Definition and Meaning

"Irs gov tax forms" refers to a collection of documents provided by the Internal Revenue Service (IRS) for individuals and businesses to report financial information, calculate taxes owed, and request refunds. These forms are essential for ensuring compliance with federal tax laws, allowing taxpayers to accurately declare income, claim deductions and credits, and make informed tax payments.

The IRS offers a wide range of tax forms, each serving a specific purpose or accommodating a particular financial scenario. It is crucial to select the correct form to avoid discrepancies and ensure efficient tax processing. Key tax forms include the 1040 for individual income tax returns, the W-2 for reporting wages, and the 1099 for documenting various types of income.

How to Use IRS Gov Tax Forms

Using IRS tax forms involves several steps to ensure accurate and compliant submissions. For individual taxpayers, the process typically begins with collecting necessary financial information throughout the year, including income statements, receipts for deductible expenses, and records of tax payments.

-

Gathering Information:

- Income documents such as W-2, 1099-MISC, and 1099-DIV

- Records of deductible expenses, like medical bills or educational expenses

- Information on tax credits available to the taxpayer

-

Choosing the Appropriate Form:

- The 1040 form is for individual taxpayers to file annual income tax returns.

- Business owners might use forms like the 1065 for partnerships or the 1120 for corporations.

-

Filling Out the Form:

- Complete personal information, such as Social Security numbers and contact details.

- Enter financial data, including income, tax deductions, and credits.

-

Reviewing for Accuracy:

- Double-check calculations to prevent errors.

- Verify that all necessary forms and schedules are included.

-

Submitting the Form:

- Submit electronically through IRS-approved software or mail to the appropriate IRS address.

- Keep copies of all forms and supporting documents for personal records.

How to Obtain IRS Gov Tax Forms

IRS tax forms are readily accessible to taxpayers through multiple channels, ensuring ease of access and flexibility for different preferences:

-

Online Access:

- The IRS website offers downloadable PDF versions of all tax forms. Users can search by form number or browse categories.

- Tax software like TurboTax or H&R Block provides form-filling services that directly integrate with IRS databases.

-

Physical Copies:

- Forms can be ordered for free from the IRS by phone for those preferring non-digital formats.

- Many local post offices and libraries carry a selection of common forms during tax season.

-

Assistance Programs:

- The Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs provide help in obtaining and completing tax forms.

Steps to Complete IRS Gov Tax Forms

Filling out IRS tax forms can seem daunting, but breaking down the process helps ensure accurate completion:

-

Selecting the Correct Form: Identify the appropriate tax form based on your status (individual, business, etc.).

