standards such as the ESIGN Act in the United States. This ensures that electronic signatures and records are given the same legal significance as their paper counterparts. It's crucial for businesses and individuals to comply with legal standards when creating and using forms to avoid potential disputes.

Software Compatibility and Integration

DocHub forms can be seamlessly integrated with popular software platforms, enhancing workflow efficiency:

- Google Workspace: Import documents from Google Drive, edit, and return without leaving the Google environment.

- Other Cloud Services: Sync with Dropbox, OneDrive, and others to maintain document consistency across platforms.

- Compatible Software: Integrates smoothly with applications like QuickBooks and TurboTax for financial and tax documentation.

Differences Between Digital and Paper Forms

Digital forms offer several advantages over traditional paper forms:

- Efficiency: Fill out and submit forms quickly without printing.

- Security: Protect information with encryption and password protection.

- Accessibility: Access and complete forms from any device with internet connectivity.

- Tracking: Track changes, submissions, and signatures easily.

- Environmental Impact: Reduce paper waste and the carbon footprint associated with printing.

Form Submission Methods

DocHub provides multiple methods for form submission:

- Online: Complete and submit forms directly through the DocHub platform.

- Email: Send completed forms as attachments or links to recipients.

- Export: Download forms in various formats, such as PDF, for offline use or additional distribution methods.

- Cloud Services: Save and share directly from cloud storage options like Google Drive.

These features enhance user experience by providing flexibility and control over document management and workflow processes.