Definition and Meaning

The 2013 Form 1040-ES is an essential tax document issued by the Internal Revenue Service (IRS). It is used by individuals in the United States to calculate and make estimated tax payments. This form is especially important for those whose income isn't subject to withholding tax, such as self-employed individuals, retirees, and certain investors. The 2013 version of this form reflects the tax laws and requirements specific to that tax year, aiding taxpayers in complying with federal tax obligations.

How to Use the 2013 Form 1040-ES

Using the 2013 Form 1040-ES involves calculating your expected income and determining the amount of tax you are required to pay throughout the year. It requires an estimation of income, deductions, and credits. Taxpayers must:

- Estimate their total income for 2013.

- Determine their total expected deductions and credits.

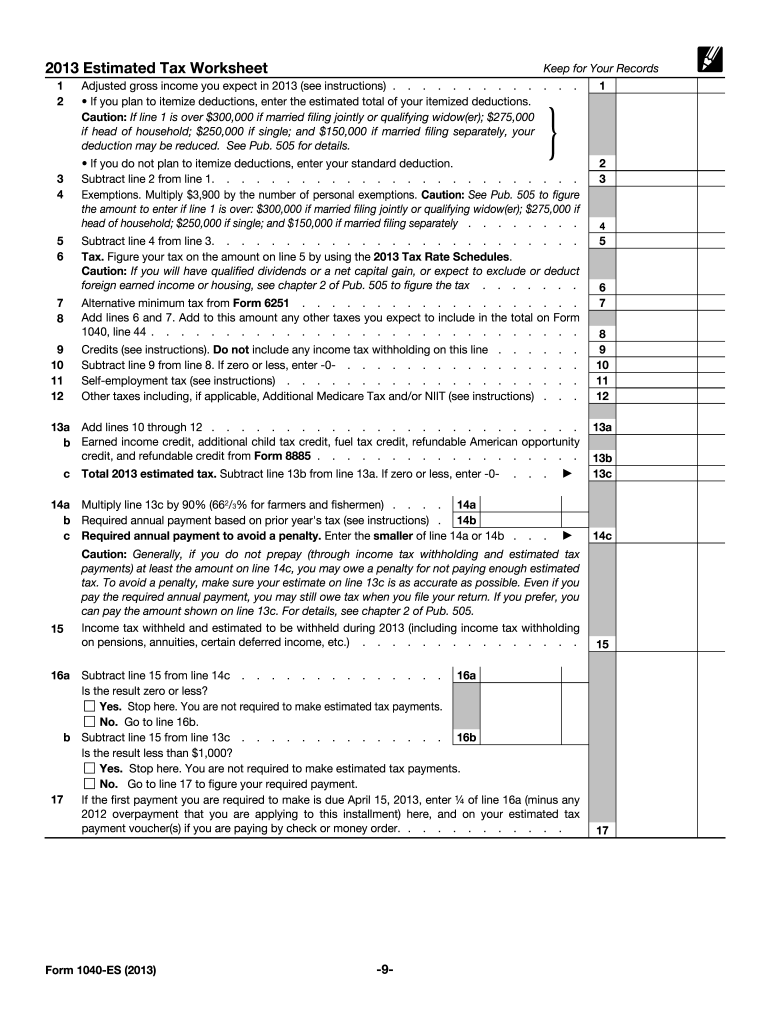

- Use the worksheet included with the form to figure out estimated tax payments.

Make payments quarterly by the specified deadlines to avoid penalties for underpayment. The IRS provides detailed instructions accompanying the form, making it easier for taxpayers to understand the necessary calculations.

Steps to Complete the 2013 Form 1040-ES

Completing the 2013 Form 1040-ES is a step-by-step process:

- Estimate Income: Start by estimating your total income for the year 2013. Include all sources of income that are taxable.

- Calculate Deductions: Deduct any applicable deductions to reduce your taxable income.

- Apply Tax Credits: Use eligible tax credits to decrease your overall tax liability.

- Compute Estimated Tax: Utilize the provided worksheet to determine your expected tax payments.

- Quarterly Payments: Divide the total estimated tax into four equal parts to be paid quarterly.

- Submit Payments: Ensure timely submission of estimated tax payments by the due dates to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for those using the 2013 Form 1040-ES. These include details about who must pay estimated taxes and special considerations for certain taxpayers. For instance:

- Individuals with high incomes may have different payment requirements.

- Farmers and fishermen have distinct provisions regarding payment deadlines.

- Those with complex financial situations should carefully follow the IRS instructions to ensure compliance.

Instructions also outline how to amend estimates if financial circumstances change during the tax year.

Filing Deadlines and Important Dates

The 2013 Form 1040-ES has specific quarterly payment due dates:

- April 15, 2013: First payment

- June 17, 2013: Second payment

- September 16, 2013: Third payment

- January 15, 2014: Fourth payment

These dates are critical as late payments can result in penalties. The IRS may offer exceptions under certain circumstances, but adherence to these deadlines is generally required to avoid penalties.

Required Documents

Before filling out the 2013 Form 1040-ES, gather the necessary financial documents, such as:

- Previous year’s tax return

- Income statements (W-2, 1099 forms)

- Records of deductions (medical expenses, charitable contributions)

- Reports of investment income

Accurate and thorough documentation helps ensure correct computation of estimated tax liabilities.

Penalties for Non-Compliance

Failure to comply with the 2013 Form 1040-ES filing requirements can lead to penalties. Common penalties include:

- Late Payment Penalties: Payment not made by the due date may incur charges.

- Underpayment Penalties: If quarterly installments do not meet the minimum required amounts.

- Intentional Negligence: Willful failure to pay may result in more severe penalties.

However, the IRS may waive penalties for reasonable causes or if certain circumstances apply.

Examples of Using the 2013 Form 1040-ES

Several scenarios illustrate the use and importance of the form:

- Self-Employed Individuals: Professionals like freelance writers or consultants use the form to manage taxes on untaxed income.

- Retirees with Investment Income: Retired individuals use the form to account for income derived from investments or pensions not subject to withholding.

- Seasonal Workers: Those with uneven income distributions over the year adjust their estimated payments according to their earnings.

By understanding these practical applications, taxpayers can better manage their tax responsibilities using the 2013 Form 1040-ES.