-

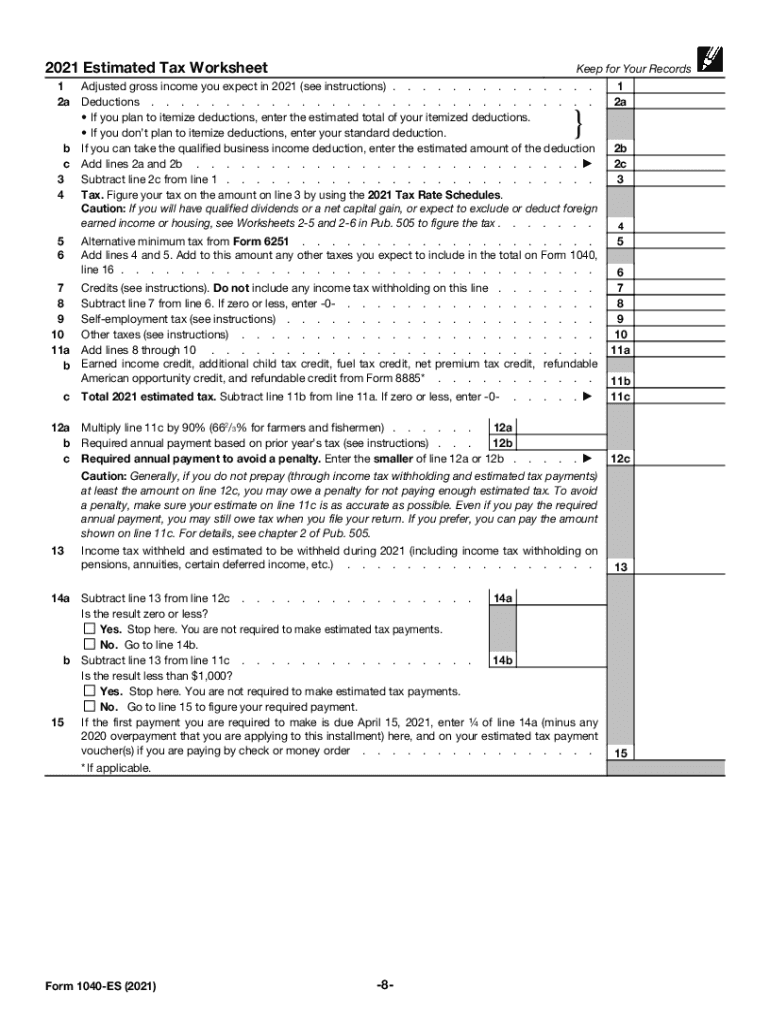

Completion and Documentation:

- Fill out the necessary fields with precise and accurate data from financial documents.

- Use worksheets and schedules as supplementary documents when deductions or credits are claimed.

-

Include All Supporting Schedules:

- Attach any required schedules or worksheets for income, deductions, or credits.

- Ensure forms like Schedule A for itemized deductions are included if applicable.

-

Double-Check Information:

- Review entries for errors, ensuring consistency across all documents.

- Utilize tax software for accuracy checks and error detection.

-

Submit:

- File early to avoid delays, using e-file through approved software systems for faster processing.

- For paper submissions, use certified mail for tracking purposes.

Why Use IRS Gov Tax Forms

IRS tax forms are essential for multiple reasons, supporting both individual and business financial management:

- Legal Compliance: Tax forms ensure compliance with federal tax laws and prevent penalties.

- Financial Management: They provide a structure for organizing and reporting financial affairs accurately.

- Eligibility for Refunds and Credits: Proper form completion can maximize refunds or credits, reducing the amount owed or increasing returns.

- Audit Defense: Accurate form submission can serve as a defense in case of IRS audits, showcasing due diligence in tax reporting.

Key Elements of IRS Gov Tax Forms

IRS tax forms are structured to facilitate comprehensive and accurate tax reporting. Some of their critical elements include:

-

Personal Information Section:

- Social Security Number

- Filing Status: Single, married filing jointly, etc.

-

Income Section:

- Wages, salaries, and tips

- Dividends, interest, and capital gains

-

Deductions and Credits:

- Standard vs. itemized deductions

- Available tax credits

-

Tax Calculation & Payments:

- Tax owed or refundable amounts calculated based on entered data

- Methods for submitting payments or receiving refunds

IRS Guidelines

The IRS provides substantial guidance to assist taxpayers in understanding and correctly filling out tax forms:

- Instructions Booklet: Accompanying each form, offering detailed line-by-line instructions.

- IRS Publications: In-depth guides on various tax topics to provide further clarity and legislative updates.

- Online Tools: Calculators and FAQs to help taxpayers determine accurate inputs for taxes owed or refunds expected.

- Customer Service: The IRS offers phone support, online chat, and in-person assistance for specific inquiries or complex issues.

Filing Deadlines and Important Dates

Adhering to deadlines is crucial to avoid penalties and ensure efficient processing:

- April 15: Typical deadline for filing individual tax returns.

- October 15: Extended deadline for those who filed for an extension.

- Quarterly Deadlines: Businesses and self-employed individuals must pay estimated taxes quarterly.

- End-of-Year Preparation: Gather documents and begin preparation in December for timely filing.

Important Considerations

- Extensions:

- Filing extensions must be submitted before the April deadline, giving six additional months.

- Penalties:

- Failure to file or pay can result in penalties and interest on owed amounts.

- State Deadlines:

- State tax deadlines may differ; confirm local requirements to avoid missteps.

By following organized and well-informed approaches, taxpayers can optimize their use of IRS tax forms to meet legal requirements, manage finances efficiently, and minimize potential liabilities.