Definition & Meaning

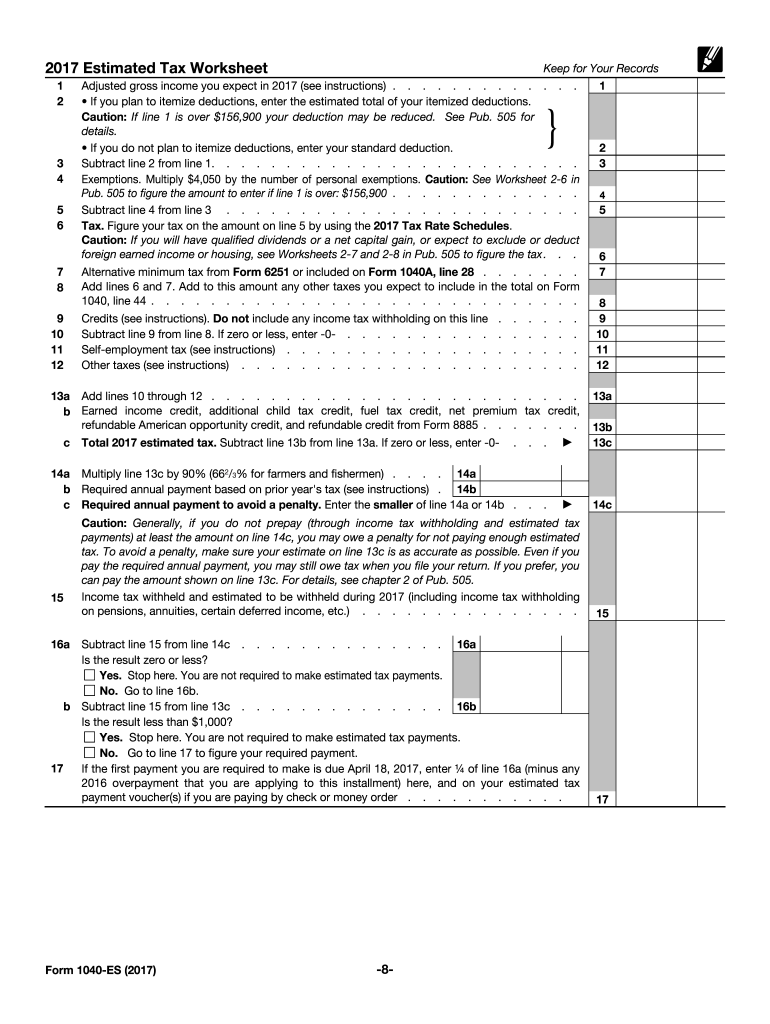

The 2017 Form 1040-ES is a document issued by the Internal Revenue Service (IRS) in the United States, specifically designed for individuals to calculate and remit their estimated quarterly tax payments. This form is primarily used by taxpayers who expect to owe at least $1,000 in taxes after accounting for withheld amounts and credits. It is essential for those whose income is not subject to withholding, such as self-employed individuals, retirees, or those who earn significant income outside of traditional employment settings. The form provides detailed instructions to assist taxpayers in determining the correct amount of estimated tax to pay.

How to Obtain the 1040-ES 2017 Form

To access the 2017 Form 1040-ES, individuals can visit the official IRS website and download the form directly. Alternatively, taxpayers can request a physical copy to be mailed to them by calling the IRS or visiting an IRS office in person. Various online tax preparation platforms may also provide downloadable versions of the form along with interactive tools to help users complete it accurately. Additionally, for those who prefer offline methods, financial advisers or tax consultants can offer copies and guidance on using the form.

Steps to Complete the 1040-ES 2017 Form

-

Estimate Income and Deductions:

- Use the worksheets provided with the form to estimate your expected income, deductions, and credits for the year.

- Consider your prior year's tax return as a reference point to input relevant data.

-

Calculate Estimated Tax:

- Based on your estimates, calculate the overall tax you owe for the year.

- Divide the total amount by four to determine the quarterly payments if using a standard payment schedule.

-

Adjust Payment Amounts if Necessary:

- Consider adjusting your estimates if there are significant changes in your income or deductions during the year.

-

Fill Out Payment Voucher:

- Complete the payment voucher with your name, address, Social Security number, and the calculated payment amount.

-

Submit Payment:

- Choose your preferred payment method: online through IRS Direct Pay, by check via mail, or electronic funds transfer.

IRS Guidelines

The IRS provides comprehensive guidelines on the use of the 2017 Form 1040-ES to ensure accurate estimation of taxes. Key aspects include the calculation of tax based on withholding and credits, special considerations for varied income levels such as farmers or fishers, and instructions for those subject to the alternative minimum tax (AMT). The guidance emphasizes the importance of accurate income estimation to avoid underpayment penalties and suggests using prior year returns for reference when projecting current year earnings and obligations.

Filing Deadlines / Important Dates

For the 2017 tax year, estimated tax payments were due on a quarterly basis with specific deadlines:

- April 18, 2017, for the first payment.

- June 15, 2017, for the second payment.

- September 15, 2017, for the third payment.

- January 16, 2018, for the fourth and final payment. Failure to adhere to these deadlines may result in penalties.

Required Documents

Completing the 2017 Form 1040-ES necessitates various financial documents, including:

- Prior year's tax return for reference.

- Pay stubs and income statements if applicable.

- Records of taxable income such as dividend payments and rental income.

- Documentation of applicable deductions or credits, like student loan interest or mortgage payments.

Form Submission Methods

The 2017 Form 1040-ES offers several submission methods for taxpayers:

- Online: Payments can be made using IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

- Mail: Taxpayers can send checks or money orders with completed payment vouchers to the designated IRS address.

- In Person: Payments can be made directly at IRS offices if preferred, considering the additional processing time this may require.

Penalties for Non-Compliance

Failure to correctly calculate or timely submit estimated tax payments can result in IRS-imposed penalties. These penalties include interest on underpayments, which accrue over time until the amount due is fully paid. To avoid such penalties, taxpayers must ensure accurate calculations and timely payments, taking swift action to amend any discrepancies as instructed by IRS guidelines.