Definition & Meaning

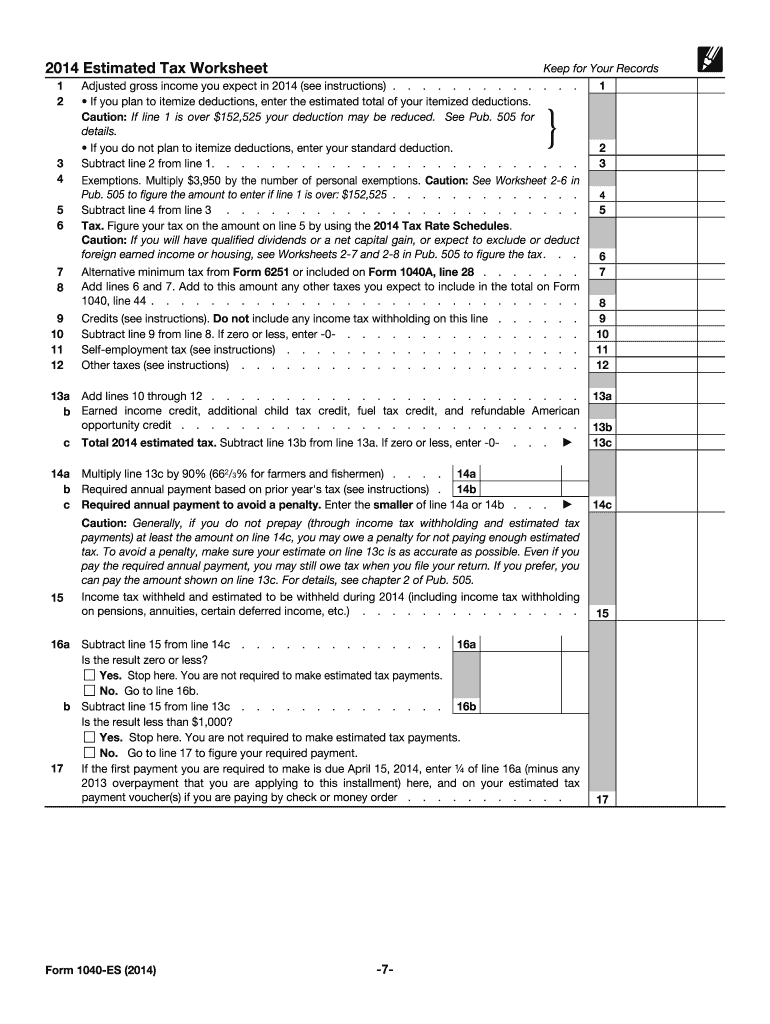

Form 1040-ES for the year 2014 is an estimated tax payment form used by individuals in the United States to report and pay their quarterly estimated taxes. It is primarily used by those who do not have their tax withheld automatically by an employer, such as self-employed individuals, retirees, or those with significant non-wage income.

- It serves as a means to estimate and prepay tax due on income that isn't subject to withholding.

- Commonly utilized by individuals who expect to owe taxes of $1,000 or more when their annual return is filed.

How to Use the Form 1040-ES 2014

Using the 2014 version of Form 1040-ES involves several steps, ensuring correct estimation and timely payment of taxes.

- Estimate Your Total Income: Assess all income sources, including self-employment income, interest, dividends, alimony, and rental income.

- Calculate Deductions and Credits: Deduct allowable expenses and apply tax credits to lower your taxable income.

- Determine Your Tax Liability: Use tax rate schedules provided in the form instructions to estimate your total tax liability.

- Compute Estimated Tax Payments: Subtract any tax credits and prepayments from your total estimated tax liability to find the amount needed per quarter.

- File Quarterly Payments: Send payments by the specified due dates to avoid penalties.

How to Obtain the Form 1040-ES 2014

Getting a copy of the 1040-ES form for 2014 is a straightforward process.

- Download from IRS Website: The IRS website has a searchable archive where you can download historical forms.

- Request by Phone: Contacting the IRS hotline allows requesting a mailed copy.

- Visit Local IRS Office: Physical copies may be available at local IRS branches or libraries.

Steps to Complete the Form 1040-ES 2014

To accurately fill out Form 1040-ES 2014, follow these critical steps:

- Gather Necessary Information: Collect previous tax returns, income statements, and deduction documentation.

- Complete the Worksheets: Use the worksheets included with the form to calculate estimated taxes.

- Fill in the Payment Vouchers: Enter your calculated payments on the provided payment vouchers for each quarter.

- Submit Payments: Mail payments with completed vouchers on time to the IRS or pay electronically through IRS payment portals.

- Record Retention: Keep copies of your worksheets and vouchers for future reference and audits.

Who Typically Uses the Form 1040-ES 2014

Form 1040-ES 2014 is geared towards individuals and entities who need to make quarterly tax payments due to non-wage income.

- Self-Employed Individuals: Since they typically do not have tax withheld from earnings, they must estimate and pay directly.

- Retirees with Investment Income: Those with interest or dividends that exceed their withholding requirements.

- Independent Contractors and Freelancers: They often receive payment without tax deductions, necessitating estimated payments.

IRS Guidelines for Form 1040-ES 2014

The IRS provides specific guidelines for the use of Form 1040-ES 2014 to ensure compliant submission and payment processes.

- Estimated Tax Requirement: Taxpayers who expect to owe at least $1,000 after subtracting withholding and refundable credits should use this form.

- Underpayment Penalty Avoidance: To avoid penalties, the taxpayer should pay at least 90% of the current year's tax liability or 100% of the previous year's tax.

- Amendment Process: If your income or deductions change significantly during the year, adjust your payments accordingly using updated worksheets.

Filing Deadlines / Important Dates

It is crucial to adhere to the deadlines associated with filing Form 1040-ES to avoid penalties.

- Quarterly Due Dates:

- April 15 for payment of taxes on income from January 1 to March 31.

- June 15 for payment on income up to May 31.

- September 15 for income up to August 31.

- January 15 of the following year for income through December 31.

Required Documents for Form 1040-ES 2014

Before completing the form, gather all relevant documents to support your estimated tax calculations.

- Income Statements: W-2s, 1099s, and other income documentation.

- Previous Tax Returns: To assist in estimating income and deductions.

- Deduction Information: Receipts or records of expenses incurred that are tax-deductible.

- Financial Records: Bank statements to verify income and expenses.

By comprehensively understanding, preparing, and filing the 2014 Form 1040-ES through these steps and requirements, taxpayers can better manage their obligations, remain compliant with IRS regulations, and avoid potential complications related to underpayment of estimated taxes.