Definition and Purpose of the 2016 Form 1040-ES

The 2016 Form 1040-ES, also known as Estimated Tax for Individuals, is a critical document for taxpayers who need to prepay a portion of their annual tax liabilities. It is primarily used by individuals whose income is not subject to automatic tax withholding, such as self-employed workers or investors. The form provides a structured approach to calculating quarterly estimated tax payments based on expected annual income, deductions, and credits. Its main goal is to prevent taxpayers from owing a large sum when annual taxes are due by ensuring that they pay the correct amount throughout the year. The form includes detailed instructions on how to calculate these payments, covering various income scenarios and applicable tax regulations.

Importance of Using the 2016 Form 1040-ES

Using the 2016 Form 1040-ES is essential for taxpayers who earn a significant portion of their income from sources where taxes are not withheld automatically. It allows individuals to comply with IRS requirements by making four estimated payments a year, reducing the possibility of penalties for underpayment. The form is particularly beneficial for:

- Self-employed individuals who receive direct compensation for their services.

- Investors and retirees with substantial investment income from dividends, interest, and capital gains.

- People with complex income streams, such as rental properties, who cannot rely on payroll withholding.

Timely submission and accurate calculations using this form help avoid potential financial penalties and interest charges from the IRS.

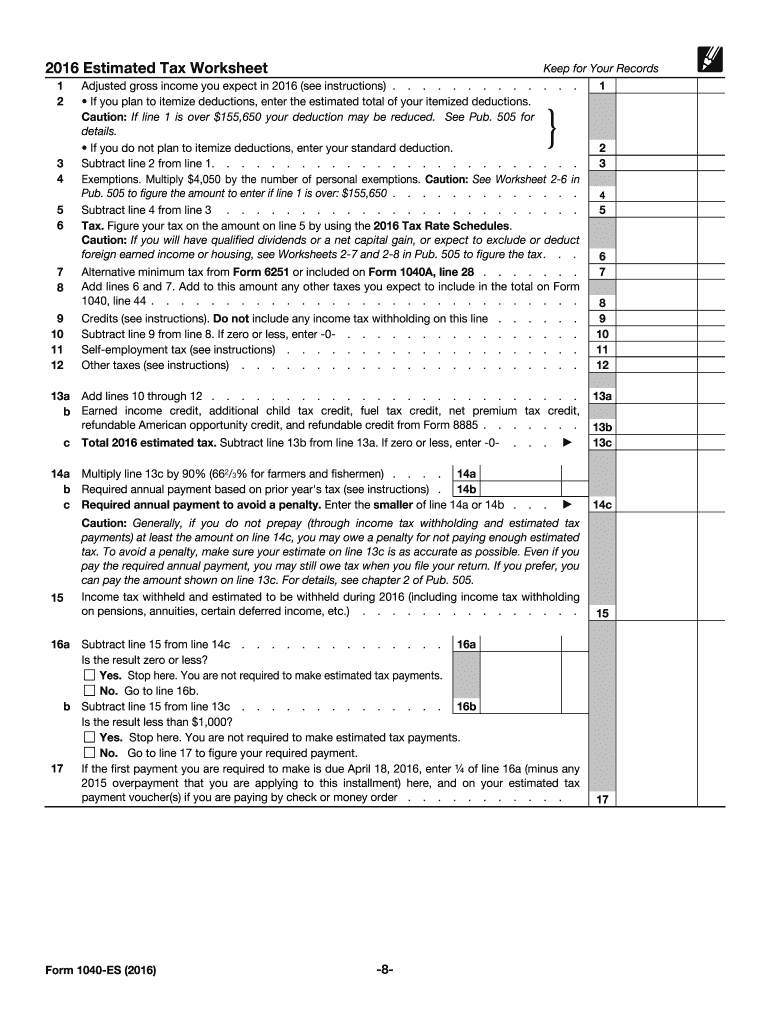

Steps to Complete the 2016 Form 1040-ES

-

Estimate Your Total Income for 2016:

- Include all sources of income, such as wages, dividends, business income, and rental properties.

-

Subtract Adjustments and Deductions:

- Adjust for any eligible deductions, such as student loan interest or health savings account contributions.

-

Calculate Your Expected Tax Liability:

- Use the IRS tax tables provided in the 1040-ES instructions to find your applicable tax rate.

-

Factor in Tax Credits:

- Apply any tax credits, such as education credits, that you are eligible for to reduce your tax liability.

-

Determine Your Quarterly Payments:

- Divide your total expected tax liability by four to determine the amount of each quarterly estimated payment.

How to Obtain the 2016 Form 1040-ES

The 2016 Form 1040-ES can be obtained from multiple sources, ensuring accessibility for all taxpayers. These sources include:

- IRS Website: Download the form and instruction booklet directly as a PDF from the official IRS website.

- Local IRS Offices: Visit an IRS office in person to obtain a physical copy of the form.

- Professional Tax Preparers: Request a copy from a certified accountant or tax preparer who may also assist with filling out the form.

- Tax Software Programs: Access and complete the form via tax software platforms that support prior-year filings.

Key Elements of the 2016 Form 1040-ES

The 2016 Form 1040-ES includes several critical sections that guide taxpayers through the estimated tax process:

- Payment Vouchers: Used to accompany each quarterly payment sent to the IRS.

- Tax Rate Schedules: Provide the applicable tax rates based on filing status and income level.

- Help and Instructions: Offer guidance on common calculations and scenarios tailored to different taxpayer situations.

- Record of Estimated Tax Payments: A worksheet to track amounts and dates of payments.

Relevant IRS Guidelines

The IRS provides explicit guidelines to assist taxpayers in correctly completing and submitting their Form 1040-ES:

- Due Dates: Payments are typically due on April 15, June 15, September 15, and January 15 of the following year.

- Safe Harbor Rules: If taxpayers pay at least 90% of their current year’s tax or 100% of their prior year’s tax, they generally avoid underpayment penalties.

- Amended Payments: If income changes significantly during the year, taxpayers can adjust their remaining quarterly payments by recompleting a new 1040-ES.

Filing Deadlines and Important Dates

Meeting filing deadlines is crucial to avoiding penalties:

- April 15, 2016: First estimated payment deadline.

- June 15, 2016: Second payment deadline.

- September 15, 2016: Third payment deadline.

- January 17, 2017: Fourth and final payment deadline.

These deadlines ensure that estimated taxes are paid in a timely manner throughout the tax year.

Penalties for Non-Compliance

Failing to submit estimated tax payments or underpaying can result in penalties:

- Underpayment Penalty: Calculated based on the shortfall amount and duration of underpayment.

- Late Payment Penalties: Charged when payments are not received by the IRS deadlines.

- Interest Charged: In addition to penalties, interest is applied to any unpaid tax liabilities from the due date until payment in full.

By understanding and adhering to the guidelines, taxpayers can mitigate the risk of these financial penalties.