Definition & Meaning of the 2010 Form Download

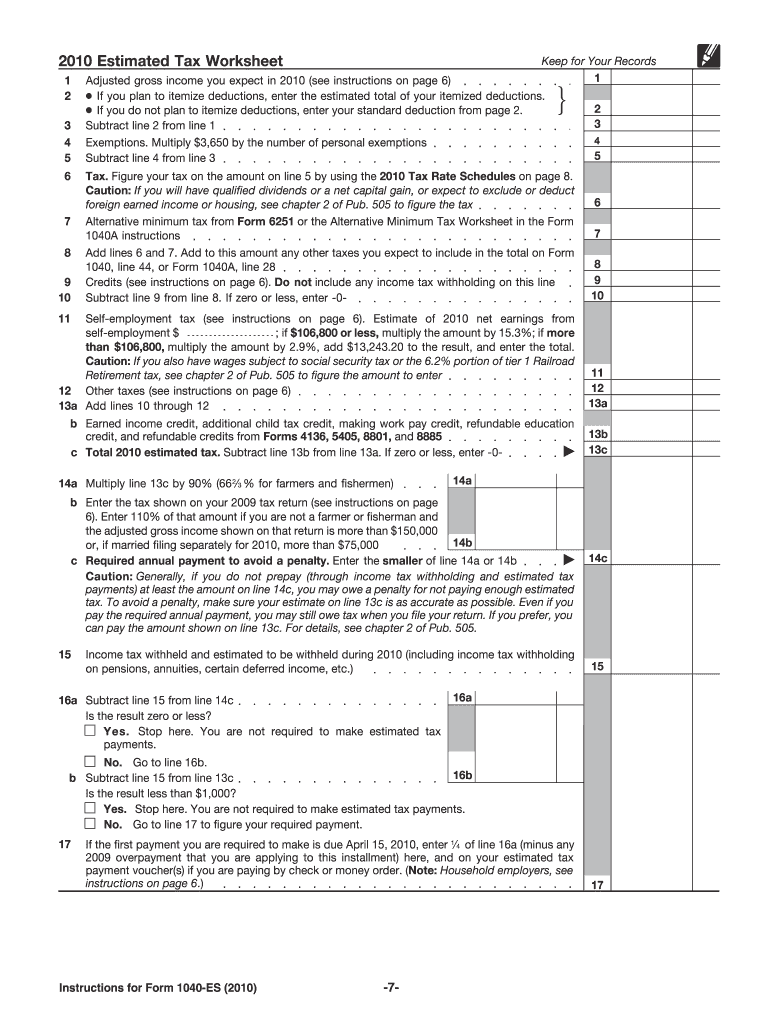

The term "2010 form download" refers to the ability to electronically retrieve forms relevant to the 2010 tax year. These forms are essential for individuals and businesses that need to address specific tax-related obligations for that year. Often, these forms include various IRS documents such as the Form 1040-ES used for estimating tax payments, among others. The convenience of downloading these forms ensures that taxpayers can efficiently manage their tax responsibilities.

How to Use the 2010 Form Download

Using the 2010 form download involves identifying the correct tax form required for your specific situation. Once identified, you can download the form, fill it out digitally or print it for manual completion. It's crucial to thoroughly read the instructions accompanying each form to ensure accurate completion. For example, if using the Form 1040-ES, understand the estimation process for calculating taxes to make appropriate payments throughout the year.

Steps for Utilizing the Form

- Identify the Necessary Document: Determine the exact form needed for your specific tax or business requirement.

- Download the Document: Access the form through verified platforms or the official IRS website to ensure accuracy and validity.

- Complete the Form: Follow the detailed instructions provided, ensuring all required information is accurately filled.

- Submit the Form: Submit the form as per guidelines—electronically or via mail—alongside any required supplementary documents.

How to Obtain the 2010 Form Download

Acquiring the 2010 form download typically involves visiting the IRS website, where a repository of past forms, including those from 2010, is available. Alternatively, trusted tax software platforms may offer access to these forms, ensuring they meet legal compliance and accuracy. The convenience of these online resources simplifies the process, providing easy access to historical documentation.

Methods to Download

- Online IRS Repository: Navigate to the IRS's archived forms section and download the necessary form.

- Tax Software Platforms: Utilize platforms like TurboTax or QuickBooks where they offer downloads for filed taxes including previous years.

Steps to Complete the 2010 Form Download

Completing a 2010 form entails following a systematic approach to correctly enter all necessary financial and personal information. It's pivotal to adhere to federal, and any specific state, guidelines relevant to that document. For tax forms such as the Form 1040-ES, background knowledge of tax laws applicable to your personal or business situation is necessary.

Detailed Instructions

- Gather Required Information: Have all necessary personal, financial accounts, or business details ready.

- Carefully Fill Out the Form: Use digital tools or printouts; ensure legibility and accuracy in data entry.

- Review for Accuracy: Double-check all entries to minimize errors that could lead to penalties or submission rejections.

- File Appropriately: Follow submission instructions whether filing online or via postal mail, ensuring you meet any associated deadlines.

Key Elements of the 2010 Form Download

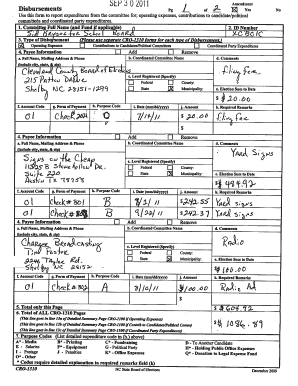

The fundamental components of any 2010 tax form include fields for recording personal identification details, income information, deductions, credits, and a comprehensive summary of financial obligations. Thorough understanding and accurate entry to these fields are crucial for compliance with tax regulations of that fiscal year.

Common Elements

- Personal Information Fields: Name, address, and identification numbers.

- Financial Reporting Areas: Income, deductions, tax credits, and liabilities.

- Submission Instructions: Guidance on filing methodology and documentation required.

Legal Use of the 2010 Form Download

The use of 2010 forms must comply with IRS guidelines and other applicable regulations. This entails using the data captured on these forms for legitimate tax computation and payment purposes. Any misrepresentations or inaccuracies, whether intentional or accidental, can result in penalties or legal consequences.

Compliance Requirements

- Authorized Use Only: Forms should be used only by authorized individuals and for legitimate financial reporting purposes.

- Accurate Representation: Ensure all provided information reflects true financial conditions and activities.

Filing Deadlines / Important Dates

For 2010 tax forms, adhering to the specified deadlines is crucial to avoid penalties. While the deadline for federal tax returns typically falls on April 15, state-specific deadlines may vary. Understanding and adhering to these timelines is integral to maintaining compliance.

Key Dates for Consideration

- Federal Tax Return Deadline: April 15 of the subsequent year.

- Extensions and State-specific Deadlines: Potential variance in state deadlines necessitates a check with respective state tax authorities.

Required Documents for the 2010 Form Download

Completing any 2010 form requires supporting documents, such as prior year tax returns, income statements, and any relevant tax credits or deductions documentation. Ensuring completeness of these documents ahead of submission is essential.

Essential Supporting Materials

- Income Statements: W-2s, 1099s, and other forms of income verification.

- Deduction and Credit Documentation: Receipts or statements validating deductions and credits claimed.

- Prior Year Tax Return: For comparative analysis and continuity in filing history.