Definition and Meaning

Estimated tax payments refer to quarterly tax payments made by individuals or entities that don't have taxes withheld automatically from income. These payments typically apply to self-employed individuals, sole proprietors, partnerships, S-corporation shareholders, and others whose income isn't subject to withholding. The concept is designed to ensure that taxpayers who receive income outside of traditional salary structures still contribute to federal income taxes at appropriate intervals throughout the year.

Importance of Estimated Tax Payments

- Consistent Tax Contribution: Helps taxpayers avoid a large tax bill at the end of the year.

- Cash Flow Management: By paying taxes gradually, taxpayers can better manage their cash flow.

- Avoid Penalties: Missing estimated payments or paying insufficient amounts can lead to penalties and interest charges.

Why Make Estimated Tax Payments

The primary reason for making these payments is to comply with IRS regulations and avoid penalties for underpayment of taxes. If insufficient tax is withheld, or no tax is withheld from income such as investments, dividends, or rental income, estimated tax payments help cover the gap.

Types of Income Requiring Payments

- Business Profits: Sole proprietors, freelancers, and independent contractors must account for business income not subject to withholding.

- Investment Income: Dividends, interest, and capital gains should be factored into payments.

- Other Sources: Alimony, rental income, and other non-wage earnings.

IRS Guidelines

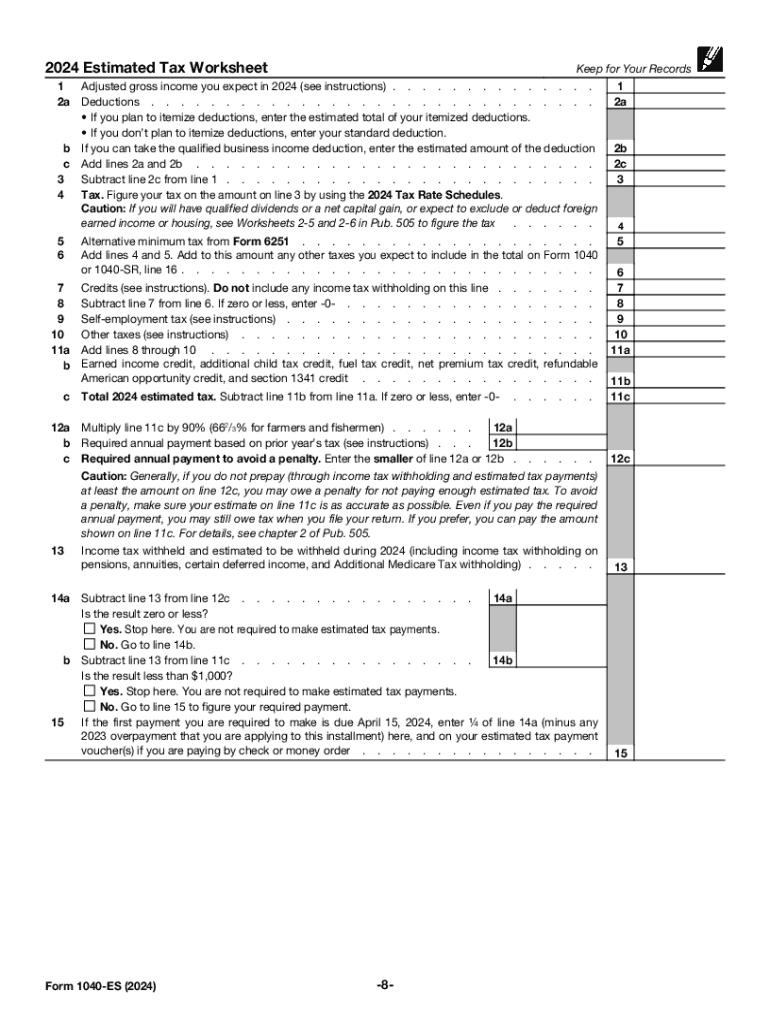

The IRS outlines specific guidelines in Form 1040-ES for calculating and submitting estimated tax payments. Taxpayers are expected to use this form to evaluate their expected income, deductions, credits, and taxes to determine their quarterly payment amounts.

Tips for Compliance

- Review Income Regularly: Update estimated tax payments as necessary based on income changes.

- Use IRS Worksheets: Complete worksheets provided in Form 1040-ES to avoid errors in calculations.

- Consult IRS Publications: Refer to IRS resources for detailed guidelines and examples.

Steps to Complete Estimated Tax Payments

- Calculate Total Estimated Tax: Use current year forecasts to determine tax liability.

- Divide Payments into Quarters: Ensure payments are spread evenly across the four quarters of the tax year.

- Use Form 1040-ES: Fill out and file Form 1040-ES based on calculations.

- Submit Payments: Pay electronically, via mail, or through other IRS-approved methods.

Key Considerations

- Ensure accuracy in estimates to prevent underpayment.

- Adjust calculations as financial situations change over the year.

- Keep detailed records of income and expenses for verification.

Filing Deadlines and Important Dates

Taxpayers should adhere to quarterly due dates set by the IRS to avoid penalties. Typically, the deadlines are April 15, June 15, September 15, and January 15 of the following year. If the 15th falls on a weekend or holiday, the due date may shift to the next business day.

Strategies for Meeting Deadlines

- Mark Calendars: Set reminders to prepare and submit payments on time.

- Plan Ahead: Start calculations early to ensure complete accuracy.

- Automate Payments: Consider setting up automated electronic payments to ensure timeliness.

Penalties for Non-Compliance

Failing to make estimated tax payments can result in significant penalties. The IRS imposes penalties for underpayment, late payment, and non-payment of estimated taxes. These penalties can accrue over time, increasing taxpayer liabilities.

Penalty Avoidance Tips

- Make at least quarterly payments that equal or exceed the lesser of 90% of the current year’s tax liability or 100% of the previous year’s liability.

- Correct underpayments promptly to stop additional penalty accrual.

- Contact the IRS if experiencing financial hardship to explore options for managing payments.

Taxpayer Scenarios and Case Studies

Various taxpayer scenarios necessitate consideration of estimated tax payments. For instance, a self-employed graphic designer or a retiree with significant investment income might need to make quarterly payments to align with IRS guidelines.

Real-World Examples

- Self-Employed Individuals: Must calculate tax liability based on business profits minus deductible expenses.

- Investors: Should consider income from dividends and capital gains in their calculations.

- Retirees: Those receiving income from IRAs or rental properties need to account for taxable portions.

State-Specific Rules

While federal guidelines govern estimated tax payments, state requirements can vary. Some states have their own estimated tax payment forms and processes. Taxpayers should consult state tax agencies to ensure full compliance.

Examples of State Variations

- Some states may require additional quarterly payments.

- Penalty structures and filing deadlines can differ between states.

- Each state may have unique deductions or credits impacting payment calculations.

Digital vs. Paper Version

Estimated tax payments can be filed electronically or via paper forms. Electronic filing is generally faster and more secure, offering immediate confirmation of receipt by the IRS.

Advantages of Electronic Filing

- Speed: Faster processing times help confirm timely submissions.

- Convenience: Simplified filing using IRS e-file services or authorized service providers.

- Accuracy: Reduces errors through pre-filled data and automatic calculations.