Definition and Purpose of the 2011 Form 1040-ES Online

The 2011 Form 1040-ES is an estimation form provided by the Internal Revenue Service (IRS) that assists individuals in calculating and paying their federal estimated taxes for the year 2011. This form is particularly crucial for those whose earnings are not subject to withholding taxes. It applies to self-employed individuals, retirees, investors, and others who receive income from dividends, interest, alimony, rent, or gains from the sale of assets. The online version of the 2011 Form 1040-ES offers a streamlined approach for users to complete their tax obligations efficiently.

Why You Should Use the 2011 Form 1040-ES Online

Using the 2011 Form 1040-ES online offers several advantages, including ease of access and increased efficiency. Taxpayers can conveniently calculate their quarterly estimated taxes without needing to print out and manually fill in forms. The online platform ensures that calculations are accurate and minimizes errors often associated with manual entries. Furthermore, the online submission of the form speeds up the filing process, ensuring that payments are received promptly by the IRS, thereby avoiding potential penalties.

Obtaining the 2011 Form 1040-ES Online

Steps to Access the Form

- Visit the IRS Website: Start by visiting the official IRS website where the 2011 Form 1040-ES is hosted.

- Navigate to Forms Section: Use the search function to locate the 1040-ES form or navigate to the forms section dedicated to past tax documents.

- Download or Fill Online: You can choose to download the form as a PDF or fill it out directly online, depending on your preference.

Importance of Source Verification

Ensure that you are accessing the form from a legitimate source, particularly when using third-party platforms. Verification prevents issues related to data security and ensures compliance with IRS guidelines.

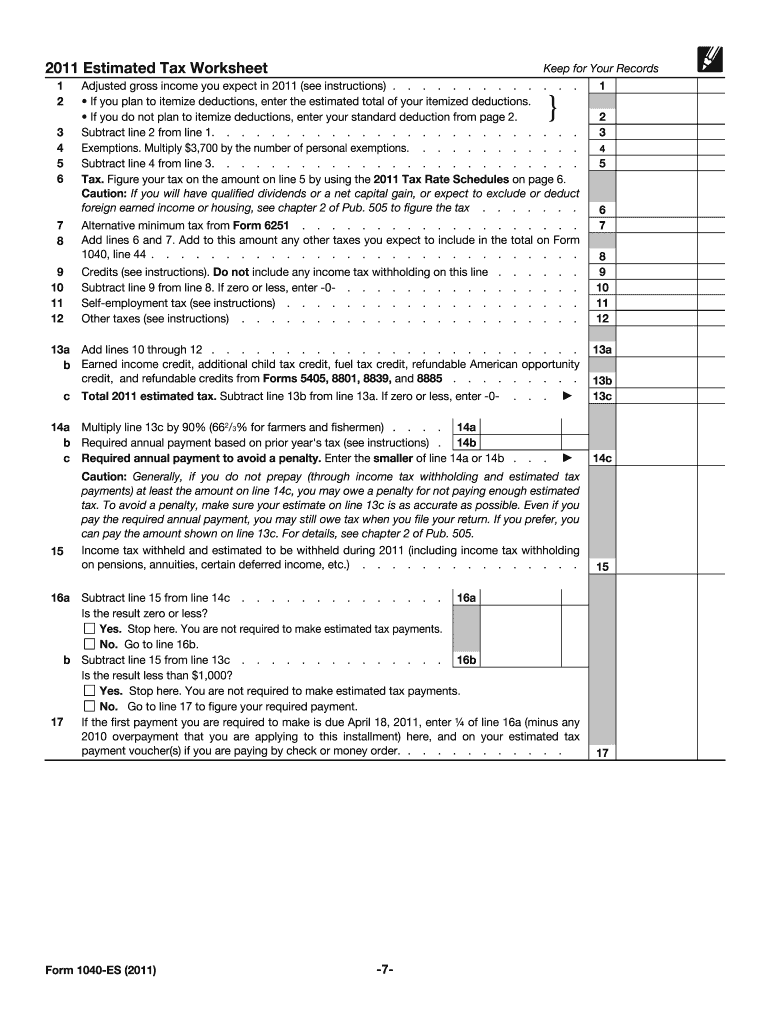

Completing the 2011 Form 1040-ES Online

Required Documentation

To accurately complete the 2011 Form 1040-ES, gather the following documents:

- Previous year's tax return for reference

- W-2 and 1099 forms, if applicable

- Records of any additional income sources

- Details of potential deductions and credits

Step-by-Step Process

- Input Personal Information: Start by entering your personal details, including your name, Social Security number, and address.

- Calculate Estimated Income: Use your previous year's income data and current year projections to estimate your earnings.

- Determine Deductions: Identify eligible deductions to reduce your taxable income.

- Compute Tax Liability: Using IRS-provided tables, calculate the estimated tax liability based on your income and deductions.

- Submit Payments: Select the mode of payment and ensure each installment is submitted by the due dates.

IRS Guidelines and Filing Deadlines for 2011

The IRS mandates quarterly payments for estimated taxes. For the 2011 tax year, the deadlines were typically set for April 15, June 15, September 15, and January 15 of the following year. Timely submission is crucial to avoid penalties and interest charges. These deadlines remain consistent in most tax years, providing a reliable schedule for taxpayers to follow.

Penalties for Non-Compliance

Failure to submit the estimated tax payments on time may result in penalties. The IRS imposes interest on any unpaid taxes, which can accumulate quickly if left unresolved. Therefore, it is vital for taxpayers to adhere to the suggested guidelines and deadlines.

Typical Users and Scenarios

Who Typically Uses the 2011 Form 1040-ES?

- Self-Employed Individuals: Those without employer withholding.

- Investors: Individuals with dividend or interest income.

- Retirees: Persons receiving pension or social security benefits not fully withheld.

- Landlords: Rental income earners.

Each category of user benefits from accurately estimating their taxes using this form to ensure compliance and financial planning.

Example Scenarios

- Self-Employed Freelancer: A freelance graphic designer without taxes withheld from payments must calculate estimated taxes using this form to avoid owing large sums at year-end.

- Investor with Dividend Income: An individual with substantial dividend income uses the form to ensure that their tax payments align with IRS requirements, avoiding penalties.

State-Specific Variations and Their Impact

Certain states may have their own versions or requirements for estimated tax payments independent of the IRS's standards. It is important for taxpayers to check their state's tax department for specific rules or forms that complement the federal requirements. This ensures comprehensive tax compliance and helps in accurate financial forecasting.