Overview of the 2022 Form 1040-ES

The 2022 Form 1040-ES from the Internal Revenue Service (IRS) is a vital tool for individuals to calculate and pay estimated taxes. This form is especially important for those who are self-employed, have investment income, or earn income not subject to withholding throughout the year. By using this form, taxpayers can avoid underpayment penalties and ensure that they meet their tax obligations accurately and timely. The 2022 Form 1040-ES guides users through the process of determining required estimated tax payments based on projected income and deductions.

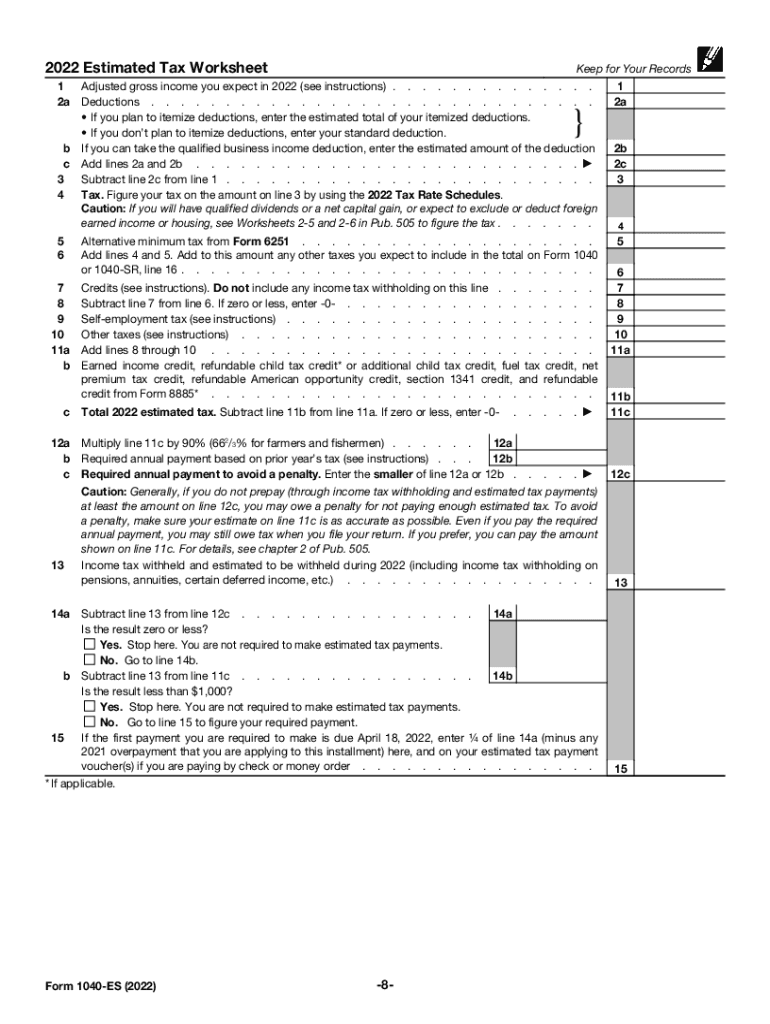

How to Use the 2022 Form 1040-ES

The process of using the 2022 Form 1040-ES involves several detailed steps to determine your estimated tax payments. First, you need to calculate your expected adjusted gross income, taxable income, taxes, deductions, and credits. Next, subtract your expected withholding and any credits to find the total estimated tax. There are multiple worksheets provided to help break down these calculations. Finally, divide this amount by four to find your quarterly payments. Each payment should be sent to the IRS by the designated due dates to avoid penalties.

Acquiring the 2022 Form 1040-ES

Obtaining the 2022 Form 1040-ES is straightforward and can be done digitally for convenience. The form is available on the IRS website for download, allowing taxpayers to print a paper version if preferred. Alternatively, many tax preparation software programs include this form, providing a digital method of handling your estimated tax calculations and submissions. Whether you choose a paper or digital method, ensure you are using the correct year’s form to avoid discrepancies.

Completing the 2022 Form 1040-ES

Filling out the 2022 Form 1040-ES requires attention to detail. Start with the first worksheet to estimate your total income for the year, then move to estimate your allowable deductions. Utilize the worksheet instructions to ensure accurate entries and calculations. Taxpayers should consider any changes in income or deductions that might occur during the year and adjust their calculations accordingly. This forward-looking strategy helps in avoiding underpayment and the accompanying penalties.

Importance of Using Form 1040-ES

Using the 2022 Form 1040-ES is crucial for managing your tax liabilities. This form allows you to spread your tax payments over the year, reducing the likelihood of a large tax bill at the year's end. It also helps in avoiding underpayment penalties by ensuring timely and accurate tax payments. For self-employed individuals, in particular, this form is an essential part of their financial planning toolkit, as it accounts for income without traditional withholding.

Who Should Use the 2022 Form 1040-ES?

The form is primarily used by those who do not have taxes withheld from their income, such as self-employed individuals, landlords, investors, and retirees. Individuals earning income in various categories without tax withholding throughout the year should rely on this form to make quarterly estimated tax payments. The IRS provides guidelines on scenarios where using the 2022 Form 1040-ES is required, typically if you expect to owe at least $1,000 in taxes when you file your return.

Key Components of the 2022 Form 1040-ES

The form includes several key components essential for calculating estimated taxes:

- Worksheet 1: Used to estimate total income, deductions, credits, and any taxes owed.

- Vouchers: Used to submit the quarterly estimated tax payments; they must be sent with each payment.

- Instructions: Detailed guidance on completing the form accurately, including special considerations and definitions of terms.

- Payment Due Dates: Clearly outlines when each payment is due within the tax year.

IRS Guidelines for Form 1040-ES

The IRS provides comprehensive instructions on how to use the 2022 Form 1040-ES. These guidelines include who must file estimated taxes and how much to pay. The IRS requires quarterly payments to be made in April, June, September, and January of the following year. Guidelines also cover special rules for certain taxpayers, such as farmers and fishermen, who might have different filing requirements and due dates.

Filing Deadlines and Important Dates

Estimated tax payments are due four times a year:

- April 15 - The first payment for the current tax year.

- June 15 - The second installment.

- September 15 - The third payment.

- January 15 of the following year - The final payment for the previous tax year.

Meeting these deadlines is crucial to avoid penalties for late payment, which can significantly impact your financial situation.

Methods for Submitting the 2022 Form 1040-ES

Various options exist for submitting your 2022 Form 1040-ES estimated tax payments:

- Online Payment: Use the IRS Direct Pay or EFTPS (Electronic Federal Tax Payment System) to pay electronically.

- Mail: Send your completed voucher and check or money order to the IRS address stated on the form. Ensure checks are payable to the United States Treasury.

- In-Person: Payments can also be made in person at local IRS offices, though this option is less common.

These methods provide flexibility based on your convenience and preference.